BP 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

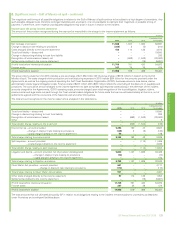

1. Significant accounting policies, judgements, estimates and assumptions – continued

For the purpose of hedge accounting, hedges are classified as:

• fair value hedges when hedging exposure to changes in the fair value of a recognized asset or liability

• cash flow hedges when hedging exposure to variability in cash flows that is attributable to either a particular risk associated with a recognized asset

or liability or a highly probable forecast transaction.

Hedge relationships are formally designated and documented at inception, together with the risk management objective and strategy for undertaking

the hedge. The documentation includes identification of the hedging instrument, the hedged item or transaction, the nature of the risk being hedged,

and how the entity will assess the hedging instrument effectiveness in offsetting the exposure to changes in the hedged item’s fair value or cash flows

attributable to the hedged risk. Such hedges are expected at inception to be highly effective in achieving offsetting changes in fair value or cash flows.

Hedges meeting the criteria for hedge accounting are accounted for as follows:

Fair value hedges

The change in fair value of a hedging derivative is recognized in profit or loss. The change in the fair value of the hedged item attributable to the risk

being hedged is recorded as part of the carrying value of the hedged item and is also recognized in profit or loss. The group applies fair value hedge

accounting when hedging interest rate risk and certain currency risks on fixed rate borrowings.

If the criteria for hedge accounting are no longer met, or if the group revokes the designation, the accumulated adjustment to the carrying amount of a

hedged item at such time is then amortized to profit or loss over the remaining period to maturity.

Cash flow hedges

The effective portion of the gain or loss on a cash flow hedging instrument is recognized within other comprehensive income, while the ineffective

portion is recognized in profit or loss. Amounts taken to other comprehensive income are reclassified to the income statement when the hedged

transaction affects profit or loss.

Where the hedged item is a non-financial asset or liability, such as a forecast foreign currency transaction for the purchase of property, plant and

equipment, the amounts recognized within other comprehensive income are reclassified to the initial carrying amount of the non-financial asset or

liability. Where the hedged item is an equity investment, the amounts recognized in other comprehensive income remain in the separate component of

equity until the hedged cash flows affect profit or loss. Where the hedged item is recognized directly in profit or loss, the amounts recognized in other

comprehensive income are reclassified to production and manufacturing expenses, except for cash flow hedges of variable interest rate risk which are

reclassified to finance costs.

If the hedging instrument expires or is sold, terminated or exercised without replacement or rollover, or if its designation as a hedge is revoked,

amounts previously recognized within other comprehensive income remain in equity until the forecast transaction occurs and are reclassified to the

income statement or to the initial carrying amount of a non-financial asset or liability as above.

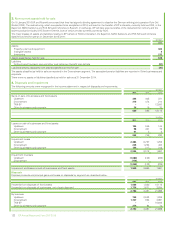

Significant estimate or judgement: application of hedge accounting

The decision as to whether to apply hedge accounting within subsidiaries, and by equity-accounted entities, can have a significant impact on the

group’s financial statements. Cash flow and fair value hedge accounting is applied to certain finance debt-related instruments in the normal course of

business and cash flow hedge accounting is applied to certain highly probable foreign currency transactions as part of the management of currency

risk. See Note 16, Note 28 and Note 29 for further information.

Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. The

group categorizes assets and liabilities measured at fair value into one of three levels depending on the ability to observe inputs employed in their

measurement. Level 1 inputs are quoted prices in active markets for identical assets or liabilities. Level 2 inputs are inputs that are observable, either

directly or indirectly, other than quoted prices included within level 1 for the asset or liability. Level 3 inputs are unobservable inputs for the asset or

liability reflecting significant modifications to observable related market data or BP’s assumptions about pricing by market participants.

Significant estimate or judgement: valuation of derivatives

In some cases the fair values of derivatives are estimated using internal models due to the absence of quoted prices or other observable, market-

corroborated data. This applies to the group’s longer-term derivative contracts. The majority of these contracts are valued using models with inputs

that include price curves for each of the different products that are built up from available active market pricing data and modelled using the

maximum available external pricing information. Additionally, where limited data exists for certain products, prices are determined using historic and

long-term pricing relationships. Price volatility is also an input for options models.

Changes in the key assumptions could have a material impact on the fair value gains and losses on derivatives recognized in the income statement.

For more information see Note 29.

Offsetting of financial assets and liabilities

Financial assets and liabilities are presented gross in the balance sheet unless both of the following criteria are met: the group currently has a legally

enforceable right to set off the recognized amounts; and the group intends to either settle on a net basis or realize the asset and settle the liability

simultaneously. A right of set off is the group’s legal right to settle an amount payable to a creditor by applying against it an amount receivable from the

same counterparty. The relevant legal jurisdiction and laws applicable to the relationships between the parties are considered when assessing whether

a current legally enforceable right to set off exists.

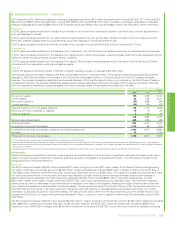

Provisions, contingencies and reimbursement assets

Provisions are recognized when the group has a present legal or constructive obligation as a result of a past event, it is probable that an outflow of

resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of the obligation.

Where appropriate, the future cash flow estimates are adjusted to reflect risks specific to the liability.

If the effect of the time value of money is material, provisions are determined by discounting the expected future cash flows at a pre-tax risk-free rate

that reflects current market assessments of the time value of money. Where discounting is used, the increase in the provision due to the passage of

time is recognized within finance costs. A provision is discounted using either a nominal discount rate of 2.75% (2014 2.75%) or a real discount rate of

0.75% (2014 0.75%), as appropriate. Provisions are split between amounts expected to be settled within 12 months of the balance sheet date (current)

and amounts expected to be settled later (non-current).

BP Annual Report and Form 20-F 2015 113

Financial statements