BP 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2. Significant event – Gulf of Mexico oil spill – continued

of claims. In addition, although some pre-determination data has been provided to BP, detailed data on the majority of pre-determination claims is not

available due to a court order to protect claimant confidentiality. Therefore, there is an insufficient level of detail to enable a complete or clear

understanding of the composition of the underlying claims population.

There is insufficient data available to build up a track record of claims determinations under the policies and protocols that are now being applied

following resolution of the matching and causation issues. We are unable to reliably estimate future trends of the number and proportion of claims that

will be determined to be eligible, nor can we reliably estimate the value of such claims. A provision for such business economic loss claims will be

established when these uncertainties are sufficiently reduced and a reliable estimate can be made of the liability.

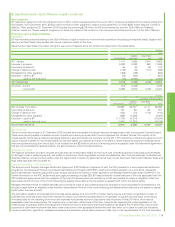

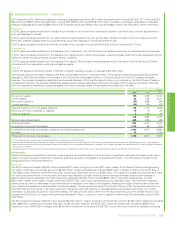

The current estimate for the total cost of those elements of the PSC settlement that BP considers can be reliably estimated, including amounts already

paid, is $12.4 billion. Prior to the end of the month following the balance sheet date, the DHCSSP had issued eligibility notices, many of which are

disputed by BP, in respect of business economic loss claims of approximately $402 million which have not been provided for. The total cost of the PSC

settlement is likely to be significantly higher than the amount recognized to date of $12.4 billion because the current estimate does not reflect business

economic loss claims not yet processed, or processed but not yet paid, except where an eligibility notice had been issued before the end of the month

following the balance sheet date and is not subject to appeal by BP within the claims facility.

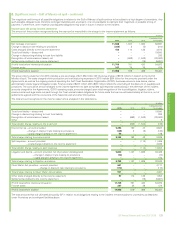

There continues to be a high level of uncertainty with regards to the amounts that ultimately will be paid in relation to current claims as described

above and there is also uncertainty as to the cost of administering the claims process under the DHCSSP and in relation to future legal costs. The

timing of payment of provisions related to the PSC settlement is dependent upon ongoing claims facility activity and is therefore also uncertain.

Litigation and claims – Other claims

The provision recognized for litigation and claims includes amounts agreed under the Agreements in relation to state claims. The amount provided in

respect of state claims is payable over 18 years from the date the court approves the Consent Decree, of which $1 billion is due following the court

approval of the Consent Decree. The vast majority of local government entities who filed claims have issued releases, which were accepted by BP;

amounts due under those releases were paid during 2015.

Clean Water Act penalties

A provision has been recognized for penalties under Section 311 of the Clean Water Act, as determined in the Agreements. The amount is payable in

instalments over 15 years, commencing one year after the court approves the Consent Decree. The unpaid balance of this penalty accrues interest at a

fixed rate.

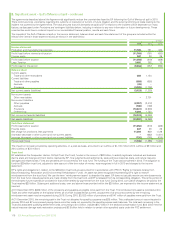

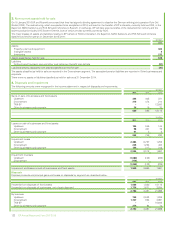

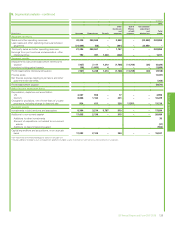

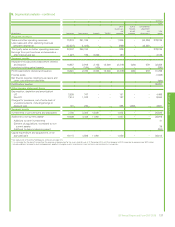

Provision movements

The total amount recognized as an increase in provisions during the year was $11,886 million. This increase relates primarily to amounts provided for

the Agreements, and additional increases in the litigation and claims provision for business economic loss claims, associated claims administration

costs and other items. After deducting amounts utilized during the year totalling $3,279 million, comprising payments from the trust fund of

$3,022 million and payments made directly by BP of $257 million (2014 $2,071 million, comprising payments from the trust fund of $1,681 million and

payments made directly by BP of $390 million), and after adjustments for discounting, the remaining provision as at 31 December 2015 was

$16,507 million (2014 $8,605 million).

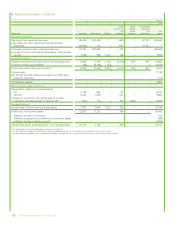

Contingent liabilities

BP has provided for its best estimate of amounts expected to be paid that can be measured reliably. It is not possible, at this time, to measure reliably

other obligations arising from the incident, nor is it practicable to estimate their magnitude or possible timing of payment. Therefore, no amounts have

been provided for these obligations as at 31 December 2015.

Business economic loss claims under the PSC settlement

The potential cost of business economic loss claims not yet processed and paid (except where an eligibility notice had been issued before the end of

the month following the balance sheet date and is not subject to appeal by BP within the claims facility) is not provided for and is disclosed as a

contingent liability. A significant number of business economic loss claims have been received but have not yet been processed and paid. See

Provisions above for further information.

Securities-related litigation

Proceedings relating to securities class actions (MDL 2185) pending in federal court in Texas, including a purported class action on behalf of purchasers

of American Depositary Shares under US federal securities law, are continuing. A jury trial is scheduled to begin in July 2016 and the timing of any

outflow of resources, if any, is dependent on the duration of the court process. No reliable estimate can be made of the amounts that may be payable

in relation to these proceedings, if any, so no provision has been recognized at 31 December 2015. In addition, no reliable estimate can be made of the

amounts that may be payable in relation to any other securities litigation, if any, so no provision has been recognized at 31 December 2015.

Other litigation

In addition to the securities class actions described above, BP is named as a defendant in approximately 2,700 other civil lawsuits brought by

individuals and corporations in US federal and state courts, as well as certain non-US jurisdictions, resulting from the Deepwater Horizon accident,the

Gulf of Mexico oil spill, and the spill response efforts. Further actions may still be brought. Among other claims, these lawsuits assert claims for

personal injury in connection with the accident and the spill response, commercial and economic injury, damage to real and personal property, breach

of contract and violations of statutes, including, but not limited to, alleged violations of US securities and environmental statutes. In addition, claims

have been received, primarily from business claimants, under the Oil Pollution Act of 1990 (OPA 90) in relation to the 2010 federal deepwater drilling

moratoria. Furthermore, there are also uncertainties around the outcomes of any further litigation including by parties excluded from, or parties who

opted out of, the PSC settlement. Until further fact and expert disclosures occur, court rulings clarify the issues in dispute, liability and damage trial

activity nears or progresses, or other actions such as further possible settlements occur, it is not possible given these uncertainties to arrive at a range

of outcomes or a reliable estimate of the liabilities that may accrue to BP in connection with or as a result of these lawsuits, nor is it possible to

determine the timing of any payment that may arise. Therefore no amounts have been provided for these items as at 31 December 2015.

Settlement and other agreements

Under the settlement agreements with Anadarko and MOEX, the other working interest owners in the Macondo well at the time of the incident, and

with Cameron International, the designer and manufacturer of the Deepwater Horizon blowout preventer, BP has agreed to indemnify Anadarko,

MOEX and Cameron for certain claims arising from the accident. It is therefore possible that BP may face claims under these indemnities, but it is not

currently possible to reliably measure, nor identify the timing of, any obligation in relation to such claims and therefore no amount has been provided

as at 31 December 2015. There are also agreements indemnifying certain third-party contractors in relation to litigation costs and certain other claims.

A contingent liability also exists in relation to other obligations under these agreements.

120 BP Annual Report and Form 20-F 2015