BP 2015 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

damages, including natural resource damages under federal and state

law, to recover civil penalties, attorney’s fees and response costs under

state law, and to recover for alleged negligence, nuisance, trespass,

fraudulent concealment and negligent misrepresentation of material facts

regarding safety procedures and BP’s (and other defendants’) ability to

manage the oil spill, unjust enrichment from economic and other

damages to the State of Louisiana and its citizens, and punitive damages.

In addition, the Louisiana Department of Environmental Quality issued an

administrative order seeking environmental civil penalties and other relief

under state law.

On 10 December 2010, the Mississippi Department of Environmental

Quality issued a Complaint and Notice of Violation alleging violations of

several state environmental statutes.

In April 2013, the states of Alabama, Florida and Mississippi each filed

actions against BP related to the Incident, including general maritime law

claims of negligence, gross negligence, and wilful misconduct; claims

under OPA 90 seeking damages for removal costs, natural resource

damages, property damage, lost tax and other revenue and damages for

providing increased public services during or after removal activities; and

various state law claims.

On 17 May 2013, the State of Texas filed suit against BP and others in

federal court in Texas. Its complaint asserted claims under OPA 90 for

natural resource damages, lost sales tax and state park revenue; claims

for natural resource damages under the Comprehensive Environmental

Response, Compensation, and Liability Act; and claims for natural

resource damages, cost recovery, civil penalties and economic damages

under state environmental statutes.

Each of these actions filed by the Gulf Coast states was consolidated

with MDL 2179.

On 28 August 2015, the district court in MDL 2179 issued an order

dismissing the local government entity master complaint in view of the

fact that the vast majority of local government entity plaintiffs who had

preserved their claims had released their claims as part of the local

government entity settlement with BPXP (as described below under

‘Consent Decree and Settlement Agreement’). With respect to claims by

local government entities that have not released their claims, the court

held that they are time-barred except to the extent that those local

government entities previously made timely presentment of their claims

under OPA 90 and previously filed either a complaint or a valid short-form

joinder in the MDL 2179 master complaint for local government entities.

Consent Decree and Settlement Agreement

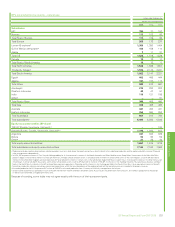

On 2 July 2015, BP announced that BPXP had executed agreements in

principle with the United States federal government and five Gulf Coast

states to settle all federal and state claims arising from the Incident. In

addition to settling claims with the states of Alabama, Florida, Louisiana,

Mississippi and Texas, BPXP also settled the claims made by more than

400 local government entities.

On 5 October 2015, the United States lodged with the district court in

MDL 2179 a proposed Consent Decree between the United States, the

Gulf states and BP to fully and finally resolve any and all natural resource

damages claims of the United States, the Gulf states and their respective

natural resource trustees and all CWA penalty claims, and certain other

claims of the United States and the Gulf states. Concurrently, BP entered

into a definitive Settlement Agreement with the five Gulf states

(Settlement Agreement) with respect to state claims for economic,

property and other losses. The United States is expected to file a motion

with the court to enter the Consent Decree as a final settlement around

the end of March, which the court will then consider. The time period for

public comments on the Consent Decree ended on 4 December 2015.

The proposed Consent Decree and the Settlement Agreement are

conditional upon each other and neither will become effective unless

there is final court approval of the Consent Decree. A further condition of

the agreements in principle was that local government entities execute

releases to BP’s satisfaction. BP advised the court that it was satisfied

with and has accepted releases received from the vast majority of local

entities. Accordingly, on 27 July 2015, the district court ordered BP to

commence processing payments required under the releases and BP

made such payments in accordance with the court’s order.

