Blackberry 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

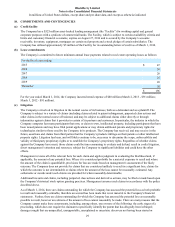

28

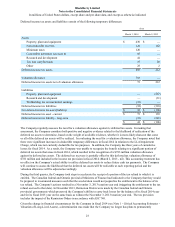

During the year ended March 1, 2014, there were no stock options granted (March 2, 2013 - 5,288,040; March 3, 2012 -

there were no stock options granted).

Restricted Share Unit Plan

The Company recorded compensation expense with respect to RSUs of approximately $63 million in the year ended

March 1, 2014 (March 2, 2013 -$78 million; March 3, 2012 -$70 million).

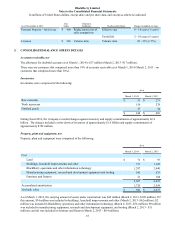

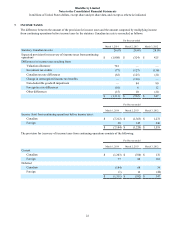

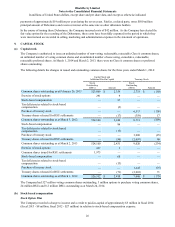

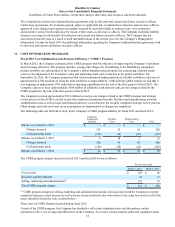

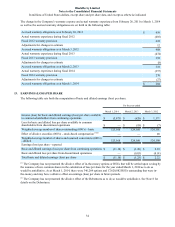

A summary of RSU activity since February 26, 2011 is shown below:

RSUs Outstanding

Number

(000’s)

Weighted-

Average

Grant Date

Fair Value

Average

Remaining

Contractual

Life in Years

Aggregate

Intrinsic

Value

(millions)

Balance as at February 26, 2011 2,703 $ 57.40

Granted during the year 7,093 25.33

Vested during the year (359) 60.42

Forfeited/cancelled during the year (842) 45.73

Balance as at March 3, 2012 8,595 31.96

Granted during the year 11,189 7.94

Vested during the year (2,697) 38.96

Forfeited/cancelled during the year (1,902) 25.46

Balance as at March 2, 2013 15,185 13.83

Granted during the year 21,741 7.39

Vested during the year (4,977) 17.11

Forfeited/cancelled during the year (7,604) 11.44

Balance as at March 1, 2014 24,345 $ 8.15 2.86 $ 244

Vested and expected to vest March 1, 2014 23,736 $ 8.11 2.89 $ 237

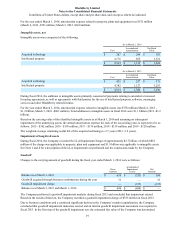

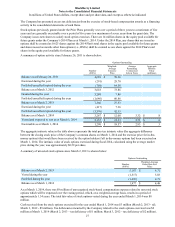

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the aggregate closing share

price of the Company’s common shares on March 1, 2014) that would have been received by RSU holders if all RSUs had

been vested on March 1, 2014.

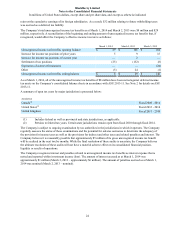

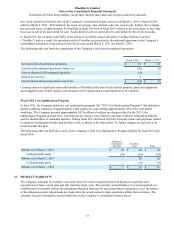

Tax deficiencies incurred by the Company related to the RSUs vested was $11 million for the year ended March 1, 2014

(March 2, 2013 - $10 million; March 3, 2012 - nil).

In order to comply with its obligation to deliver shares upon vesting, the Company purchases shares via a trustee selected

by the Company or issues new common shares. During the year ended March 1, 2014, the Company purchased 1,641,447

common shares for total cash consideration of approximately $16 million (March 2, 2013 - 3,005,670 common shares

were purchased for total cash consideration of approximately $25 million). These purchased shares are classified as

treasury stock for accounting purposes and included in the shareholders’ equity section of the Company’s consolidated

balance sheets.

As at March 1, 2014, there was $167 million of unrecognized compensation expense related to RSUs that will be

expensed over the vesting period, which, on a weighted-average basis, results in a period of approximately 2.04 years.

During the year ended March 1, 2014, there were 21,741,154 RSUs granted (March 2, 2013 – 11,189,498 RSUs were

granted), of which 16,210,460 will be settled upon vesting by the issuance of new common shares and 10,521,418 of

which were granted as an inducement grant and are exempt from the equity pool under the Company's 2014 Plan.

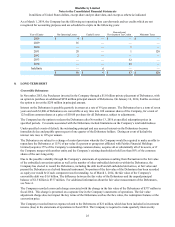

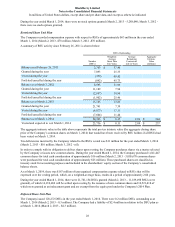

Deferred Share Unit Plan

The Company issued 128,272 DSUs in the year ended March 1, 2014. There were 0.2 million DSUs outstanding as at

March 1, 2014 (March 2, 2013 - 0.3 million). The Company had a liability of $2.4 million in relation to the DSU plan as

at March 1, 2014 (March 2, 2013 - $4.3 million).