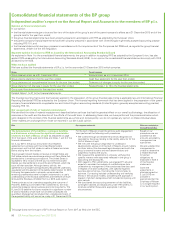

BP 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This page does not form part of BP’s Annual Report on Form 20-F as filed with the SEC.

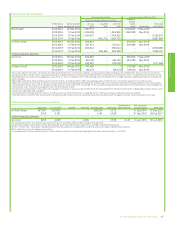

Risk Our response to the risk What we concluded to

the Audit Committee

The significant decrease in current and future oil and gas

prices during 2015 and the impact this has had on the

carrying value of the group’s Upstream assets (as described

on page 69 of the report of the audit committee and Note 1 of

the financial statements).

Declines in commodity prices have had a significant effect on

the carrying value of the group’s assets, as evidenced by the

impairments recognized in the 2015 financial statements and in

the prior year.

The principal risk is in relation to management’s assessment of

future cash flows, which are used to project the recoverability of

tangible and intangible assets.

We extended the scope of our original planned procedures to

address the changing risk. This included further use of EY

valuation experts in critically assessing and corroborating the

revised assumptions used in impairment testing, the most

significant of these being future market oil and gas prices and

discount rates. We also focused on reserves and resources

volumes, as described elsewhere in our report.

In addressing this risk, audit procedures were performed by the

component teams at each of the group’s 14 Upstream locations

scoped-in for the audit of asset impairment and by the primary

audit engagement team for the remaining assets identified at

risk of impairment.

•We walked through and tested the controls designed and

operated by the group relating to the assessment of the

carrying value of tangible and intangible assets.

•We examined the methodology used by management to

assess the carrying value of tangible and intangible assets

assigned to cash-generating units, to determine its

compliance with accounting standards and consistency of

application.

•We corroborated estimates of future cash flows and

challenged whether these were appropriate in light of future

price assumptions and the cost budgets. We performed

sensitivity analyses over inputs to the cash flow models.

•Together with EY valuation experts we assessed specific

inputs to the determination of the discount rate, including the

risk-free rate and country risk rates, along with gearing and

cost of debt. Such inputs were benchmarked against risk

rates in international markets in which the group operates.

•We performed procedures over the completeness of the

impairment charge and exploration write-offs, also validating

that base data used in the impairment models agreed to the

underlying books and records.

BP’s oil and gas

price assumptions

are comparable to

the range seen

within the industry at

this time.

The reduction in the

pre-tax discount rate

from 12% to 11%

and the post-tax

discount rate from

8% to 7% are within

the range of our

expectation.

Based on our

procedures, we

believe the

impairment charge is

appropriate.

Based on our

procedures on the

exploration portfolio

we consider the

write-offs were

properly recorded

and remaining

carrying values are

appropriate.

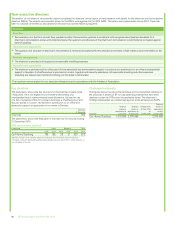

The estimate of oil and gas reserves and resources has a

significant impact on the financial statements, particularly

impairment testing and depreciation, depletion and

amortization (‘DD&A’) charges (as described on page 69 of

the report of the audit committee and Note 1 of the financial

statements).

The estimation of oil and natural gas reserves and resources is a

significant area of judgement due to the technical uncertainty in

assessing quantities and complex contractual arrangements

dictating the group’s share of reportable volumes.

Reserves and resources are also a fundamental indicator of the

future potential of the group’s performance.

Audit procedures were performed by the component teams at

each of the group’s 14 Upstream locations scoped-in for the

audit of reserves and resources and by the primary audit

engagement team.

•We tested the group’s controls over their internal certification

process for technical and commercial experts who are

responsible for reserves and resources estimation.

•We assessed the competence and objectivity of these

experts, to satisfy ourselves they were appropriately qualified

to carry out the volumes estimation.

•We confirmed that significant changes in reserves and

resources were made in the appropriate period, and in

compliance with the Discovered Resources Management

Policy (‘DRM-P’). We gave specific consideration to BP’s

reported share of reserves in joint arrangements and

associates, including Rosneft.

•Where volumetric movements had a material impact on the

financial statements, we validated these volumes against

underlying information and documentation as required by the

DRM-P, along with checking that assumptions used to

estimate reserves and resources were made in compliance

with relevant regulations.

•We validated that the updated reserves and resources

estimates were included appropriately in the group’s

consideration of impairment and in accounting for DD&A.

Based on our

procedures we

consider that the

reserves estimations

are reasonable for

useinthe

impairment testing

and calculation of

DD&A.

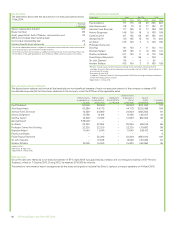

Unauthorized trading activity within the integrated

supply & trading function and the potential impact on

revenue (as described on page 69 of the report of the audit

committee and Note 1 of the financial statements).

Unauthorized trading activity is a fraud risk associated with a

potential deliberate misstatement of the group’s trading

positions or mis-marking of positions with an intention to:

•minimize trading losses.

•maximize trading profits.

•understate profits or move profits to subsequent periods

when bonus ceilings have already been reached, to maximize

individual bonuses across financial years.

These acts would lead to an overstatement or understatement

of the group’s revenue and profits.

Audit procedures on revenue and trading were performed by

component teams and the primary audit engagement team at 7

locations across the US, UK and Singapore.

•We walked through and tested the controls designed and

operated by the group over unauthorized trading activity.

•Using analytics software we identified trades with the highest

risk of unauthorized activity so as to focus our testing on

these trades.

•We obtained confirmations directly from third parties for a

sample of trades.

•We verified the fair value of a sample of derivatives using

contract and external market prices.

•We tested the completeness of the amounts recorded in the

financial statements through performing procedures to detect

unrecorded liabilities as well as detailed cut-off procedures

around sales, purchases, trade receivables and trade

payables.

Based on our

procedures we

identified no matters

to report to the Audit

Committee.

BP Annual Report and Form 20-F 2015 97

Financial statements