Blackberry 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

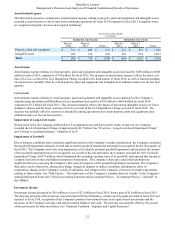

Management’s Discussion and Analysis of Financial Condition and Results of Operations

13

the Company utilizes third party appraisals, based on discounted cash flow or market comparable valuation approaches.

The Company estimates costs to sell based on historical costs incurred for similar transactions. Should any of the estimates

change, or if the actual proceeds of disposal differ from the estimate of fair value, it could have a material impact on earnings.

Adoption of Accounting Policies

In February 2013, the Financial Accounting Standards Board issued authoritative guidance to improve the reporting of

reclassifications out of accumulated other comprehensive income (loss) (“AOCI”). The guidance requires an entity to present

changes in AOCI by component and report the effect of significant reclassifications out of AOCI on the respective line items in

net income if the amount being reclassified is required under U.S. GAAP to be reclassified in its entirety to net income. For

other amounts that are not required under U.S. GAAP to be reclassified in their entirety to net income in the same reporting

period, an entity is required to cross-reference other disclosures required under U.S. GAAP that provide additional detail about

those amounts. The new authoritative guidance became effective for annual and interim reporting periods beginning on or after

December 15, 2012, with early adoption permitted. The Company adopted this guidance in the first quarter of fiscal 2014. As a

result, the Company presents, by component, changes in AOCI and the effect of significant reclassifications out of AOCI on the

respective line items in net income in Note 14 to the Consolidated Financial Statements.

In July 2013, the Financial Accounting Standards Board issued authoritative guidance to eliminate diversity in practice related

to the financial statement presentation of an unrecognized tax benefit when a net operating loss carryforward, a similar tax loss,

or a tax credit carryforward exists. The guidance requires that under certain circumstances, an unrecognized tax benefit is to be

presented in the financial statements as a reduction to a deferred tax asset as opposed to being presented as a liability. The new

authoritative guidance will become effective for fiscal years and interim reporting periods beginning after December 15, 2013,

with early adoption and retrospective application permitted. The Company has adopted this guidance in the fourth quarter of

fiscal 2014. As a result, the Company has presented the unrecognized tax benefit as a reduction to the deferred tax asset in the

consolidated balance sheets.