Blackberry 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

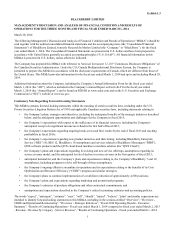

Management’s Discussion and Analysis of Financial Condition and Results of Operations

9

integrated BlackBerry 10 service offerings focused on enterprise customers that leverage the Company’s strengths such as

BBM, security and manageability to generate new service revenue streams. Customers that require enhanced services,

including advanced security, mobile device management, secure enterprise instant messaging and other services, are expected

to continue to generate monthly service revenue. Other customers who do not utilize such services are expected to generate less

or no service revenue. The Company believes that offering alternative levels of service and pricing will better meet the needs of

its customers. In addition, the Company believes that by offering these services it may be able to expand the size of its

addressable market for recurring service revenue. The Company believes this strategy will help broaden the BlackBerry

ecosystem over time, which will potentially give the Company and its application developers access to a broader market into

which to sell their respective services.

The Company expects the transition from BlackBerry 7 to BlackBerry 10 to continue to be gradual, given that the Company

has a diversified global customer base, many of whom are in markets that are expected to transition more slowly to “4G”

wireless networks. As a result of the changes and the pressure to reduce its SAF as described above, the Company anticipates

further declines in service revenue in the coming quarters, which could be significant. The Company cannot predict this

anticipated rate of decline with any degree of certainty, as it depends on a number of factors, including the outcome of

negotiations with the Company’s carrier customers and distribution partners, the rate at which current BlackBerry 6 and

BlackBerry 7 customers migrate to BlackBerry 10 and use only standard BlackBerry services, the Company’s ability to attract

existing and new enterprise customers to use the enhanced services offered by BlackBerry 10, the Company’s ability to

continue charging SAF for its BlackBerry 6 and BlackBerry 7 products, and the Company’s ability to successfully develop over

a transition period a compelling integrated services and software offering that generates new service and software revenues

from the BlackBerry 10 platform.

The Company also generated revenue from the embedded market through licensing QNX software products and providing

professional services to support customers in developing their products.

An important part of the Company’s BlackBerry wireless solution is the software that is installed at the corporate or small- and

medium-size enterprise server level, and in some cases, on personal computers. Software revenues include fees from licensing

the Company’s BES software, BlackBerry® Client Access Licenses (“CALs”), which are charged for each subscriber using the

BlackBerry service via a BES, maintenance and upgrades to software and technical support.

Revenues are also generated from non-warranty repairs and sales of accessories.

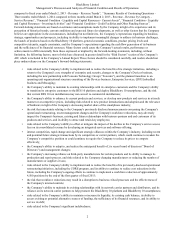

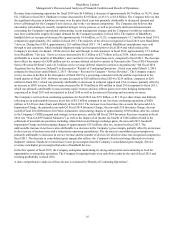

Long-Lived Asset Impairment Charge

During fiscal 2014, the Company experienced a significant decline in its share price following its pre-release of its second

quarter fiscal 2014 results on September 20, 2013, as well as its announcement on November 4, 2013 that the Purchasers were

investing in the Company through the $1.0 billion private placement of Debentures in lieu of finalizing the purchase of the

Company as contemplated in the previously-announced LOI. The Company further identified the continuing decline in

revenues, the generation of operating losses and the decrease in cash flows from operations as indicators of potential long-lived

asset (“LLA”) impairment. Further, the Company believes that its recently completed strategic review process may have

increased market uncertainty as to the future viability of the Company and may have negatively impacted demand for the

Company's products. Accordingly, a cash flow recoverability test was performed as of November 4, 2013 (the “Measurement

Date”). The estimated undiscounted net cash flows were determined utilizing the Company's internal forecast and incorporated

a terminal value of the Company utilizing its market capitalization, calculated as the number of the Company's common shares

outstanding as at the interim testing date by the average market price of the shares over a 10 day period following the

Measurement Date. The Company used this duration in order to incorporate the inherent market fluctuations that may affect

any individual closing price of the Company's shares. As a result, the Company concluded that the carrying value of its net

assets exceeded the undiscounted net cash flows as at the Measurement Date. Consequently, step two of the LLA impairment

test was performed whereby the fair values of the Company's assets were compared to their carrying values. As a result, the

Company recorded a non-cash, pre-tax charge against its LLA (the “LLA Impairment Charge”) of $2.7 billion ($2.5 billion

after tax, $4.71 per share diluted), in fiscal 2014. Significant judgment was required in calculating the LLA Impairment Charge.

See “Critical Accounting Estimates - Valuation of LLA”, “Cautionary Statement Regarding Forward-Looking Statements” and

the “Risk Factors” section of the AIF, which is included in the Annual Report, including the risk factors titled “The Company

may be required to record long-lived asset impairment charges, which could adversely impact the Company’s financial results”

and “The Company faces substantial inventory and other asset risk, including risks related to its ability to sell its inventory of

BlackBerry 10 products, manage its purchase obligations with its manufacturing partners and the potential for additional

charges related to its inventory, as well as risks related to its ability to mitigate inventory risk through its new partnership with

Foxconn”.