Blackberry 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

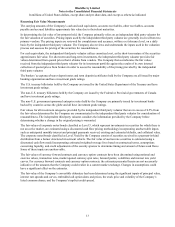

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

19

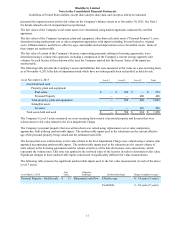

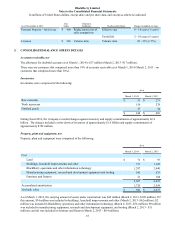

For the year ended March 1, 2014, amortization expense related to property, plant and equipment was $532 million

(March 2, 2013 -$721 million; March 3, 2012 -$660 million).

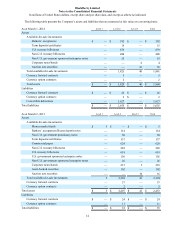

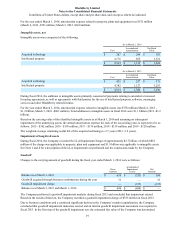

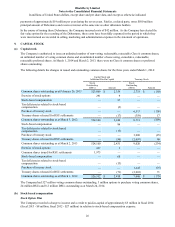

Intangible assets, net

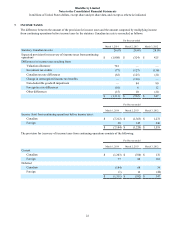

Intangible assets were comprised of the following:

As at March 1, 2014

Cost Accumulated

Amortization Net Book

Value

Acquired technology $ 387 $ 284 $ 103

Intellectual property 2,176 855 1,321

$ 2,563 $ 1,139 $ 1,424

As at March 2, 2013

Cost Accumulated

Amortization Net Book

Value

Acquired technology $ 432 $ 257 $ 175

Intellectual property 4,382 1,127 3,255

$ 4,814 $ 1,384 $ 3,430

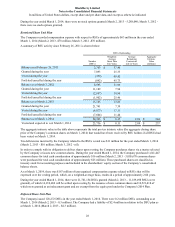

During fiscal 2014, the additions to intangible assets primarily consisted of payments relating to amended or renewed

licensing agreements, as well as agreements with third parties for the use of intellectual property, software, messaging

services and other BlackBerry related features.

For the year ended March 1, 2014, amortization expense related to intangible assets was $738 million (March 2, 2013 -

$1.2 billion; March 3, 2012 -$863 million). Total additions to intangible assets in fiscal 2014 were $1.1 billion (2013 -$1.2

billion).

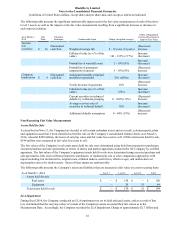

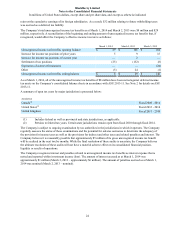

Based on the carrying value of the identified intangible assets as at March 1, 2014 and assuming no subsequent

impairment of the underlying assets, the annual amortization expense for each of the succeeding years is expected to be as

follows: 2015 - $362 million; 2016 - $195 million; 2017 - $176 million; 2018 - $139 million; and 2019 - $128 million.

The weighted-average remaining useful life of the acquired technology is 3.7 years (2013 -3.2 years).

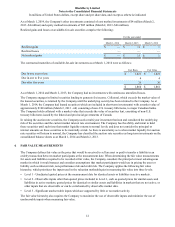

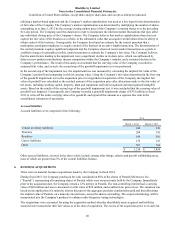

Impairment of long-lived assets

During fiscal 2014, the Company recorded the LLA Impairment Charge of approximately $2.7 billion, of which $852

million of the charge was applicable to property, plant and equipment and $1.9 billion was applicable to intangible assets.

See Note 1 and 4 for a description of the LLA impairment test performed and the conclusions made by the Company.

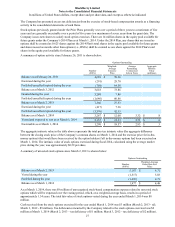

Goodwill

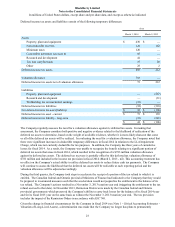

Changes to the carrying amount of goodwill during the fiscal year ended March 1, 2014 were as follows:

Gross

Amount

Accumulated

Impairment

Losses Net

Amount

Balance as at March 3, 2012 $ 659 $ (355) $ 304

Goodwill acquired through business combinations during the year 31 — 31

Goodwill impairment charge —(335)(335)

Balance as at March 2, 2013 and March 1, 2014 $ 690 $ (690) $ —

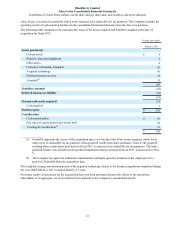

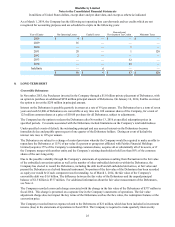

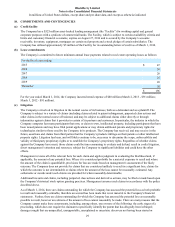

The Company performed a goodwill impairment analysis during fiscal 2012 and concluded that impairment existed.

Based on the results of that test, the Company recorded a goodwill impairment charge of $355 million in fiscal 2012.

Due to business conditions and a continued significant decline in the Company’s market capitalization, the Company

concluded that goodwill impairment indicators existed and an interim goodwill impairment assessment was required in

fiscal 2013. In the first step of the goodwill impairment test, the estimated fair value of the Company was determined