BP 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

Performance framework

Corporate governance

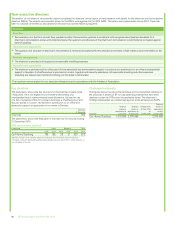

• Salary increases are not directly linked to

performance. However a base-line level of

personal contribution is needed in order to be

considered for a salary increase and

exceptional sustained contribution may be

grounds for accelerated salary increases.

• Both deferred and matched shares must

pass an additional hurdle related to safety and

environmental sustainability performance in

order to vest.

• If there has been a material deterioration in

safety and environmental metrics, or there

have been major incidents revealing underlying

weaknesses in safety and environmental

management then the committee, with advice

from the safety, ethics and environmental

assurance committee, may conclude that

shares vest in part, or not at all.

• All deferred shares are subject to clawback

provisions if they are found to have been

granted on the basis of materially misstated

financial or other data.

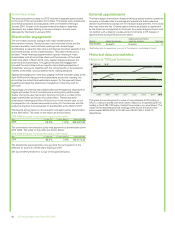

• Performance shares will vest on the following

three performance measures:

– Total shareholder return relative to other

oil majors.

– Operating cash flow.

– Strategic imperatives.

• Measures based on relative performance to oil

majors will vest 100%, 80%, 25% for first,

second and third place finish respectively and

0% for fourth or fifth position.

• The committee identifies the specific strategic

imperatives to be included every year and may

also alter the other measures if others are

deemed to be more aligned to strategic

priorities. These are explained in the annual

report on remuneration.

• The committee may exercise judgement to

adjust vesting outcomes if it concludes that the

formulaic approach does not reflect the true

underlying performance of the company’s

business or is inconsistent with shareholder

benefits.

• All performance shares are subject to

clawback provisions if they are found to have

been granted on the basis of materially

misstated financial or other data.

• Salary increases will be in line with all

employee increases in the UK and US

and limited to within 2% of average

increase for the group leaders.

• Benefits reflect home country norms.

The current package of benefits will be

maintained, although the taxable value

may fluctuate.

• Where shares vest, additional shares

representing the value of reinvested

dividends are added.

• Before being released, all matched shares

that vest after the three-year performance

period are subject (after tax) to an

additional three-year retention period.

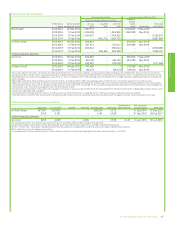

• Current US executive directors participate

in transition arrangements related to

heritage plans of Amoco and Arco and

normal defined benefit plans that apply to

executives with an accrual rate of 1.3% of

final earnings (salary plus bonus) for each

year of service.

• Where shares vest, additional shares

representing the value of reinvested

dividends are added.

• Before being released, those shares that

vest after the three-year performance

period are subject (after tax) to an

additional three-year retention period.

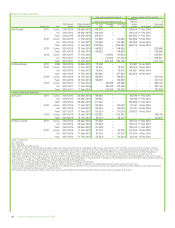

• Specific measures and targets are determined

each year by the remuneration committee.

• A proportion will be based on safety and

operational risk management and is likely to

include measures such as loss of primary

containment, recordable injury frequency

and tier 1 process safety events.

• The principal measures of annual bonus will

be based on value creation and may include

financial measures such as operating cash

flow, replacement cost operating profit and cost

management, as well as operating measures

such as major project delivery, Downstream

net income per barrel and Upstream unplanned

deferrals. The specific metrics chosen each year

will be set out and explained in the annual report

on remuneration.

• Achieving annual plan objectives equates

to on-target bonus. The level of threshold

payout for minimum performance varies

according to the nature of the measure

in question.

• Pension in the UK is not directly linked to

performance.

• Pension in the US includes bonus in

determining benefit level.

BP Annual Report and Form 20-F 2015 89