Blackberry 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

22

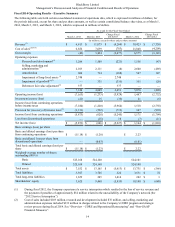

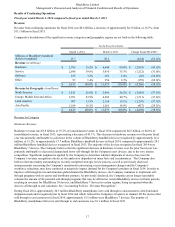

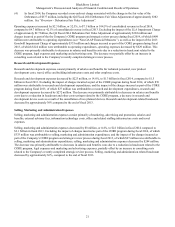

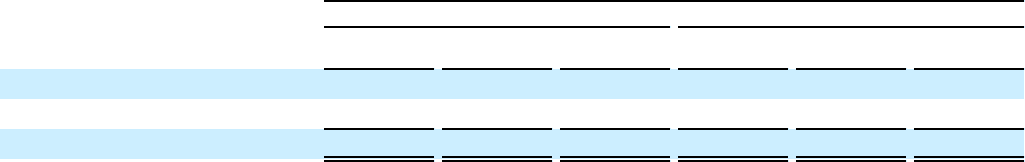

Amortization Expense

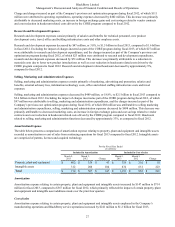

The table below presents a comparison of amortization expense relating to property, plant and equipment and intangible assets

recorded as amortization or cost of sales from continuing operations for fiscal 2014 compared to fiscal 2013. Intangible assets

are comprised of patents, licenses and acquired technology.

For the Fiscal Year Ended

(in millions)

Included in Amortization Included in Cost of sales

March 1,

2014 March 2,

2013 Change March 1,

2014 March 2,

2013 Change

Property, plant and equipment $ 321 $ 402 $ (81) $ 211 $ 319 $ (108)

Intangible assets 285 312 (27) 453 874 (421)

Total $ 606 $ 714 $ (108) $ 664 $ 1,193 $ (529)

Amortization

Amortization expense relating to certain property, plant and equipment and intangible assets decreased by $108 million to $606

million for fiscal 2014, compared to $714 million for fiscal 2013. The decrease in amortization expense reflects the lower cost

base of LLA as a result of the LLA Impairment Charge recorded in the third quarter of fiscal 2014, as well as reduced spending

on capital assets, partially offset by certain property, plant and equipment and intangible asset additions made over the last four

quarters.

Cost of sales

Amortization expense relating to certain property, plant and equipment and intangible assets employed in the Company’s

manufacturing operations and BlackBerry service operations decreased by $529 million to $664 million for fiscal 2014,

compared to $1.2 billion for fiscal 2013. This decrease primarily reflects the impact of amortizing intangible assets over lower

shipment volumes and the lower cost base of LLA as a result of the LLA Impairment Charge recorded in fiscal 2014. The

decrease was partially offset by renewed or amended licensing agreements and certain property, plant and equipment asset

additions made over the last four quarters.

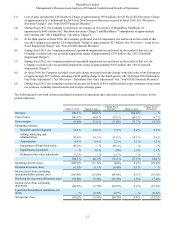

Impairment of Long-Lived Assets

During fiscal 2014, the Company performed an LLA impairment test and based on the results of that test, the Company

recorded the LLA Impairment Charge of approximately $2.7 billion. See “Overview - Long-Lived Asset Impairment Charge”

and “Critical Accounting Estimates - Valuation of LLA”.

Impairment of Goodwill

Due to business conditions and a continued significant decline in the Company’s market capitalization, the Company concluded

that goodwill impairment indicators existed and an interim goodwill impairment assessment was required for the first quarter of

fiscal 2013. The Company used a two-step impairment test to identify potential goodwill impairment and measured the amount

of the goodwill impairment loss to be recognized. As a result of the test performed, the Company recorded the 2013 Goodwill

Impairment Charge of $335 million, which eliminated the remaining carrying value of its goodwill, and reported this amount as

a separate line item in the consolidated statements of operations. The Company’s share price and control premium are

significant factors in assessing the Company’s fair value for purposes of the goodwill impairment assessment. The Company’s

share price can be affected by, among other things, changes in industry or market conditions, including the effect of

competition, changes in the Company’s results of operations, and changes in the Company’s forecasts or market expectations

relating to future results. See “Risk Factors – The market price of the Company’s common shares is volatile” in the Company’s

Annual Information Form and "Critical Accounting Estimates and Accounting Policies – Accounting Policies – Goodwill" in

this MD&A.

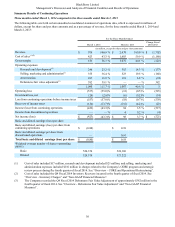

Investment Income

Investment income decreased by $36 million to a loss of $21 million in fiscal 2014, from a gain of $15 million in fiscal 2013.

The decrease primarily reflects interest costs associated with the Debentures, certain one-time gains recorded in fiscal 2013 not

repeated in fiscal 2014, recognition of the Company's portion of investment losses in its equity-based investments and the

decreases in the Company's average cash and investment balances and yield. The decrease was partially offset by the accrual

of interest income for other tax matters. See “Financial Condition - Liquidity and Capital Resources”.