Blackberry 2014 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

34

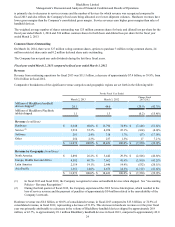

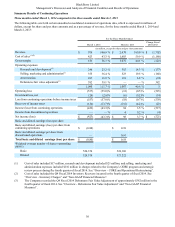

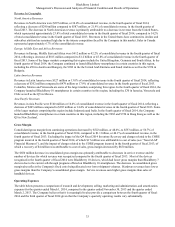

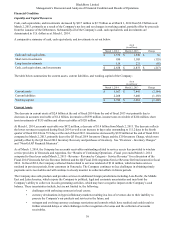

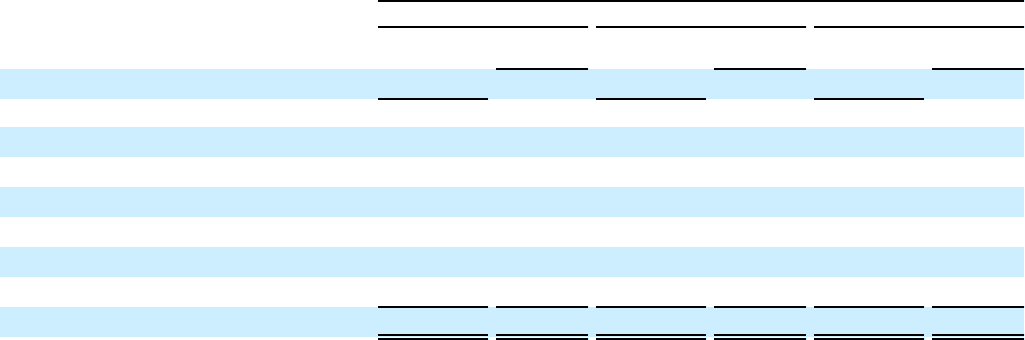

For the Three Months Ended

(in millions)

March 1, 2014 November 30, 2013 March 2, 2013

% of

Revenue % of

Revenue % of

Revenue

Revenue $ 976 $ 1,193 $ 2,678

Operating expenses

Research and development(1) 246 25.2% 322 27.0 % 383 14.3%

Selling, marketing and administration(1) 355 36.4% 548 45.9 % 523 19.5%

Amortization 107 11.0% 148 12.4 % 181 6.8%

Impairment of long-lived assets(2) — —% 2,748 230.3 % — —%

Impairment of goodwill — —% — — % — —%

Debentures fair value adjustment(3) 382 39.1% (5) (0.4)% — —%

Total $ 1,090 111.7% $ 3,761 315.2 % $ 1,087 40.6%

(1) Research and development and selling, marketing and administration expenses for the fourth quarter of fiscal 2014

included charges of approximately $21 million and $110 million, respectively, related to the Company's CORE

program.

(2) In the third quarter of fiscal 2014, the Company recorded the LLA Impairment Charge of approximately $2.7 billion.

See “Overview - Long-Lived Asset Impairment Charge” and “Non-GAAP Financial Measures”.

(3) In the fourth quarter of fiscal 2014, the Company recorded the Q4 Fiscal 2014 Debentures Fair Value Adjustment of

approximately $382 million. See “Overview - Debentures Fair Value Adjustment" and “Non-GAAP Financial

Measures”.

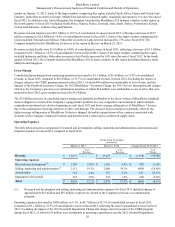

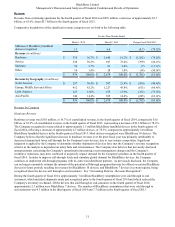

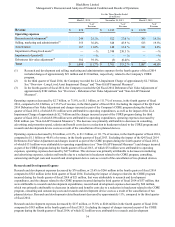

Operating expenses decreased by $2.7 billion, or 71.0%, to $1.1 billion, or 111.7% of revenue, in the fourth quarter of fiscal

2014, compared to $3.8 billion, or 315.2% of revenue, in the third quarter of fiscal 2014. Excluding the impact of the Q4 Fiscal

2014 Debentures Fair Value Adjustment and charges incurred as part of the Company's CORE program during the fourth

quarter of fiscal 2014, of which $131 million were attributable to operating expenditures, as well as the impact of the LLA

Impairment Charge of approximately $2.7 billion and the charges incurred as part of the CORE program during the third

quarter of fiscal 2014, of which $190 million were attributable to operating expenditures, operating expenses decreased by

$246 million (see “Non-GAAP Financial Measures”). The decrease was primarily attributable to decreases in consulting,

advertising and promotion spend, salaries and benefit costs due to a reduction in headcount related to the CORE program and

research and development device costs as a result of the cancellation of two planned devices.

Operating expenses decreased by $3 million, or 0.3%, to $1.1 billion, or 111.7% of revenue, in the fourth quarter of fiscal 2014,

compared to $1.1 billion or 40.6% of revenue, in the fourth quarter of fiscal 2013. Excluding the impact of the Q4 Fiscal 2014

Debentures Fair Value Adjustment and charges incurred as part of the CORE program during the fourth quarter of fiscal 2014,

of which $131 million were attributable to operating expenditures (see “Non-GAAP Financial Measures”) and charges incurred

as part of the CORE program during the fourth quarter of fiscal 2013, of which $33 million were attributable to operating

expenses, operating expenses decreased by $477 million. This decrease was primarily attributable to decreases in marketing

and advertising expenses, salaries and benefits due to a reduction in headcount related to the CORE program, consulting,

outsourcing and legal costs and research and development device costs as a result of the cancellation of two planned devices.

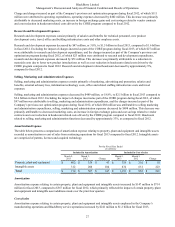

Research and Development Expense

Research and development expenses decreased by $76 million, or 23.6% to $246 million in the fourth quarter of fiscal 2014

compared to $322 million in the third quarter of fiscal 2014. Excluding the impact of charges related to the CORE program

incurred during the fourth quarter of fiscal 2014 of $21 million, that were attributable to research and development

expenditures, and the charges related to the CORE program incurred during the third quarter of fiscal 2014 of $37 million, that

were attributable to research and development expenditures, research and development expenses decreased by $60 million,

which was primarily attributable to decreases in salaries and benefits costs due to a reduction in headcount related to the CORE

program, consulting and outsourcing costs and research and development device costs as a result of the cancellation of two

planned devices. Research and development related headcount decreased by approximately 11%, compared to the third quarter

of fiscal 2014.

Research and development expenses decreased by $137 million, or 35.8% to $246 million in the fourth quarter of fiscal 2014

compared to $383 million in the fourth quarter of fiscal 2013. Excluding the impact of charges incurred as part of the CORE

program during the fourth quarter of fiscal 2014, of which $21 million were attributable to research and development