BP 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

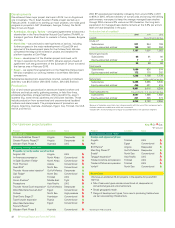

Developments

We achieved three major project start-ups in 2015: two in Angola and

one in Australia. The In Salah Southern Fields project started up in

February 2016. In addition to starting up major projects, we made good

progress in projects in AGT (Azerbaijan, Georgia, Turkey), the North

Sea, Oman and Egypt.

• Azerbaijan, Georgia, Turkey – we signed agreements to become a

shareholder in the Trans Anatolian Natural Gas Pipeline (TANAP), to

transport gas from Shah Deniz to markets in Turkey, Greece, Bulgaria

and Italy.

• North Sea – we continued to see high levels of activity, including

further progress in the major redevelopment of Quad 204 and

approval of the development plans for the Culzean field. We also

completed the Magnus life extension project and installed the

platform topsides at Clair Ridge.

• Oman – development of the Khazzan project continued, with

10 rigs in operation by the end of 2015. We also signed a heads of

agreement with the government of the Sultanate of Oman to extend

the licence area in February 2016.

• Egypt – we signed final agreements on the West Nile Delta project.

We also increased our working interest in both West Nile Delta

concessions.

Subsidiaries development expenditure incurred, excluding midstream

activities, was $13.5 billion (2014 $15.1 billion, 2013 $13.6 billion).

Production

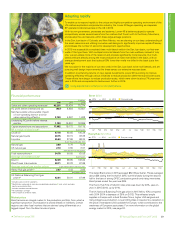

Our oil and natural gas production assets are located onshore and

offshore and include wells, gathering centres, in-field flow lines,

processing facilities, storage facilities, offshore platforms, export

systems (e.g. transit lines), pipelines and LNG plant facilities. These

include production from conventional and unconventional (coalbed

methane and shale) assets. The principal areas of production are

Angola, Argentina, Australia, Azerbaijan, Egypt, Iraq, Trinidad, the UAE,

the UK and the US.

With BP-operated plant reliability increasing from around 86% in 2011

to 95% in 2015, efficient delivery of turnarounds and strong infill drilling

performance, we expect to keep the average managed base decline

through 2016 at around 2% versus our 2014 baseline. Our long-term

expectation for managed base decline remains at the 3-5% per annum

level we have described in the past.

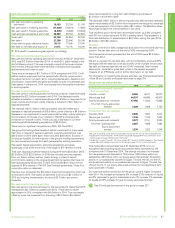

Production (net of royalties)a

2015 2014 2013

Liquids thousand barrels per day

Crude oilb

Subsidiaries 971 844 789

Equity-accounted entitiesc165 163 294

1,1371,007 1,083

Natural gas liquids

Subsidiaries 88 91 86

Equity-accounted entitiesc77 8

95 99 94

Total liquids

Subsidiaries 1,060 936 874

Equity-accounted entitiesc172 170 302

1,2321,106 1,176

Natural gas million cubic feet per day

Subsidiaries 5,495 5,585 5,845

Equity-accounted entitiesc 456 431 415

5,951 6,016 6,259

Total hydrocarbons thousand barrels of oil equivalent per day

Subsidiaries 2,007 1,898 1,882

Equity-accounted entitiesc251245 374

2,2582,143 2,256

a Because of rounding, some totals may not agree exactly with the sum of their component parts.

b Includes condensate and bitumen which are not material.

c Includes BP’s share of production of equity-accounted entities in the Upstream segment.

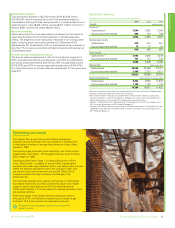

Our Upstream project pipeline

Project Location Type

2015 start-ups

Kizomba Satellites Phase 2 Angola Deepwater

Greater Plutonio Phase 3* Angola Deepwater

Western Flank Phase A Australia LNG

Expected start-ups 2016-2020

Projects currently under construction

Angola LNG Angola LNG

In Amenas compression North Africa Conventional

In Salah Southern FieldsaNorth Africa Conventional

Point Thomson Alaska Conventional

Quad 204* North Sea Conventional

Thunder Horse water injection* Gulf of Mexico Deepwater

Clair Ridge* North Sea Conventional

Juniper Trinidad LNG

Oman Khazzan* Middle East Tight

Persephone Asia Pacific LNG

Thunder Horse South expansion* Gulf of Mexico Deepwater

West Nile Delta Taurus/Libra* Egypt Conventional

Culzean North Sea High pressure

Shah Deniz Stage 2* Azerbaijan Conventional

Taas-Yuryakh expansion Russia Conventional

West Nile Delta Giza/

Fayoum/Raven*

Egypt Conventional

Western Flank Phase B Australia Conventional

Key: Oil Gas

*BP operated

Project Location Type

Expected start-ups 2017-2020

Design and appraisal phase

Angelin Trinidad LNG

Atoll Egypt Conventional

B18 Platina*Angola Deepwater

Mad Dog Phase 2*Gulf of Mexico Deepwater

Snadd*North Sea Conventional

Tangguh expansion*Asia Pacific LNG

Trinidad onshore compression Trinidad LNG

Trinidad offshore compression Trinidad LNG

Vorlich*North Sea Conventional

Beyond 2020

We have an additional 35-40 projects in the pipeline for post-2020

start-up.

• Mix of resource types across conventional oil, deepwater oil,

conventional gas and unconventionals.

• Broad geographic reach.

• Range of development types, from new to producing fields where

we can use existing infrastructure.

a Started up in February 2016.

BP Annual Report and Form 20-F 201532