BP 2015 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

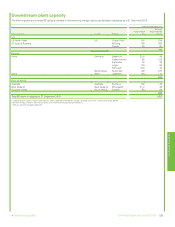

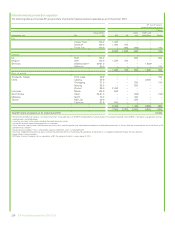

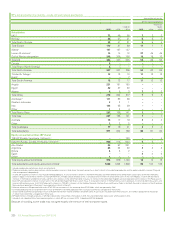

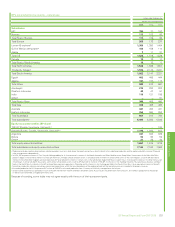

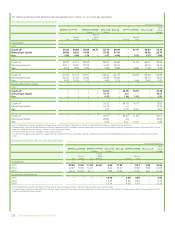

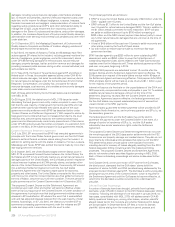

Environmental expenditure

$ million

2015 2014 2013

Environmental expenditure relating to the

Gulf of Mexico oil spill 5,452 190 (66)a

Operating expenditure 521 624 657

Capital expenditure 733 590 1,091

Clean-ups 34 33 42

Additions to environmental remediation

provision 305 371 472

Additions to decommissioning provision 972 2,216 2,092

aThe environmental expenditure credit of $66 million in 2013 arises primarily from the write-back

of a spill response provision.

Environmental expenditure relating to the Gulf of

Mexico oil spill

For full details of all environmental activities in relation to the Gulf of

Mexico oil spill, see Financial statements – Note 2.

Other environmental expenditure

Operating and capital expenditure on the prevention, control, treatment

or elimination of air and water emissions and solid waste is often not

incurred as a separately identifiable transaction. Instead, it forms part of a

larger transaction that includes, for example, normal operations and

maintenance expenditure. The figures for environmental operating and

capital expenditure in the table are therefore estimates, based on the

definitions and guidelines of the American Petroleum Institute.

Environmental operating expenditure of $521 million in 2015 (2014

$624 million) decreased primarily due to Downstream reduced level of

turnaround activity in 2015.

Environmental capital expenditure in 2015 was higher than in 2014,

primarily driven by the installation of a dissolved nitrogen floatation unit at

Whiting refinery’s wastewater treatment plant that is designed to

improve the quality of cleaned water before it leaves the refinery. The

increase also reflects the investment at our Cooper River, US and Geel,

Belgium petrochemicals site to upgrade it to our latest generation PTA

technology that is expected to significantly increase manufacturing

efficiency resulting in lower greenhouse gas emissions and improved

energy efficiency.

Clean-up costs increased to $34 million in 2015 compared with

$33 million in 2014, primarily due to higher remediation management

costs.

In addition to operating and capital expenditures, we also establish

provisions for future environmental remediation. Expenditure against

such provisions normally occurs in subsequent periods and is not

included in environmental operating expenditure reported for such

periods.

Provisions for environmental remediation are made when a clean-up is

probable and the amount of the obligation can be reliably estimated.

Generally, this coincides with the commitment to a formal plan of action

or, if earlier, on divestment or on closure of inactive sites.

The extent and cost of future environmental restoration, remediation and

abatement programmes are inherently difficult to estimate. They often

depend on the extent of contamination, and the associated impact and

timing of the corrective actions required, technological feasibility and

BP’s share of liability. Though the costs of future programmes could be

significant and may be material to the results of operations in the period

in which they are recognized, it is not expected that such costs will be

material to the group’s overall results of operations or financial position.

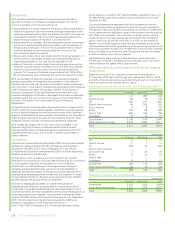

In 2015 the additions to the environmental provision were lower as 2014

included more new sites and increased provisions from existing sites

resulting from recent acquisitions. The charge for environmental

remediation provisions in 2015 included $6 million in respect of

provisions for new sites (2014 $13 million and 2013 $13 million).

In addition, we make provisions on installation of our oil- and gas-

producing assets and related pipelines to meet the cost of eventual

decommissioning. On installation of an oil or natural gas production

facility, a provision is established that represents the discounted value of

the expected future cost of decommissioning the asset.

In 2015 additions to the decommissioning provision were less than in

2014, and occurred as a result of detailed reviews of expected future

costs. The majority of these additions related to our sites in the North

Sea, the Gulf of Mexico and Angola. The additions in 2013 and 2014

were driven by detailed reviews of expected future costs, increases to

the asset base and for 2013, changes in estimation processes.

We undertake periodic reviews of existing provisions. These reviews

take account of revised cost assumptions, changes in decommissioning

requirements and any technological developments.

Provisions for environmental remediation and decommissioning are

usually established on a discounted basis, as required by IAS 37

‘Provisions, Contingent Liabilities and Contingent Assets’.

Further details of decommissioning and environmental provisions appear

in the financial statements – Note 22.

Regulation of the group’s business

BP’s activities, including its oil and gas exploration and production,

pipelines and transportation, refining and marketing, petrochemicals

production, trading, biofuels, wind and shipping activities, are conducted

in more than 70 countries and are subject to a broad range of EU, US,

international, regional and local legislation and regulations, including

legislation that implements international conventions and protocols.

These cover virtually all aspects of BP’s activities and include matters

such as licence acquisition, production rates, royalties, environmental,

health and safety protection, fuel specifications and transportation,

trading, pricing, anti-trust, export, taxes and foreign exchange.

The terms and conditions of the leases, licences and contracts under

which our oil and gas interests are held vary from country to country.

These leases, licences and contracts are generally granted by or entered

into with a government entity or state-owned or controlled company and

are sometimes entered into with private property owners.

Arrangements with governmental or state entities usually take the form

of licences or production-sharing agreements (PSAs), although

arrangements with the US government can be by lease. Arrangements

with private property owners are usually in the form of leases.

Licences (or concessions) give the holder the right to explore for and

exploit a commercial discovery. Under a licence, the holder bears the

risk of exploration, development and production activities and provides

the financing for these operations. In principle, the licence holder is

entitled to all production, minus any royalties that are payable in kind. A

licence holder is generally required to pay production taxes or royalties,

which may be in cash or in kind. Less typically, BP may explore for and

exploit hydrocarbons under a service agreement with the host entity in

exchange for reimbursement of costs and/or a fee paid in cash rather

than production.

PSAs entered into with a government entity or state-owned or

controlled company generally require BP to provide all the financing and

bear the risk of exploration and production activities in exchange for a

share of the production remaining after royalties, if any.

In certain countries, separate licences are required for exploration and

production activities, and in some cases production licences are limited

to only a portion of the area covered by the original exploration licence.

Both exploration and production licences are generally for a specified

period of time. In the US, leases from the US government typically

remain in effect for a specified term, but may be extended beyond that

term as long as there is production in paying quantities. The term of

BP’s licences and the extent to which these licences may be renewed

vary from country to country.

BP frequently conducts its exploration and production activities in joint

arrangements*or co-ownership arrangements with other international

oil companies, state-owned or controlled companies and/or private

companies. These joint arrangements may be incorporated or

unincorporated arrangements, while the co-ownerships are typically

unincorporated. Whether incorporated or unincorporated, relevant

agreements set out each party’s level of participation or ownership

Additional disclosures

BP Annual Report and Form 20-F 2015 233