BP 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

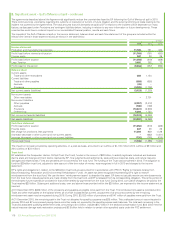

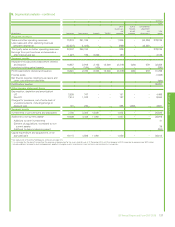

2. Significant event – Gulf of Mexico oil spill – continued

The agreements described above (the Agreements) significantly reduce the uncertainties faced by BP following the Gulf of Mexico oil spill in 2010.

There continues to be uncertainty regarding the outcome or resolution of current or future litigation and the extent and timing of costs relating to the

incident not covered by the Agreements. The total amounts that will ultimately be paid by BP in relation to the incident will be dependent on many

factors, as discussed under Provisions and contingent liabilities below, including in relation to any new information or future developments. These

uncertainties could have a material impact on our consolidated financial position, results and cash flows.

The impacts of the Gulf of Mexico oil spill on the income statement, balance sheet and cash flow statement of the group are included within the

relevant line items in those statements and are shown in the table below.

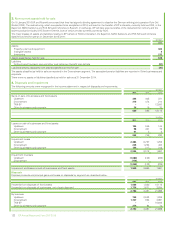

$ million

2015 2014 2013

Income statement

Production and manufacturing expenses 11,709 781 430

Profit (loss) before interest and taxation (11,709) (781) (430)

Finance costs 247 38 39

Profit (loss) before taxation (11,956) (819) (469)

Less: Taxation 3,492 262 73

Profit (loss) for the period (8,464) (557) (396)

Balance sheet

Current assets

Trade and other receivables 686 1,154

Current liabilities

Trade and other payables (693) (655)

Accruals (40) –

Provisions (3,076) (1,702)

Net current assets (liabilities) (3,123) (1,203)

Non-current assets

Other receivables –2,701

Non-current liabilities

Other payables (2,057) (2,412)

Accruals (186) (169)

Provisions (13,431) (6,903)

Deferred tax 5,200 1,723

Net non-current assets (liabilities) (10,474) (5,060)

Net assets (liabilities) (13,597) (6,263)

Cash flow statement

Profit (loss) before taxation (11,956) (819) (469)

Finance costs 247 38 39

Net charge for provisions, less payments 11,296 939 1,129

(Increase) decrease in other current and non-current assets –(662) (1,481)

Increase (decrease) in other current and non-current liabilities (732) (792) (618)

Pre-tax cash flows (1,145) (1,296) (1,400)

The impact on net cash provided by operating activities, on a post-tax basis, amounted to an outflow of $1,130 million (2014 outflow of $9 million and

2013 outflow of $73 million).

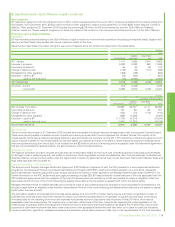

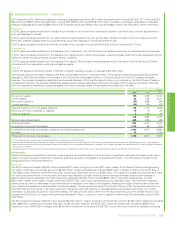

Trust fund

BP established the Deepwater Horizon Oil Spill Trust (the Trust), funded in the amount of $20 billion, to satisfy legitimate individual and business

claims, state and local government claims resolved by BP, final judgments and settlements, state and local response costs, and natural resource

damages and related costs. Fines and penalties are not covered by the trust fund. The funding of the Trust was completed in 2012. The obligation to

fund the $20-billion trust fund, adjusted to take account of the time value of money, was recognized in full in 2010 and charged to the income

statement.

BP’s rights and obligations in relation to the $20-billion trust fund are accounted for in accordance with IFRIC 5 ‘Rights to Interests Arising from

Decommissioning, Restoration and Environmental Rehabilitation Funds’. An asset has been recognized representing BP’s right to receive

reimbursement from the trust fund. We use the term ‘reimbursement asset’ to describe this asset. BP does not actually receive any reimbursements

from the trust fund, instead payments are made directly from the trust fund, and BP is released from its corresponding obligation. This is the portion of

the estimated future expenditure provided for that will be settled by payments from the trust fund. During 2014, cumulative charges to be paid by the

Trust reached $20 billion. Subsequent additional costs, over and above those provided within the $20 billion, are expensed to the income statement as

incurred.

At 31 December 2015, $686 million of the provisions and payables are eligible to be paid from the Trust. The reimbursement asset is recorded within

Trade and other receivables on the balance sheet, all of which is classified as current, as payment of all amounts covered by the remaining

reimbursement asset may be requested during 2016. During 2015, $3,022 million of provisions and $147 million of payables were paid from the Trust.

At 31 December 2015, the remaining cash in the Trust not allocated for specific purposes was $25 million. This unallocated amount was exhausted in

January 2016 and BP commenced paying claims and other costs not covered by the specific-purpose cash balances. The total cash remaining in the

Trust and associated qualifying settlement funds, amounting to $1.4 billion, includes $0.7 billion in the seafood compensation fund, $0.2 billion held for

natural resource damage early restoration projects and $0.5 billion held in relation to certain other specified costs under the PSC settlement.

118 BP Annual Report and Form 20-F 2015