Blackberry 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

6

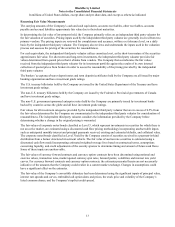

Shipping and Handling Costs

Amounts billed to customers related to shipping and handling are classified as revenue, and the Company’s shipping and

handling costs are included in cost of sales. Shipping and handling costs that cannot be reasonably attributed to certain

customers are included in selling, marketing and administration.

Multiple-Element Arrangements

The Company enters into revenue arrangements that may consist of multiple deliverables of its product and service

offerings. The Company’s typical multiple-element arrangements involve: (i) BlackBerry 7 or earlier handheld devices

with services, (ii) BlackBerry 10 handheld devices with unspecified software upgrades on a when-and-if available basis

along with undelivered non-software services, and (iii) software with technical support services.

For the Company’s arrangements involving multiple deliverables of BlackBerry 7 or earlier handheld devices with

services, the consideration from the arrangement is allocated to each respective element based on its relative selling price,

using vendor-specific objective evidence of selling price (“VSOE”). In certain limited instances when the Company is

unable to establish the selling price using VSOE, the Company attempts to establish the selling price of each element

based on acceptable third party evidence of selling price (“TPE”); however, the Company is generally unable to reliably

determine the selling prices of similar competitor products and services on a stand-alone basis. In these instances, the

Company uses best estimated selling price (“BESP”) in its allocation of arrangement consideration. The objective of

BESP is to determine the price at which the Company would transact a sale if the product or service was sold on a stand-

alone basis.

Beginning in January 2013, the Company introduced its BlackBerry 10 devices which use the Company’s network

infrastructure in a different manner than BlackBerry 7 or earlier devices. As a result, for arrangements involving multiple

deliverables including the BlackBerry 10 device and the essential operating system software, as well as unspecified

software upgrade rights and non-software services for which the Company may not charge for separately, the

consideration from the arrangement is allocated to each respective element based on the relative selling price, using the

Company’s BESP as the device, unspecified upgrade rights and non-software services are no longer sold separately. The

consideration for the delivered hardware and the related essential operating system software are recognized at the time of

sale provided that the four general revenue recognition criteria have been met. The consideration allocated to the

unspecified software upgrade rights and non-software services is deferred and recognized ratably over the 24-month

estimated life of the devices.

For arrangements involving multiple deliverables of software with technical support services, the revenue is recognized

based on the industry-specific software revenue recognition accounting guidance. If the Company is not able to determine

VSOE for all of the deliverables of the arrangement, but is able to obtain VSOE for all undelivered elements, revenue is

allocated using the residual method. Under the residual method, the amount of revenue allocated to delivered elements

equals the total arrangement consideration less the aggregate fair value of any undelivered elements. If VSOE of any

undelivered software items does not exist, revenue from the entire arrangement is initially deferred and recognized at the

earlier of: (i) delivery of those elements for which VSOE did not exist; or (ii) when VSOE can be established.

The Company determines BESP for a product or service by considering multiple factors including, but not limited to,

historical pricing practices for similar offerings, market conditions, competitive landscape, internal costs, gross margin

objectives and pricing practices. The determination of BESP is made through consultation with and formal approval by,

the Company’s management, taking into consideration the Company’s marketing strategy. The Company regularly

reviews VSOE, TPE and BESP, and maintains internal controls over the establishment and updates of these estimates.

Based on the above factors, the Company’s BESP for the unspecified software upgrade right and non-software services

ranges from $10-$20 per BlackBerry 10 device.

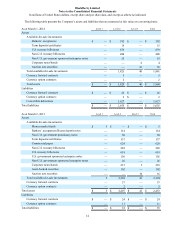

Income taxes

The Company uses the liability method of income tax allocation to account for income taxes. Deferred income tax assets

and liabilities are recognized based upon temporary differences between the financial reporting and income tax bases of

assets and liabilities, and measured using enacted income tax rates and laws that will be in effect when the differences are

expected to reverse. The Company records a valuation allowance to reduce deferred income tax assets to the amount that

is more likely than not to be realized. The Company considers both positive evidence and negative evidence, to determine

whether, based upon the weight of that evidence, a valuation allowance is required. Judgment is required in considering

the relative impact of negative and positive evidence.

Significant judgment is also required in evaluating the Company’s uncertain income tax positions and provisions for

income taxes. Liabilities for uncertain income tax positions are recognized based on a two-step approach. The first step is