BP 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance shares

Framework

Performance shares were conditionally awarded to each executive director

in 2013. Maximum awards under the policy were granted representing

five-and-a-half-times salary for Bob Dudley and four-times salary for

Dr Brian Gilvary. Vesting of these awards was subject to delivering targets

set over the three-year performance period.

One third of the award was based on relative total shareholder return

(TSR), one third on operating cash flow and one third on three strategic

imperatives: relative reserves replacement ratio (RRR), safety and

operational risk (S&OR) and major projects delivery, all equally weighted.

Performance against each of these measures was designed to be aligned

with group strategy and key performance indicators (KPIs). Some

measures appear in both the annual cash bonus and performance shares

scorecards as they serve to track in-year performance as well as growth/

improvement over a three-year period.

Relative TSR represents the change in value of a BP shareholding between

the average of the fourth quarter of 2012 and the fourth quarter of 2015

compared to other oil majors (dividends are re-invested). RRR represents

organic reserves added over the three-year performance period divided by

the reserves extracted. This ratio is ranked against like-for-like organic RRR

for other oil major peers.

The 2013-15 comparator group for relative TSR (33.3% weight) and relative

RRR (11.1% weight) was Chevron, ExxonMobil, Shell and Total. The

number of conditional shares that would vest for each of the relative

performance measures for first, second and third place was set at the start

of 2013 and equals 100%, 70% and 35% respectively. This reflects the

approved rules applicable to the 2013-2015 plan. No shares would vest for

fourth or fifth place.

Operating cash flow represented a further one third of the award. BP’s

approved policy specifically states that: operating cash flow has been

identified as a core measure of strategic performance of the company.

Targets reflected agreed plans and normal operating assumptions.

For S&OR, improvement targets were set. For major project delivery, the

committee set a number of projects expected to be delivered over three

years. In reviewing project delivery the committee reviews the cost and

any delays to the original schedule.

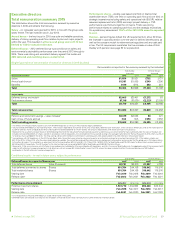

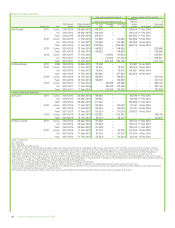

2015 outcomes

The committee considered the performance of the group over the

three-year period of the plan and the specific achievements against

each of the targets set for the measures. The results are summarized in

the table below.

Relative TSR, representing a third of the award, was in third place versus

the comparator group resulting in 35% vesting. Consequently 11.7% of the

overall shares for this measure will vest. The significant weight associated

with this measure aligns the actual value delivered to executive directors

with that to shareholders.

Operating cash flow represented a further one third of the award. In

considering measures and targets for performance share awards BP has

historically adopted a normalized or

‘

like-for-like’ approach reflecting

changes in oil and gas prices. This avoids windfall gains or penal losses in

periods of extreme volatility. The target set in 2013 for 2015 operating cash

flow was $35 billion based on the plan assumptions relating to oil and gas

price and refining margins at that time. This target was reviewed at the

start of 2015 in the light of divestments and plan assumptions relating to

environment, principally oil and gas prices and refining margins. Consistent

with its previous practice the committee normalized the operating cash

flow target. Based on the above assumptions, adjusting for major

divestments and for contributions to the Gulf of Mexico restoration made

in the year, the operating cash flow target was set at $17.7 billion. A scale

comprising threshold and maximum figures was set around the target on a

linear basis. The actual 2015 operating cash flow was $19.1 billion,

equalling the maximum set and resulting in vesting of 33.3% of all shares

for this measure.

2013-2015 performance shares

Measures Relative total

shareholder

return

Operating

cash flow

Relative

reserves

replacement

ratio Safety and operational risk

Major

project

delivery

Total

Weight at maximum 33.3% 33.3% 11.1% 11.1% 11.1% 100%

Outcome % 11.7% 33.3% 11.1% 10.4% 11.1% 77.6%

Met

Not met

Group key performance indicator

Loss of primary

containmentb

Tier 1 process

safety events

Recordable

injury frequencyc

Maximum First $19.1bn First 191

events

27

events

0.220/

200k hours 13 projects

Plan/target Outperform

peers $17.7bn Outperform

peers

212

events

30

events

0.240/

200k hours 11 projects

Threshold Third $16.2bn Third 220

events

32

events

0.260/

200k hours 9 projects

Outcome Third $19.1bn Firsta208

events

20

events

0.223/

200k hours

15 projects

started

a This represents a preliminary assessment.

b Adjusted in accordance with the treatment of the LOPC KPI on page 20. Full LOPC is 235.

c RIF excludes biofuels.

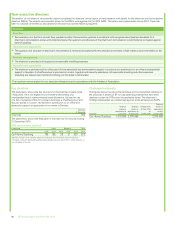

33.3%

11.7%11.1%11.1%

3.7%

3.1%3.6%

BP Annual Report and Form 20-F 201580