Blackberry 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

17

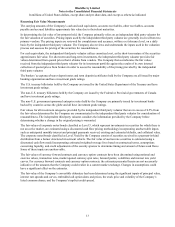

presented the impaired assets at their fair values on the Company’s balance sheets as at November 30, 2013. See Note 1

for details related to the LLA impairment test performed.

The fair values of the Company’s real estate assets were determined using market appraisals conducted by certified

appraisers.

The fair values of the Company’s property, plant and equipment, other than real estate assets ("Personal Property"), were

determined using replacement cost or sales comparison approaches with inputs including, but not limited to, original

costs, inflation indices, useful lives, effective ages, and market-derived depreciation curves for similar assets. Some of

these inputs are unobservable.

The fair value of certain of the Company’s licenses, representing payments relating to licensing agreements, were

determined using a volume ratio approach, including a comparison of the Company’s current average quarterly unit

volumes for each license to those known at the time the Company entered into the license. Some of the inputs are

unobservable.

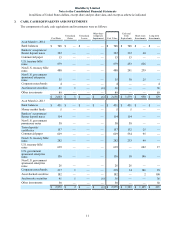

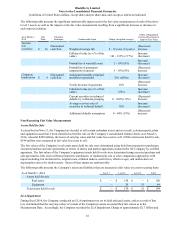

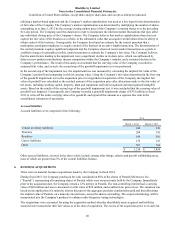

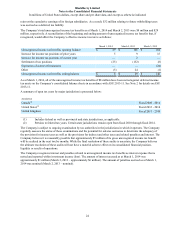

The following table presents the Company’s assets and liabilities that were measured at fair value on a non-recurring basis

as at November 4, 2013 (the date of impairment) and which have not subsequently been reclassified as held for sale:

As at November 4, 2013 Level 1 Level 2 Level 3 Total

Assets held and used

Property, plant and equipment

Real estate $ — $ 594 $ — $ 594

Personal Property — — 408 408

Total property, plant and equipment — 594 408 1,002

Intangible assets

Licenses — — 226 226

Total assets held and used $ — $ 594 $ 634 $ 1,228

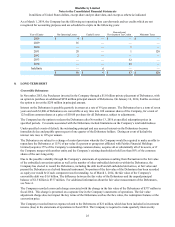

The Company’s Level 3 assets measured on a non-recurring basis consist of personal property and licenses that were

written down to fair value related to the LLA Impairment Charge.

The Company’s personal property that was written down was valued using replacement cost or sales comparison

approaches, both utilizing unobservable inputs. The unobservable inputs used in the valuations are the current effective

age of the personal property being valued and the estimated useful life.

The licenses that were written down to fair value related to the LLA Impairment Charge were valued using a volume ratio

approach incorporating unobservable inputs. The unobservable inputs used in the valuation are the current volume of

units subject to the licensing agreements and the volume of units as of the date the licenses were entered into, which

represents the volume ratio. This ratio was applied to the net book value of the licenses in order to determine its fair value.

Significant changes in these unobservable inputs could result in significantly different fair value measurements.

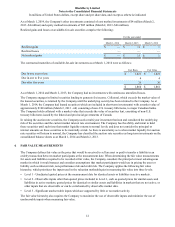

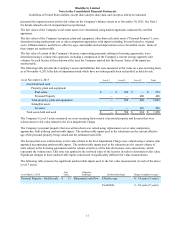

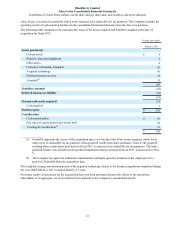

The following table presents the significant unobservable inputs used in the fair value measurement of each of the above

Level 3 assets:

As at March 1, 2014 Fair

Value Valuation

Technique Unobservable Input Range (weighted average)

Personal Property - held for sale $ 15 Discounted cash flow Effective age 0 - 14 years (3 years)

Useful life 2 - 10 years (5 years)