BP 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

Directors’ shareholdings

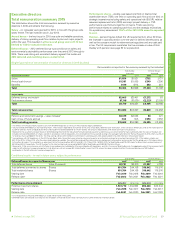

Executive directors are required to develop a personal shareholding of five

times salary within a reasonable period of time from appointment. It is the

stated intention of the policy that executive directors build this level of

personal shareholding primarily by retaining those shares that vest in the

deferred bonus and performance share plans which are part of the EDIP.

In assessing whether the requirement has been met, the committee takes

account of the factors it considers appropriate, including promotions and

vesting levels of these share plans, as well as any abnormal share price

fluctuations. The table below shows the status of each of the executive

directors in developing this level. These figures include the value as at

22 February 2016 from the directors’ interests shown below plus the

assumed vesting of the 2013-2015 performance shares and is consistent

with the figures reported in the single figure table on page 77.

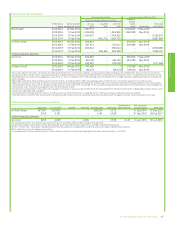

Appointment date

Value of current

shareholding

% of policy

achieved

Bob Dudley October 2010 $12,478,540 135

Dr Brian Gilvary January 2012 £3,559,733 97

The committee is satisfied that all executive directors’ shareholdings meet

the policy requirement.

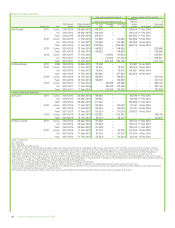

The figures below indicate and include all beneficial and non-beneficial

interests of each executive director of the company in shares of BP (or

calculated equivalents) that have been disclosed to the company under the

Disclosure and Transparency Rules (DTRs) as at the applicable dates.

Current directors

Ordinary

shares or

equivalents at

1 Jan 2015

Ordinary

shares or

equivalents at

31 Dec 2015

Change from

31 Dec 2015

to

22 Feb 2016

Ordinary

shares or

equivalents

total at

22 Feb 2016

Bob Dudleya738,858 1,554,198 285,366 1,839,564

Dr Brian Gilvary 545,217 903,856 201,710 1,105,566

a Held as ADSs.

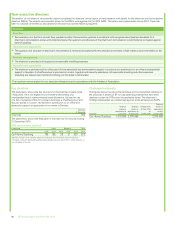

The following table shows both the performance shares and the deferred

bonus element awarded under the EDIP. These figures represent the

maximum possible vesting levels. The actual number of shares/ADSs that

vest will depend on the extent to which performance conditions have been

satisfied over a three-year period.

Current directors

Performance

shares at

1 Jan 2015

Performance

shares at

31 Dec 2015

Change from

31 Dec 2015 to

22 Feb 2016

Performance

shares total at

22 Feb 2016

Bob Dudleya5,227,500 5,536,950 (458,760)5,078,19 0

Dr Brian Gilvary 2,375,957 2,789,921 (315,260) 2,474,661

a Held as ADSs.

At 22 February 2016, the following directors held the numbers of options

under the BP group share option schemes over ordinary shares or their

calculated equivalent set out below. None of these are subject to

performance conditions. Additional details regarding these options can be

found on page 87.

Current director Options

Dr Brian Gilvary 504,191

No director has any interest in the preference shares or debentures of the

company or in the shares or loan stock of any subsidiary company.

There are no directors or other members of senior management who own

more than 1% of the ordinary shares in issue. At 22 February 2016, all

directors and other members of senior management as a group held

interests of 17,529,149 ordinary shares or their calculated equivalent,

8,761,779 performance shares or their calculated equivalent and 6,039,841

options over ordinary shares or their calculated equivalent under the BP

group share option schemes. Senior management comprises members of

the executive team. See pages 60-61 for further information.

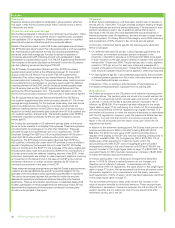

History of CEO remuneration

Year CEO

Total

remuneration

thousanda

Annual bonus

% of

maximum

Performance

share vesting

% of maximum

2009 Hayward £6,753 89b17.5

2010cHayward £3,890 0 0

Dudley $8,057 0 0

2011 Dudley $8,43967 16.7

2012 Dudley $9,609 65 0

2013 Dudley $15,086 88 45.5

2014 Dudley $16,390 73 63.8

2015 Dudley $19,602 100 77.6

a Total remuneration figures include pension. For Bob Dudley this has been restated since 2010 in

accordance with the principles explained on page 82, to include the value of the company’s

contribution to his US retirement savings arrangements. The total figure is also affected by share

vesting outcomes and these numbers represent the actual outcome for the periods up to 2011 or

the adjusted outcome in subsequent years where a preliminary assessment of the performance

for EDIP was made. For 2015, the preliminary assessment has been reflected.

b 2009 annual bonus did not have an absolute maximum and so is shown as a percentage of the

maximum established in 2010.

c 2010 figures show full year total remuneration for both Tony Hayward and Bob Dudley, although

Bob Dudley did not become CEO until October 2010.

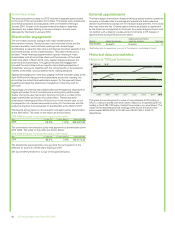

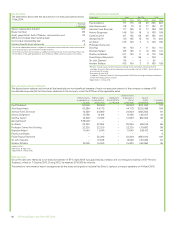

Relative importance of spend on pay (million)

Distributions to

shareholders

Remuneration paid to

all employeesa

Capital investmentb

2015 2014 2015 2014 2015 2014

Total 38.8% decrease 7.2% decrease 18.1% decrease

Dividends 1.9%

increase

No buybacks

in 2015

a Total remuneration reflects overall employee costs. See Financial statements – Note 34 for further

information.

b Capital investment reflects organic capital expenditure★.

c See Financial statements – Note 30 for further information.

d Dividends includes both scrip dividends as well as those paid in cash. See Financial statements –

Note 9 for further information.

$12,928 $13,936

$22,892

$18,748

Buybacksc

$4,770

Dividendsd

$7,168

$7,301

$11,938

Dividendsd

Percentage change in CEO remuneration

Comparing 2015 to 2014 Salary Benefits Bonus

% change in CEO remuneration 1.5%4.4%38.4%

% change in comparator group remuneration 0%a0%b27.9%

a The comparator group comprises some 31% of BP’s global employee population being

professional/managerial grades of employees based in the UK and US and employed on more

readily comparable terms.

b There was no change in employee benefits level.

Defined on page 256.BP Annual Report and Form 20-F 2015 85