BP 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Integrated business

We benefit from having both upstream and

downstream businesses, as well as a well-

established oil and gas trading function that can

generate value for the group when prices are

volatile. A weak environment in one part of the

group can create opportunities in another. For

example, we delivered record profits in our

Downstream business in 2015.

Balanced portfolio

The geographical diversity and mix of resource

types in our portfolio can provide us with resilience

to a wide range of operating conditions and

opportunities for growth. In Upstream we operate

in countries with different commercial frameworks.

We have a significant part of our portfolio in

production-sharing agreements, where revenues

are typically less sensitive to oil price fluctuations.

Balance sheet flexibility

We maintain a strong balance sheet with

sufficient cash reserves, which helps to withstand

price falls and other events. We began 2015 with

significant cash reserves due to strong operating

cash flow in 2014 and the two divestment

programmes made since the Gulf of Mexico oil

spill. Most of these sales were made in the higher

oil price environment.

We are taking action to adapt to a lower oil and gas

price environment – while maintaining longer-term

growth prospects.

Lower oil and gas prices

Remodelling Mad Dog Phase 2 reduced our

project cost estimate by more than half.

Since 2010, we have been working to create a

stronger, simpler and more focused business.

This has positioned us well to respond to the

lower oil and gas price environment. We are

reducing capital expenditure by paring back and

rephasing activities as necessary, as well as

capturing the benefits of deflation of industry

costs. We are driving down cash costs★ through

a reduction in third-party costs, and through

efficiency and simplification across the

organization. As always, safe and reliable

operations are our first priority.

Between 2010 to mid-2014 oil prices were relatively

stable, averaging around $100 per barrel. In 2014, strong

supply growth, largely as a result of growth in US shale,

caused oil prices to fall sharply. Prices fell further in 2015

as OPEC production increased and supply continued to

outstrip demand. There are, however, increasing signs

that the market is adjusting to the current low level of

prices, with strong demand growth and weakening

supply. The high level of inventories suggests that this

adjustment process is likely to take some time, but it

does appear to be underway. This underpins our belief

that prices will stay lower for longer, but not forever.

Gas prices also fell, albeit on a more regional and less

dramatic scale. In markets such as the US, gas prices

are at historically low levels, with increases in

production from shale being a key factor.

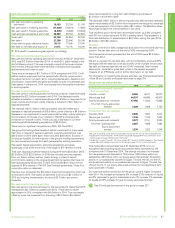

The cash flow from our Upstream operations

was significantly lower than in 2014 although

Downstream cash flows were strong. We

significantly reduced the capital expenditure of

the group as well as received proceeds from

divestments. The strength of our balance sheet

helped us meet the balance of outgoings.

How we are resilient

Industry context

Sources and uses of cash

30

25

20

15

10

5

Operating cash flow − rest of group

Disposal proceeds − investing activities

Sources

Uses

Capital investment − investing activities

Dividends paid

Operating cash flow − Gulf of Mexico oil spill

($ billion) For the year ended 31 December 2015.

Sources Uses

$

Brent dated average crude oil prices

($/barrel)

2015

$52.39

2014

$98.95

2013

$108.66

Low prices are having a significant effect on our

industry, including BP. With falling revenues,

companies need to re-base costs and activity – a

process that could take several years. We expect

2016 to be a period of intense change, with ongoing

restructuring and further deflation in the supply

chain. That said, periods of low prices are not

uncommon in our industry and BP has gone through

such cycles in the past.

For BP, the lower prices significantly impacted our

2015 financial results. The result for the year was

a loss of $6.5 billion. Underlying replacement

cost profit★ was $5.9 billion (2014 $12.1 billion)

and operating cash flow★ was $19.1 billion

(2014 $32.8 billion).

BP Annual Report and Form 20-F 201518