Blackberry 2014 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

42

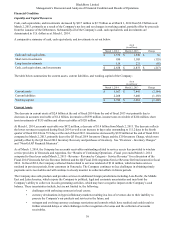

pursue opportunities to attain further cost savings in the coming fiscal quarters as it executes on its operational restructuring

plan noted above. The Company has also identified additional opportunities to generate liquidity through the anticipated receipt

of a $413 million Canadian income tax refund in the first half of fiscal 2015 and the dispositions of assets, classified as held for

sale on the Company's balance sheets. The Company has also announced that it has entered into an agreement for the

divestiture of the majority of its real estate holdings in Canada, with an expected closing in the first quarter of fiscal 2015.

Based on its current financial projections, the Company believes its financial resources, including the proceeds from the

Debentures, the tax refund received in the third quarter of fiscal 2014 and the tax refund expected to be received in the first half

of fiscal 2015, together with expected future operating cash generating and operating expense reduction activities, available

borrowings under the Facility and access to other potential financing arrangements should be sufficient to meet funding

requirements for current financial commitments, for future operating expenditures not yet committed and should provide the

necessary financial capacity for the foreseeable future. However, as noted above, the Company’s expectations with respect to

its cash position and future liquidity are forward-looking statements that are subject to many risks, including the inherent risk

of difficulties in forecasting the Company’s financial results and performance for future periods, particularly over longer

periods, given the rapid technological changes, evolving industry standards, intense competition and short product life cycles

that characterize the wireless communications industry. These difficulties in forecasting the Company's financial results and

performance are magnified at the present time given the uncertainties related to the Company's operational restructuring, recent

management changes and strategic initiatives described in this MD&A. See “Overview - CORE and Operational

Restructuring”, “Overview - Strategic Review, Debenture Financing and Management Changes”, “Overview - Strategic

Initiatives”, “Cautionary Statement Regarding Forward-Looking Statements” and the “Risk Factors” section of the AIF, which

is included in the Annual Report, including the risk factor titled “The Company’s ability to maintain or increase its liquidity, its

existing cash balance, its ability to access existing or potential alternative sources of funding, the sufficiency of its financial

resources, and its ability to service its debt, could be adversely affected by its ability to offer competitive products and services

in a timely manner at competitive prices, its ability to collect accounts receivables in jurisdictions with foreign currency

controls and its access to the capital markets”.The Company does not have any off-balance sheet arrangements as defined in

Item 303(a)(4)(ii) of Regulation S-K under the Securities Exchange Act of 1934, as amended, or under applicable Canadian

securities laws.

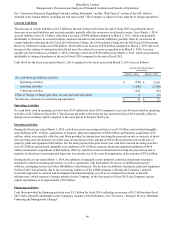

Legal Proceedings

The Company is involved in litigation in the normal course of its business, both as a defendant and as a plaintiff. The Company

is subject to a variety of claims (including claims related to patent infringement, purported class actions and other claims in the

normal course of business) and may be subject to additional claims either directly or through indemnities against claims that it

provides to certain of its partners and customers. In particular, the industry in which the Company competes has many

participants that own, or claim to own, intellectual property, including participants that have been issued patents and may have

filed patent applications or may obtain additional patents and proprietary rights for technologies similar to those used by the

Company in its products. The Company has received, and may receive in the future, assertions and claims from third parties

that the Company’s products infringe on their patents or other intellectual property rights. Litigation has been, and will likely

continue to be, necessary to determine the scope, enforceability and validity of third-party proprietary rights or to establish the

Company’s proprietary rights. Regardless of whether claims against the Company have merit, those claims could be time-

consuming to evaluate and defend, result in costly litigation, divert management’s attention and resources, subject the Company

to significant liabilities and could have the other effects that are described in greater detail under “Risk Factors” in the

Company’s Annual Information Form for the fiscal year ended March 1, 2014, which is included in the Company’s Annual

Report on Form 40-F, including the risk factors entitled “The Company is subject to general commercial litigation, class action

and other litigation claims as part of its operations, and it could suffer significant litigation expenses in defending these claims

and could be subject to significant damage awards or other remedies” and “The Company may infringe on the intellectual

property rights of others”.

Management reviews all of the relevant facts for each claim and applies judgment in evaluating the likelihood and, if

applicable, the amount of any potential loss. Where it is considered probable for a material exposure to result and where the

amount of the claim is quantifiable, provisions for loss are made based on management’s assessment of the likely outcome. The

Company does not provide for claims that are considered unlikely to result in a significant loss, claims for which the outcome

is not determinable or claims where the amount of the loss cannot be reasonably estimated. Any settlements or awards under

such claims are provided for when reasonably determinable.

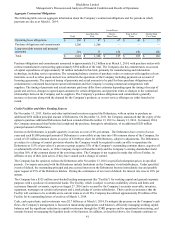

Though the Company does not believe the following legal proceedings will result in a significant loss, and does not believe

they are claims for which the outcomes are determinable or where the amounts of the loss can be reasonably estimated, the

Company has included the following summaries of certain of its legal proceedings that it believes may be of interest to its

investors.