BP 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. Significant accounting policies, judgements, estimates and assumptions – continued

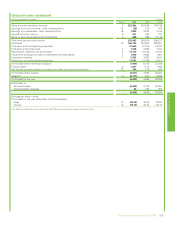

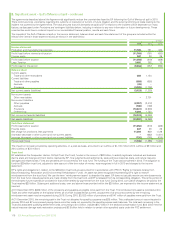

Other property, plant and equipment is depreciated on a straight-line basis over its expected useful life. The typical useful lives of the group’s other

property, plant and equipment are as follows:

Land improvements 15 to 25 years

Buildings 20 to 50 years

Refineries 20 to 30 years

Petrochemicals plants 20 to 30 years

Pipelines 10 to 50 years

Service stations 15 years

Office equipment 3 to 7 years

Fixtures and fittings 5 to 15 years

The expected useful lives of property, plant and equipment are reviewed on an annual basis and, if necessary, changes in useful lives are accounted for

prospectively.

An item of property, plant and equipment is derecognized upon disposal or when no future economic benefits are expected to arise from the continued

use of the asset. Any gain or loss arising on derecognition of the asset (calculated as the difference between the net disposal proceeds and the

carrying amount of the item) is included in the income statement in the period in which the item is derecognized.

Significant estimate or judgement: estimation of oil and natural gas reserves

The determination of the group’s estimated oil and natural gas reserves requires significant judgements and estimates to be applied and these are

regularly reviewed and updated. Factors such as the availability of geological and engineering data, reservoir performance data, acquisition and

divestment activity, drilling of new wells, and commodity prices all impact on the determination of the group’s estimates of its oil and natural gas

reserves. BP bases its proved reserves estimates on the requirement of reasonable certainty with rigorous technical and commercial assessments

based on conventional industry practice and regulatory requirements.

The estimation of oil and natural gas reserves and BP’s process to manage reserves bookings is described in Supplementary information on oil and

natural gas on page 169, which is unaudited. Details on BP’s proved reserves and production compliance and governance processes are provided on

page 228.

Estimates of oil and natural gas reserves are used to calculate depreciation, depletion and amortization charges for the group’s oil and gas properties.

The impact of changes in estimated proved reserves is dealt with prospectively by amortizing the remaining carrying value of the asset over the

expected future production. Oil and natural gas reserves also have a direct impact on the assessment of the recoverability of asset carrying values

reported in the financial statements. If proved reserves estimates are revised downwards, earnings could be affected by changes in depreciation

expense or an immediate write-down of the property’s carrying value.

The 2015 movements in proved reserves are reflected in the tables showing movements in oil and natural gas reserves by region in Supplementary

information on oil and natural gas (unaudited) on page 169. Information on the carrying amounts of the group’s oil and natural gas properties,

together with the amounts recognized in the income statement as depreciation, depletion and amortization is contained in Note 11 and Note 5

respectively.

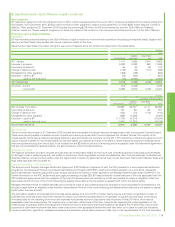

Impairment of property, plant and equipment, intangible assets, and goodwill

The group assesses assets or groups of assets, called cash-generating units (CGUs), for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset or CGU may not be recoverable; for example, changes in the group’s business plans, changes in the

group’s assumptions about commodity prices, low plant utilization, evidence of physical damage or, for oil and gas assets, significant downward

revisions of estimated reserves or increases in estimated future development expenditure or decommissioning costs. If any such indication of

impairment exists, the group makes an estimate of the asset’s or CGU’s recoverable amount. Individual assets are grouped into CGUs for impairment

assessment purposes at the lowest level at which there are identifiable cash flows that are largely independent of the cash flows of other groups of

assets. A CGU’s recoverable amount is the higher of its fair value less costs of disposal and its value in use. Where the carrying amount of a CGU

exceeds its recoverable amount, the CGU is considered impaired and is written down to its recoverable amount.

The business segment plans, which are approved on an annual basis by senior management, are the primary source of information for the

determination of value in use. They contain forecasts for oil and natural gas production, refinery throughputs, sales volumes for various types of refined

products (e.g. gasoline and lubricants), revenues, costs and capital expenditure. As an initial step in the preparation of these plans, various assumptions

regarding market conditions, such as oil prices, natural gas prices, refining margins, refined product margins and cost inflation rates are set by senior

management. These assumptions take account of existing prices, global supply-demand equilibrium for oil and natural gas, other macroeconomic

factors and historical trends and variability. In assessing value in use, the estimated future cash flows are adjusted for the risks specific to the asset

group and are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money.

Fair value less costs of disposal is the price that would be received to sell the asset in an orderly transaction between market participants and does not

reflect the effects of factors that may be specific to the group and not applicable to entities in general.

An assessment is made at each reporting date as to whether there is any indication that previously recognized impairment losses may no longer exist

or may have decreased. If such an indication exists, the recoverable amount is estimated. A previously recognized impairment loss is reversed only if

there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognized. If that is

the case, the carrying amount of the asset is increased to the lower of its recoverable amount and the carrying amount that would have been

determined, net of depreciation, had no impairment loss been recognized for the asset in prior years. Impairment reversals are recognized in profit or

loss. After a reversal, the depreciation charge is adjusted in future periods to allocate the asset’s revised carrying amount, less any residual value, on a

systematic basis over its remaining useful life.

Goodwill is reviewed for impairment annually or more frequently if events or changes in circumstances indicate the recoverable amount of the group

of cash-generating units to which the goodwill relates should be assessed. In assessing whether goodwill has been impaired, the carrying amount of

the group of CGUs to which goodwill has been allocated is compared with its recoverable amount. Where the recoverable amount of the group of

CGUs is less than the carrying amount (including goodwill), an impairment loss is recognized. An impairment loss recognized for goodwill is not

reversed in a subsequent period.

110 BP Annual Report and Form 20-F 2015