Blackberry 2014 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

39

Financial Condition

Liquidity and Capital Resources

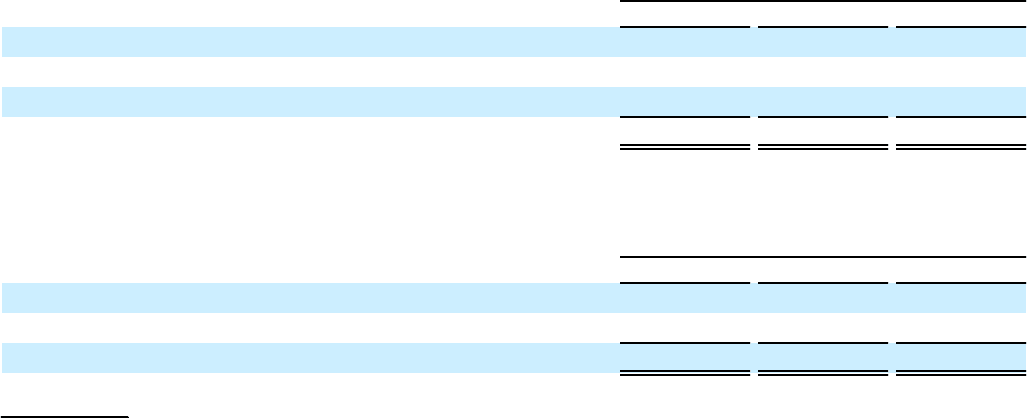

Cash, cash equivalents, and investments decreased by $217 million to $2.7 billion as at March 1, 2014 from $2.9 billion as at

March 2, 2013, primarily as a result of the Company's net loss and net changes in working capital, partially offset by proceeds

from the issuance of the Debentures. Substantially all of the Company’s cash, cash equivalents, and investments are

denominated in U.S. dollars as at March 1, 2014.

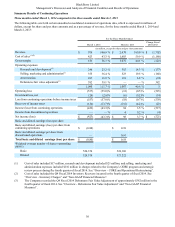

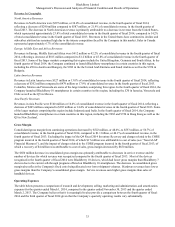

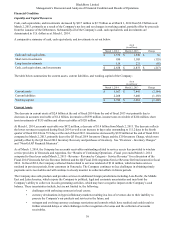

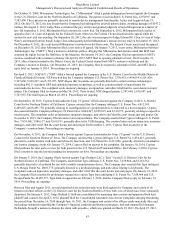

A comparative summary of cash, cash equivalents, and investments is set out below:

As at

(in millions)

March 1, 2014 March 2, 2013 Change

Cash and cash equivalents $ 1,579 $ 1,549 $ 30

Short-term investments 950 1,105 (155)

Long-term investments 129 221 (92)

Cash, cash equivalents, and investments $ 2,658 $ 2,875 $ (217)

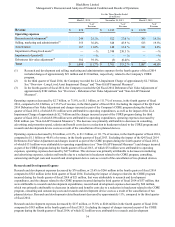

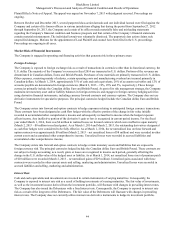

The table below summarizes the current assets, current liabilities, and working capital of the Company:

As at

(in millions)

March 1, 2014 March 2, 2013 Change

Current assets $ 5,057 $ 7,441 (2,384)

Current liabilities 2,268 3,460 (1,192)

Working capital $ 2,789 $ 3,981 (1,192)

Current Assets

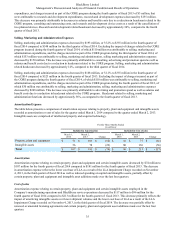

The decrease in current assets of $2.4 billion at the end of fiscal 2014 from the end of fiscal 2013 was primarily due to

decreases in accounts receivable of $1.4 billion, inventories of $359 million, income taxes receivable of $224 million, short

term investments of $155 million and other receivables of $120 million.

At March 1, 2014, accounts receivable was $972 million, a decrease of $1.4 billion from March 2, 2013. The decrease reflects

the lower revenues recognized during fiscal 2014 as well as an increase in days sales outstanding to 111.2 days in the fourth

quarter of fiscal 2014 from 79.9 days at the end of fiscal 2013. Inventories decreased by $359 million at the end of fiscal 2014

compared to March 2, 2013, primarily due to the Q3 Fiscal 2014 Inventory Charge and the Z10 Inventory Charge, which were

partially offset by the Q4 Fiscal 2014 Inventory Recovery and purchases of inventory. See “Overview - Inventory Charges”

and “Non-GAAP Financial Measures”.

As of March 1, 2014, the Company has accounts receivables outstanding related to service access fees provided to wireless

service providers in Venezuela and Argentina. See “Results of Continuing Operations - Fiscal year ended March 1, 2014

compared to fiscal year ended March 2, 2013 - Revenue - Revenue by Category - Service Revenue” for a discussion of the

Fiscal 2014 Venezuela Service Revenue Deferral and the Q4 Fiscal 2014 Argentina Service Revenue Deferral incurred in fiscal

2014. In fiscal 2014, the Company collected funds related to services rendered of $114 million, which includes services

rendered in previous periods, from customers in Venezuela. The Company continues to face challenges in obtaining timely

payments on its receivables and will continue to closely monitor its collection efforts in future periods.

The Company also sells products and provides services in additional foreign jurisdictions including Asia-Pacific, the Middle

East and Latin America, which expose the Company to political, legal and economic uncertainties and may limit the

Company’s ability to collect on its sales generating activities, which may have a negative impact on the Company’s cash

balance. These uncertainties include, but are not limited to, the following:

• challenges with enforcing contracts in local courts;

• currency devaluations in hyper-inflationary markets resulting in a loss of revenues due to their inability to

procure the Company’s our products and services in the future; and

• stringent and evolving currency exchange restrictions and controls which have resulted and could result in

further extended delays or other challenges in the recognition of revenue and the collection of accounts

receivables.