Blackberry 2014 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

30

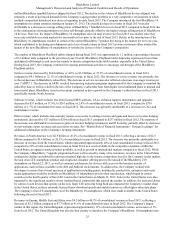

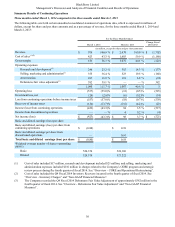

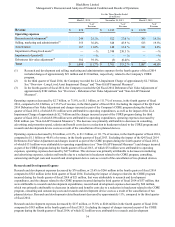

Summary Results of Continuing Operations

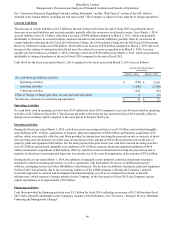

Three months ended March 1, 2014 compared to the three months ended March 2, 2013

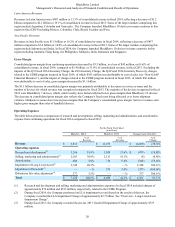

The following table sets forth certain unaudited consolidated statement of operations data, which is expressed in millions of

dollars, except for share and per share amounts and as a percentage of revenue, for the three months ended March 1, 2014 and

March 2, 2013:

For the Three Months Ended

March 1, 2014 March 2, 2013 Change Fiscal

2014/2013

(in million, except for share and per share amounts)

Revenue $ 976 100.0 % $ 2,678 100.0 % $ (1,702)

Cost of sales (1)(2) 423 43.3 % 1,603 59.9 % (1,180)

Gross margin 553 56.7 % 1,075 40.1 % (522)

Operating expenses

Research and development(1) 246 25.2 % 383 14.3 % (137)

Selling, marketing and administration(1) 355 36.4 % 523 19.5 % (168)

Amortization 107 11.0 % 181 6.8 % (74)

Debentures fair value adjustment(3) 382 39.1 % — — % 382

1,090 111.7 % 1,087 40.6 % 3

Operating loss (537) (55.0)% (12) (0.5)% (525)

Investment loss, net (20) (2.0)% (6) (0.2)% (14)

Loss from continuing operations before income taxes (557) (57.0)% (18) (0.7)% (539)

Recovery of income taxes (134) (13.7)% (112) (4.2)% (22)

Income (loss) from continuing operations (423) (43.3)% 94 3.5 % (517)

Income from discontinued operations — — % 4 0.2 % (4)

Net income (loss) $(423) (43.3)% $ 98 3.7 % $ (521)

Basic and diluted earnings (loss) per share

Basic and diluted earnings (loss) per share from

continuing operations $(0.80) $ 0.18

Basic and diluted earnings per share from

discontinued operations — 0.01

Total basic and diluted earnings (loss) per share $(0.80) $ 0.19

Weighted-average number of shares outstanding

(000’s)

Basic 526,374 524,160

Diluted 526,374 527,222

(1) Cost of sales included $17 million, research and development included $21 million, and selling, marketing and

administration expenses included $110 million in charges related to the Company’s CORE program and strategic

review process during fhe fourth quarter of fiscal 2014. See “Overview – CORE and Operational Restructuring”.

(2) Cost of sales included the Q4 Fiscal 2014 Inventory Recovery incurred in the fourth quarter of fiscal 2014. See

“Overview - Inventory Charges” and “Non-GAAP Financial Measures”.

(3) The Company recorded the Q4 Fiscal 2014 Debentures Fair Value Adjustment of approximately $382 million in the

fourth quarter of fiscal 2014. See “Overview - Debentures Fair Value Adjustment” and “Non-GAAP Financial

Measures”.