BP 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266

|

|

Unlocking energy potential

BP has invested in Egypt for half a century. And in recent years, it has

been a key location for BP discoveries. Our ongoing investment and

exploration activities are helping to unlock energy potential in the area.

In March we made a gas discovery 6,400 metres below sea level in the

North Damietta offshore area. We are working with the Egyptian

government to accelerate the development of the Atoll discovery.

The discovery is in line to become our next major project in Egypt after

completion of our West Nile Delta project.

Building a pipeline of future growth opportunities.

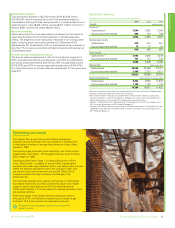

Our total hydrocarbon production for the segment in 2015 was 5.4% higher

compared with 2014. The increase comprised a 5.7% increase (13.2%

increase for liquids and 1.6% decrease for gas) for subsidiaries and a 2.4%

increase (1.2% increase for liquids and 5.8% increase for gas) for

equity-accounted entities compared with 2014. For more information on

production see Oil and gas disclosures for the group on page 227.

In aggregate, underlying production was flat versus 2014.

The group and its equity-accounted entities have numerous long-term

sales commitments in their various business activities, all of which are

expected to be sourced from supplies available to the group that are not

subject to priorities, curtailments or other restrictions. No single contract or

group of related contracts is material to the group.

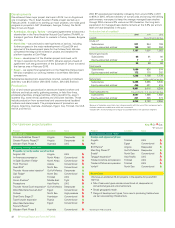

Gas marketing and trading activities

Our integrated supply and trading function markets and trades our own and

third-party natural gas (including LNG), power and NGLs. This provides us

with routes into liquid markets for the gas we produce and generates

margins and fees from selling physical products and derivatives to third

parties, together with income from asset optimization and trading. This

means we have a single interface with gas trading markets and one

consistent set of trading compliance and risk management processes,

systems and controls.

Our upstream marketing and trading activity primarily takes place in the

US, Canada and Europe and supports group LNG activities, managing

market price risk and creating incremental trading opportunities through

the use of commodity derivative contracts. It also enhances margins and

generates fee income from sources such as the management of price risk

on behalf of third-party customers.

Our trading financial risk governance framework is described in Financial

statements – Note 28 and the range of contracts used is described in

Glossary – commodity trading contracts on page 256.

For an analysis of our upstream business by geographic region

and key events in 2015, see page 221.

★ Defined on page 256.BP Annual Report and Form 20-F 2015 33

Strategic report