BP 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

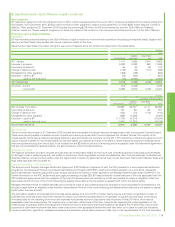

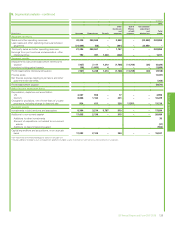

7. Exploration for and evaluation of oil and natural gas resources

The following financial information represents the amounts included within the group totals relating to activity associated with the exploration for and

evaluation of oil and natural gas resources. All such activity is recorded within the Upstream segment.

For information on significant estimates and judgements made in relation to oil and natural gas accounting see Intangible assets within Note 1.

$ million

2015 2014 2013

Exploration and evaluation costs

Exploration expenditure written offa1,829 3,029 2,710

Other exploration costs 524 603 731

Exploration expense for the year 2,353 3,632 3,441

Impairment losses –– 253

Intangible assets – exploration and appraisal expenditure 17,286 19,344 20,865

Liabilities 145 227 212

Net assets 17,141 19,117 20,653

Capital expenditure, on an accruals basis 1,197 2,870 4,464

Net cash used in operating activities 524 603 731

Net cash used in investing activities 1,216 2,786 4,275

a2015 included a $432-million write-off in Libya as there is significant uncertainty about the timing of future drilling operations. It also includes a $345-million write-off relating to the Gila discovery in the

deepwater Gulf of Mexico and a $336-million write-off relating to the Pandora discovery in Angola as development of these prospects is considered challenging. 2014 included a $544-million write-off

relating to disappointing appraisal results of Utica shale in the US Lower 48 and the subsequent decision not to proceed with its development plans, a $524-million write-off relating to the Bourarhat

Sud block licence in the Illizi Basin of Algeria, a $395-million write-off relating to Block KG D6 in India and a $295-million write-off relating to the Moccasin discovery in the deepwater Gulf of Mexico.

2013 included a $845-million write-off relating to the value ascribed to Block BM-CAL-13 offshore Brazil as a result of the Pitanga exploration well not encountering commercial quantities of oil and gas

and a $257-million write-off of costs relating to the Risha concession in Jordan as our exploration activities did not establish the technical basis for a development project in the concession. For further

information see Upstream – Exploration on page 30.

The carrying amount, by location, of exploration and appraisal expenditure capitalized as intangible assets at 31 December 2015 is shown in the table

below.

Carrying amount Location

$1 - 2 billion Angola; India

$2 - 3 billion Canada; Egypt; Brazil

$3 - 4 billion US – Gulf of Mexico

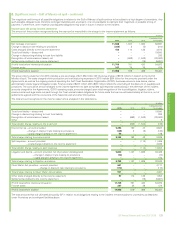

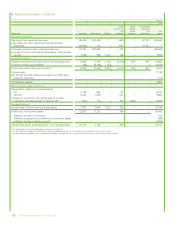

8. Taxation

Tax on profit

$ million

2015 2014 2013

Current tax

Charge for the year 1,910 4,444 5,724

Adjustment in respect of prior years (329) 48 61

1,581 4,492 5,785

Deferred tax

Origination and reversal of temporary differences in the current year (5,090) (3,194) 529

Adjustment in respect of prior years 338 (351) 149

(4,752) (3,545) 678

Tax charge (credit) on profit or loss (3,171) 947 6,463

In 2015, the total tax charge recognized within other comprehensive income was $1,140 million (2014 $1,481 million credit and 2013 $1,374 million

charge). See Note 31 for further information. The total tax charge recognized directly in equity was $9 million (2014 $36 million charge and 2013

$33 million credit).

For information on significant estimates and judgements made in relation to taxation see Income taxes within Note 1. For information on contingent

liabilities in relation to taxation see Note 32.

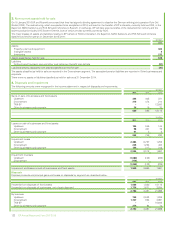

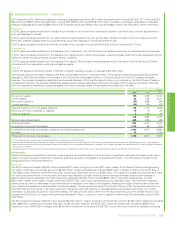

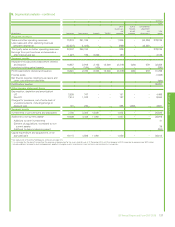

Reconciliation of the effective tax rate

The following table provides a reconciliation of the UK statutory corporation tax rate to the effective tax rate of the group on profit or loss before

taxation. With effect from 1 April 2015 the UK statutory corporation tax rate reduced from 21% to 20% on profits arising from activities outside the

North Sea.

For 2015, the items presented in the reconciliation are affected as a result of the overall tax credit for the year and the loss before taxation. In order to

provide a more meaningful analysis of the effective tax rate, the table also presents separate reconciliations for the group excluding the impacts of the

Gulf of Mexico oil spill and impairment losses, and for the impacts of the Gulf of Mexico oil spill and impairment losses in isolation.

For 2014, the items presented in the reconciliation are affected as a result of the tax credits related to the impairment losses recognized in the year and

the effect of the impairment losses on the profit for the year. In order to provide a more meaningful analysis of the effective tax rate for 2014, the table

also presents separate reconciliations for the group excluding the effects of the impairment losses, and for the effects of the impairment losses in

isolation.

BP Annual Report and Form 20-F 2015 129

Financial statements