Blackberry 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

15

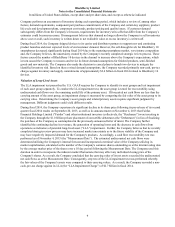

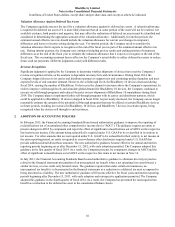

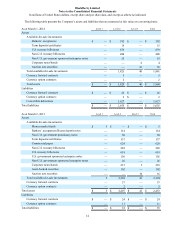

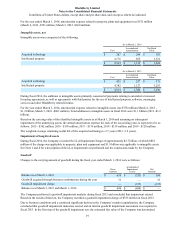

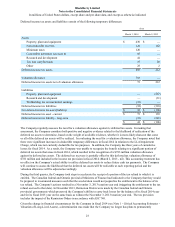

The following table summarizes the changes in fair value of the Company’s Level 3 assets for the years ended March 2,

2013 and March 1, 2014:

Level 3

Balance at March 3, 2012 $ 68

Sale of Level 3 assets (25)

Principal payments (2)

Balance at March 2, 2013 41

Principal repayments (1)

Balance at March 1, 2014 $ 40

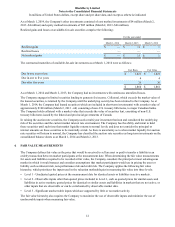

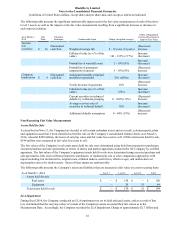

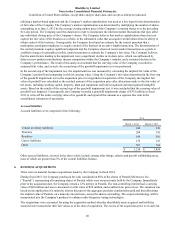

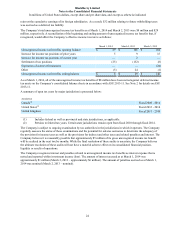

The Company recognizes transfers in and out of levels within the fair value hierarchy at the end of the reporting period in

which the actual event or change in circumstance occurred. There were no significant transfers in or out of Level 3 assets

during the year ended March 1, 2014 ($25 million transferred out of Level 3 assets representing the sale of the Company’s

unsecured claim on assets held at Lehman Brothers International (Europe) (“LBIE”) at the time of LBIE’s bankruptcy for

the year ended March 2, 2013).

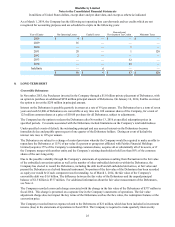

The Company’s Level 3 assets measured on a recurring basis include auction rate securities as well as corporate notes/

bonds consisting of securities received in a payment-in-kind distribution from a former structured investment vehicle.

The auction rate securities are valued using a discounted cash flow method incorporating both observable and

unobservable inputs. The unobservable inputs utilized in the valuation are the estimated weighted-average life of each

security based on its contractual details and expected paydown schedule based upon the underlying collateral, the value of

the underlying collateral which would be realized in the event of a waterfall event, an estimate of the likelihood of a

waterfall event and an estimate of the likelihood of a permanent auction suspension. Significant changes in these

unobservable inputs would result in significantly different fair value measurements. Generally, a change in the assumption

used for the probability of a waterfall event is accompanied by a directionally opposite change in the assumption used for

the probability of a permanent suspension. A waterfall event occurs if the funded reserves of the securities become

insufficient to make the interest payments, resulting in the disbursement of the securities’ underlying collateral, the value

which is currently greater than the fair value of the securities, to the security holders.

The corporate notes/bonds are valued using a discounted cash flow method incorporating both observable and

unobservable inputs. The unobservable inputs utilized in the valuation are the anticipated future monthly principal and

interest payments, an estimated rate of decrease of those payments, the value of the underlying collateral, the number of

securities currently in technical default as grouped by the underlying collateral, an estimated average recovery rate of

those securities and assumptions surrounding additional defaults. Significant changes in these unobservable inputs would

result in significantly different fair value measurements. Generally, a change in the assumption used for the anticipated

monthly payments is accompanied by a directionally similar change in the average recovery rate and a directionally

opposite change in the yearly decrease in payments and additional defaults assumptions.