BP 2015 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

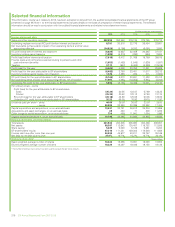

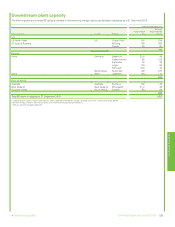

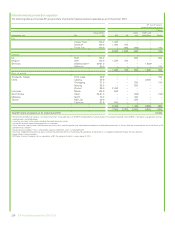

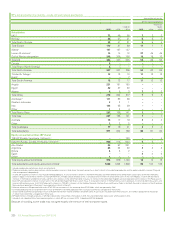

Upstream analysis by region

Our upstream operations are set out below by geographical area, with

associated significant events for 2015. BP’s percentage working interest

in oil and gas assets is shown in brackets. Working interest is the cost-

bearing ownership share of an oil or gas lease. Consequently, the

percentages disclosed for certain agreements do not necessarily reflect

the percentage interests in reserves and production.

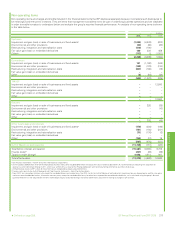

In addition to exploration, development and production activities, our

upstream business also includes midstream and LNG supply activities.

Midstream activities involve the ownership and management of crude oil

and natural gas pipelines, processing facilities and export terminals, LNG

processing facilities and transportation, and our natural gas liquids (NGLs)

extraction business.

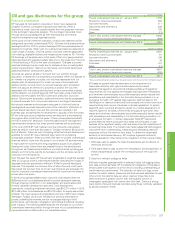

Our LNG supply activities are located in Abu Dhabi, Angola, Australia,

Indonesia and Trinidad. We market around 20% of our LNG production

using BP LNG shipping and contractual rights to access import terminal

capacity in the liquid markets of the US (via Cove Point), the UK (via the

Isle of Grain), Spain (in Bilbao) and Italy (in Rovigo), with the remainder

marketed directly to customers. LNG is supplied to customers in markets

including Japan, South Korea, China, the Dominican Republic, Argentina,

Brazil and Mexico.

Europe

BP is active in the North Sea and the Norwegian Sea. Our activities focus

on maximizing recovery from existing producing fields and selected new

field developments. BP’s production is generated from three key areas:

the Shetland area, comprising Magnus, Clair, Foinaven and Schiehallion

fields; the central area, comprising Bruce, Andrew and ETAP fields; and

Norway, comprising Valhall, Ula and Skarv fields.

• BP and its partners, ConocoPhillips, Chevron and Shell, announced

their decision to proceed with a two-year appraisal programme to

evaluate a potential third phase of the Clair field (BP 28.6%), west of

the Shetland Islands in March 2013. In March we completed the sixth

and final well of the programme. The Clair field partners will review the

significant amount of data collected to determine the potential for

development.

• The Quad 204 project, a major redevelopment to extend the life of the

Schiehallion and Loyal fields to the west of Shetland, continued in

2015. After successfully completing sea trials, Glen Lyon, the

replacement floating production, storage and offload vessel (FPSO),

departed South Korea in December at the start of its journey to the

Shetlands. We also ran a major offshore campaign focusing on the pre-

installation of risers and ancillary equipment in preparation for its arrival.

As well as the new FPSO, the redevelopment includes extension of

the existing subsea infrastructure and drilling new wells. In April, on

behalf of its co-venturers, BP announced the start of a seven-year

drilling campaign on the Loyal field by the new-build, semi-submersible

drilling rig, Deepsea Aberdeen.

• In June BP and its partners announced that the Clair Ridge platform’s

topside modules for accommodation and utilities had been installed.

The next major milestone will be the installation of the production and

drilling platform topside modules, scheduled for summer 2016, with

production expected to commence in late 2017.

• In July we were awarded five new blocks across two licences in the

North Sea as part of the second tranche of the 28th licensing round by

the UK Oil and Gas Authority, bringing the total blocks awarded to BP

to 12 to date in this licensing round.

• Maersk Oil announced the UK Oil and Gas Authority’s approval of

development plans for the Culzean field in the UK North Sea in August.

Culzean is operated by Maersk Oil on behalf of its partners, JX Nippon

and BP (16%).

• We completed the Magnus life extension project in July enabling

Magnus to continue safe and compliant operations. This was the first

project in our North Sea renewals programme, designed to extend the

productive life of mature assets. Production for Magnus has been

extended by five years to 2023. Additional accommodation has been

constructed to enable maintenance of this ageing facility and a return

to drilling in 2017.