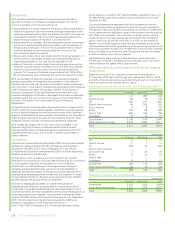

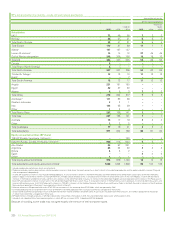

The principal payments are as follows:

• BPXP is to pay the United States a civil penalty of $5.5 billion under the

CWA – payable over 15 years.

• BPXP will pay $7.1 billion to the United States and the five Gulf states

over 15 years for natural resource damages (NRD). This is in addition to

the $1 billion already committed for early restoration. BPXP will also

set aside an additional amount (up to $700 million) consisting of

$232 million and the NRD interest payment (see below) partly to cover

any further natural resource damages that are unknown at the time of

the agreement.

• A total of $4.9 billion will be paid over 18 years to settle economic and

other claims made by the five Gulf Coast states.

• Up to $1 billion to resolve claims made by more than 400 local

government entities.

BPXP has also agreed to pay $350 million to cover outstanding NRD

assessment costs and $250 million to cover the full settlement of

outstanding response costs, claims related to the False Claims Act and

royalties owed for the Macondo well. These additional payments will be

paid over nine years, beginning in 2015.

NRD and CWA payments are scheduled to start 12 months after the

Consent Decree and the Settlement Agreement become effective. The

2016 payments in respect of the state claims are due within 90 days of

the Settlement Agreement becoming effective. Total payments for NRD,

CWA and state claims will be made at a rate of around $1.1 billion a year

for the majority of the payment period.

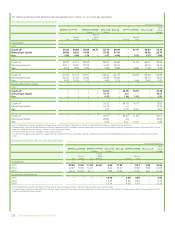

Interest will accrue at a fixed rate on the unpaid balance of the CWA and

NRD payments, compounded annually and payable in year 16. To address

possible natural resource damages unknown at the time of the

settlement, beginning 10 years after the Consent Decree and the

Settlement Agreement become effective, the federal government and

the five Gulf states may request accelerated payment of accrued but

unpaid interest on the NRD payments.

Parent company guarantees for these payments will be provided by BP

Corporation North America Inc. as the primary guarantor and BP p.l.c. as

the secondary guarantor.

The federal government and the Gulf states may jointly elect to

accelerate the payments under the Consent Decree in the event of a

change of control or insolvency of BP p.l.c., and the Gulf states

individually have similar acceleration rights under the Settlement

Agreement.

The proposed Consent Decree and Settlement Agreement do not cover

the remaining costs of the 2012 class action settlements with the PSC

for economic and property damage and medical claims. They also do not

cover claims by individuals and businesses that opted out of the 2012

PSC settlements and/or whose claims were excluded from them,

including claims for recovery of losses allegedly resulting from the 2010

federal deepwater drilling moratoria and/or the related permitting

processes. The proposed Consent Decree and Settlement Agreement

also do not resolve private securities litigation pending in MDL 2185.

Each of these outstanding proceedings and claims is discussed further

below.

On 5 October 2015, on the joint motion of BP and the five Gulf states,

the district court dismissed the five Gulf states’ claims (with the

exception of claims for NRD and CWA penalties being addressed by the

proposed Consent Decree) against BP. The dismissal is without prejudice

pending the court’s entry of the Consent Decree, which is required for

the Settlement Agreement with the Gulf states to become effective, at

which time the dismissal would be converted into a dismissal with

prejudice.

OPA 90 Test Case Proceedings

A number of lawsuits have been brought, primarily from business

claimants, under OPA 90 in relation to the 2010 federal deepwater drilling

moratoria. Following the dismissal of one test case in January 2016, six

test cases, consolidated with MDL 2179, will address certain OPA 90

liability questions focusing on, among other issues, whether plaintiffs’

alleged losses tied to the moratoria and whether federal permit delays

are compensable. In December 2015, BP filed a motion to dismiss

plaintiffs’ claims arising from the moratoria or permit process, and

238 BP Annual Report and Form 20-F 2015