Blackberry 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

41

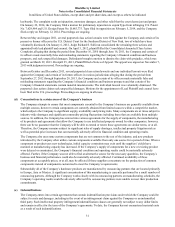

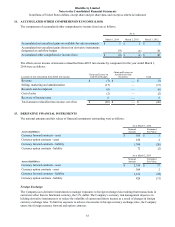

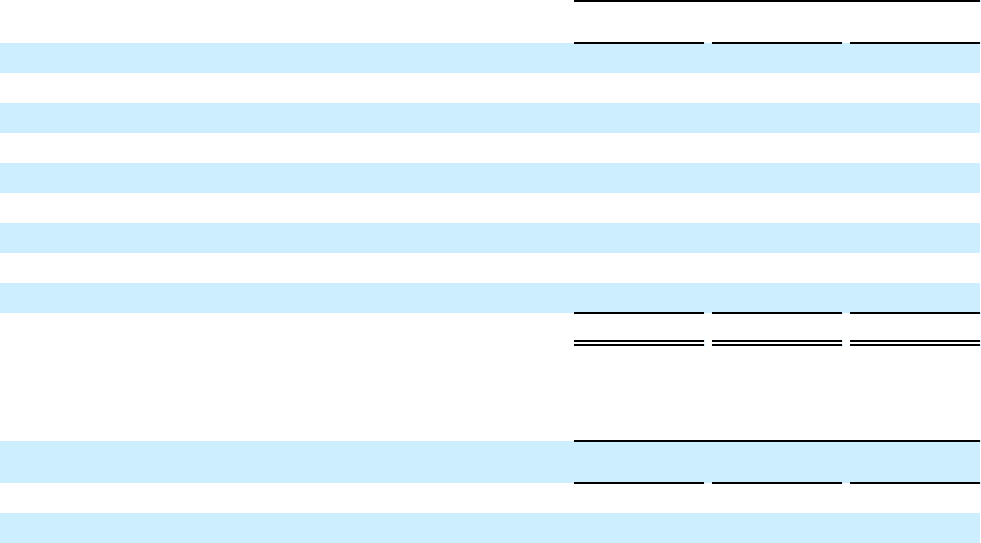

17. CASH FLOW INFORMATION

(a) Cash flows resulting from net changes in working capital items are as follows:

For the year ended

March 1, 2014 March 2, 2013 March 3, 2012

Accounts receivable $ 1,381 $ 709 $ 898

Other receivables 124 218 (168)

Inventories 359 426 (409)

Income taxes receivable 224 (463)(135)

Other current assets (26)(177)(143)

Accounts payable (590) 296 (90)

Accrued liabilities (251)(801)(156)

Income taxes payable — — (179)

Deferred revenue 38 279 151

$ 1,259 $ 487 $ (231)

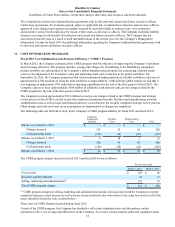

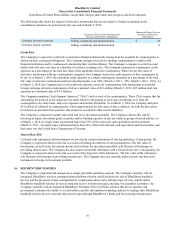

(b) Certain statement of cash flow information related to interest and income taxes paid is summarized as follows:

For the year ended

March 1, 2014 March 2, 2013 March 3, 2012

Interest paid during the year $ 29 $ — $ —

Income taxes paid during the year 131 107 684

Income tax refunds received during the year 1,447 390 —

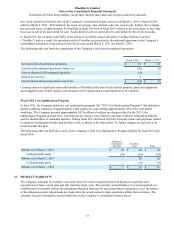

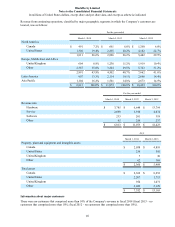

(c) Additional information

Advertising expense, which includes media, agency and promotional expenses totaling $843 million (March 2, 2013 -

$925 million; March 3, 2012 - $864 million) is included in selling, marketing and administration expenses for the fiscal

year ended March 1, 2014.

Selling, marketing and administration expense for the fiscal year ended March 1, 2014 included $62 million with respect

to foreign exchange losses (March 2, 2013 – gain of $87 million; March 3, 2012 – loss of $40 million).

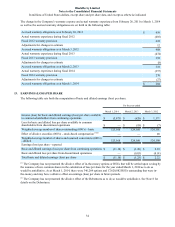

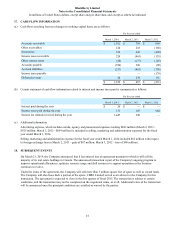

18. SUBSEQUENT EVENTS

On March 21, 2014, the Company announced that it has entered into an agreement pursuant to which it will sell the

majority of its real estate holdings in Canada. The announced transaction is part of the Company's ongoing program to

improve operational efficiencies, optimize resource usage and shift resources to support operations as the business

continues to evolve.

Under the terms of the agreement, the Company will sell more than 3 million square feet of space as well as vacant lands.

The Company will also lease back a portion of the space. CBRE Limited served as an advisor to the Company for this

transaction. The agreement is expected to close in the first quarter of fiscal 2015. The transaction is subject to certain

conditions, and the transaction may not be completed on the negotiated terms, or at all. Additional terms of the transaction

will be announced once the principal conditions are satisfied or waived by the parties.