• The ETAP life extension and additional living-quarters project began in

2015 and is scheduled to run through 2016. These activities aim to

delay cessation of production for the ETAP fields to 2030 by executing

maintenance scope and installing additional living quarters on the

central processing facility. Total investment on these projects is

currently estimated at $360 million gross.

• Operations at the Rhum gas field continued under a temporary

management scheme announced by the UK government in 2013.

Production was suspended between November 2010 and October

2014 following the imposition of EU sanctions on Iran. The field is

owned by BP (50%) and the Iranian Oil Company (IOC) under a joint

operating agreement. See International trade sanctions on page 242.

• In December, a number of North Sea assets were subject to

impairment charges totalling $830 million, primarily as a result of the

lower price environment. These were however more than offset by

impairment reversals of $945 million in relation to other assets in the

region arising as a result of decreases in cost estimates and a

reduction in the discount rate applied.

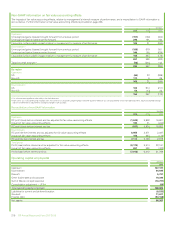

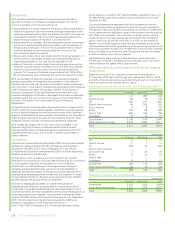

In the UK North Sea, BP operates the Forties Pipeline System (FPS)

(BP 100%), an integrated oil and NGLs transportation and processing

system that handles production from around 80 fields in the central

North Sea. The system has a capacity of more than 675mboe/d, with

average throughput in 2015 of 442mboe/d. BP also operated and had a

36% interest in the Central Area Transmission System (CATS), a 400-

kilometre natural gas pipeline system in the central UK sector of the

North Sea providing transport and processing services. Average

throughput in 2015 was 40mboe/d. In April, BP announced the sale of its

equity in the CATS business to Antin Infrastructure Partners for a

headline price of $486 million, and the sale completed in December. BP

also operates the Sullom Voe oil and gas terminal in Shetland.

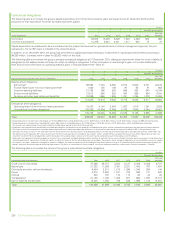

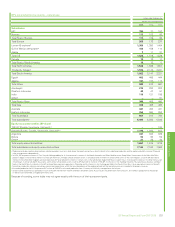

North America

Our upstream activities in North America take place in four main areas:

deepwater Gulf of Mexico, the Lower 48 states, Alaska and Canada. For

further information on BP’s activities in connection with its

responsibilities following the Deepwater Horizon oil spill, see page 41.

BP has around 500 lease blocks in the deepwater Gulf of Mexico, making

us one of the largest portfolio owners, and operates four production hubs.

• We announced a new ownership and operating model with Chevron and

ConocoPhillips in January 2015. We sold approximately half of our equity

interests in the Gila field to Chevron in December 2014 and

approximately half of our equity interest in the Tiber field to them in

January 2015. BP, Chevron and ConocoPhillips also have agreed to joint

ownership interests in exploration blocks east of Gila known as Gibson

(BP 34%). Chevron will operate Tiber (BP 31%), Gila (BP 34%) and

Gibson. Operatorship transferred at the end of 2015 after BP finished

drilling appraisal wells at Gila and Tiber. These arrangements enable us to

support exploration and development in the Paleogene, share

development costs and maximize synergies allowing us to manage and

improve capital efficiency, as well as increase our focus on maximizing

production at our existing operated hubs.

• In the fourth quarter, BP began drilling operations on two wells, the

Chevron operated Gibson prospect and the appraisal well on the

Hopkins discovery. Both wells will complete in 2016.

• In March we incurred drilling rig contract cancellation costs of

$375 million for two deepwater drilling rigs in the Gulf of Mexico which

are no longer required for our operations.

• In November BP and its partners in the Mad Dog Phase 2 project

(BP 60.5%) approved a modified development plan and were awarded

a Suspension of Production from the US Department of the Interior.

Mad Dog Phase 2 will develop resources in the central area of the field

through a subsea development consisting of up to 24 wells from four

drill centres.

• In December we wrote off $345 million relating to costs for the Gila

discovery as these resources would be challenging to develop in the

current environment.

• See also Significant estimate or judgement: oil and natural gas

accounting on page 109 for further information on leases.

• See page 30 for further information on our Thunder Horse South

Expansion project.

Additional disclosures

*Defined on page 256. BP Annual Report and Form 20-F 2015 221