BP 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

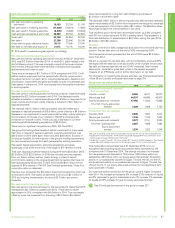

Our key performance indicators

Operating cash flow ($ billion) Gearing (net debt ratio) (%)

Refining availability (%)

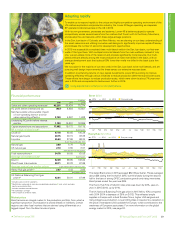

Reported recordable injury frequency

(RIF) measures the number of reported

work-related employee and contractor

incidents that result in a fatality or injury

(apart from minor first aid cases) per

200,000 hours worked.

The measure gives an indication of the

personal safety of our workforce.

2015 performance Our workforce

RIF, which includes employees and

contractors combined, was 0.24. This

improvement on 2014 was also reflected

in our other occupational safety metrics.

While this is encouraging, continued

vigilance is needed.

Loss of primary containment (LOPC)

is the number of unplanned or

uncontrolled releases of oil, gas or other

hazardous materials from a tank, vessel,

pipe, railcar or other equipment used for

containment or transfer.

By tracking these losses we can

monitor the safety and efficiency of our

operations as well as our progress in

making improvements.

2015 performance We have seen a

decrease in our loss of primary

containment to 235. Figures for 2014

and 2015 include increased reporting

due to the introduction of enhanced

automated monitoring for remote sites

in our US Lower 48 business. Using a

like-for-like approach with prior years’

reporting, our 2015 loss of primary

containment figure is 208 (2014 246).

Reported recordable injury

frequencya

Loss of primary containmenta

Underlying RC profit

per ordinary share (cents)

Underlying RC profit is a useful measure

for investors because it is one of the

profitability measures BP management

uses to assess performance. It assists

management in understanding the

underlying trends in operational

performance on a comparable

year-on-year basis.

It reflects the replacement cost of

inventories sold in the period and is

arrived at by excluding inventory holding

gains and losses from profit or loss.

Adjustments are also made for

non-operating items and fair value

accounting effects . The IFRS equivalent

can be found on page 216.

2015 performance The significant

reduction in underlying RC profit per

ordinary share for the year compared with

2014 was mainly due to lower profit in

Upstream.

Operating cash flow is net cash flow

provided by operating activities, as

reported in the group cash flow

statement. Operating activities are the

principal revenue-generating activities of

the group and other activities that are

not investing or financing activities.

2015 performance Operating cash flow

was lower in 2015, largely reflecting the

impact of the lower oil price environment.

Our gearing (net debt ratio) shows

investors how significant net debt is

relative to equity from shareholders in

funding BP’s operations.

We aim to keep our gearing around 20%

to give us the flexibility to deal with an

uncertain environment.

Gearing is calculated by dividing net

debt by total equity plus net debt. Net

debt is equal to gross finance debt,

plus associated derivative financial

instruments, less cash and cash

equivalents. For the nearest equivalent

measure on an IFRS basis and for further

information see Financial statements –

Note 26.

2015 performance Gearing at the end of

2015 was 21.6%, up 4.9% on 2014.

We assess our performance across

a wide range of measures and

indicators. Our key performance

indicators (KPIs) help the board and

executive management measure

performance against our strategic

priorities and business plans. We

periodically review our metrics and

test their relevance to our strategy.

We believe non-financial measures

– such as safety and an engaged

and diverse workforce – have a

useful role to play as leading

indicators of future performance.

Remuneration

To help align the focus of our board

and executive management with

the interests of our shareholders,

certain measures are reflected in

the variable elements of executive

remuneration.

Overall annual bonuses, deferred

bonuses and performance shares

are all based on performance

against measures and targets linked

directly to strategy and KPIs.

Directors’ remuneration

See how our performance

impacted 2015 pay on

page 76.

Underlying RC profit and gearing

are non-GAAP measures, but

are provided for investors

because they are closely tracked

by management to evaluate

BP’s operating performance and

to make financial, strategic and

operating decisions.

2011 2012 2013 2014 2015

1

25

1

00

7

5

5

0

2

5

111.

97

70.92 66.00

32.22

89.70

2011 2012 2013 2014 2015

5

0

4

0

3

0

2

0

1

0

22.2 20.5 21.1

32.8

19.1

2011 2012 2013 2014 2015

2

5

2

0

1

5

1

0

5

18.7

20.4

16.2 16.7

21.6

0.20

2011 2012 2013 2014 2015

0

.80

1.00

0

.60

0

.40

0

.20

Workforce Contractors

0.41

0.43

Employees

0.36

0.31

0.35

0.26

0.31

0.25

0.36

0.31

0.27

0.34

0.24

0.28

2011 2012 2013 2014 2015

5

00

4

00

30

0

2

00

10

0

361

261286

235

292

2011 2012 2013 2014 2015

9

8

9

6

9

4

9

2

9

0

94.8 94.8 95.3 94.9 94.7

Refining availability represents Solomon

Associates’ operational availability.

The measure shows the percentage of

the year that a unit is available for

processing after deducting the time

spent on turnaround activity and all

mechanical, process and regulatory

downtime.

Refining availability is an important

indicator of the operational performance

of our Downstream businesses.

2015 performance Refining availability

was similar to 2014.

Key

KPIs used to measure

progress against our strategy.

KPIs used to determine 2015

and 2016 remuneration.

BP Annual Report and Form 20-F 201520