BP 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate governance

Value measures made up 70% of total bonus. In order to simplify and

reflect both the current short-term imperatives and the 2015 priorities in

the group’s annual plan, the number of value measures was reduced from

six in 2014 to five in 2015. These measures were more heavily weighted

on operating cash flow and underlying replacement cost profit. The

economic environment was taken into account by looking at capital and

cost discipline and these were reflected through two measures – net

investment (organic) and corporate and functional cost management. As in

previous years, delivery of major projects remained a key focus area.

Bob Dudley and Dr Brian Gilvary’s annual bonus was based 100% on these

group-wide measures. Under the policy, one third of the total bonus is paid

in cash. A director is required to defer a further third in BP shares and the

final third is paid either in cash or voluntarily deferred in BP shares at the

individual’s election. Deferred shares are matched on a one-for-one basis,

and both deferred and matched shares vest after three years depending on

an assessment by the committee of safety and environmental

sustainability over the three-year period.

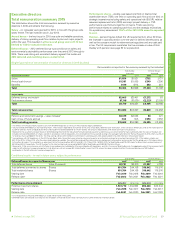

2015 outcomes

In January 2016, the committee considered the group’s performance

during 2015 against the measures and targets set out in the 2015 annual

cash bonus table.

As the table reflects, BP had an excellent year for safety and operational

performance in a difficult environment.

The company’s decision in late 2014 to plan for a ‘lower for longer’ oil price

meant that the leadership acted early and decisively to respond to the low

oil price environment. Strong and continually improving safety standards

have led to higher reliability and improved operations, contributing directly

to better financial outcomes. Cost reduction and net investment have been

managed so as not to compromise future growth. Major projects have

been delivered on time, improving forthcoming performance.

Safety performance was again very encouraging, resulting in maximum

scores for all three measures – tier 1 process safety events, loss of primary

containment and recordable injury frequency.

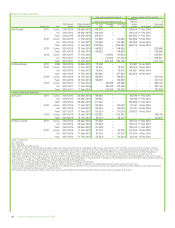

Operating cash flow for the company was $19.1 billion, well ahead of the

board’s approved plan of the target of $17.2 billion. This target was

normalized upwards since the actual oil price during the year was higher

than original plan assumptions. Underlying replacement cost profit of $5.9

billion was also significantly ahead of the target of $4.2 billion, again

normalized similar to the above. Through greater simplification and

efficiency across all functions, corporate and functional costs were

reduced by 17.6% against a targeted reduction of 5.9%. Capital discipline

was demonstrated through a reduction in the net investment (organic) of

27% against a planned reduction of 18%. Four major projects were

successfully delivered in 2015, as planned.

Based on these results, the overall group performance score was 1.91. The

committee, as is its normal practice, considered this result in the context of

the performance of the group, shareholder feedback, input from the board

and other committees, as well as the circumstances in the wider

environment. Overall, management delivered very well in terms of what

they could control. The committee agreed with the group chief executive’s

view that the dramatic dynamics in the market during the year also needed

to be recognized. He proposed a lower score and the committee agreed

that this reflected a balanced assessment of the year. A final group score

of 1.70 was agreed and applied to BP’s wider management group. In the

case of executive directors, our approved policy limits bonus to a group

score of 1.50.

The overall annual bonus for executive directors was determined by

multiplying the reduced score of 1.5 by the on-target bonus level of 150%

of salary. Both Bob Dudley and Dr Brian Gilvary deferred two thirds of their

2015 annual bonus. As a result Bob Dudley’s and Dr Brian Gilvary’s

bonuses, including the portion deferred, are shown below.

Annual bonus summary

Overall bonus Paid in cash Deferred in BP shares

Bob Dudley $ 4,171,500 $1,390,500 $2,781,000

Dr Brian Gilvary £1,645,875 £548,625 £1,097,250

2016 implementation

For 2016, 100% of Bob Dudley’s and Dr Brian Gilvary’s bonus will be

based on group results.

For the 2016 annual bonus the committee will continue to focus on the

two overall themes of safety and value. Safety will continue to have a 30%

weight in the overall bonus plan. The value measures are key to short-term

performance within the group and will have an overall weight of 70%.

Continued improvement in safety remains a group priority and is fully

reflected in the measures. As in 2015, the safety targets are anchored

on a realistic and achievable improvement from the average of the previous

three years.

The value measures have been decreased from 5 in 2015 to 4 in 2016,

increasing the weight on operating cash flow and underlying replacement

cost profit and removing the net investment measure. Targets for each

measure are challenging but realistic and have been set in the context of

the current environment. As usual they will be normalized at year end to

reflect changes in oil and gas price and refining margins.

Safety and value targets will be disclosed retrospectively in the 2016

remuneration report to the extent that they are no longer considered

commercially sensitive. The full set of 2016 short-term measures are set

out in the diagram on page 76.

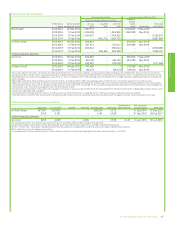

Deferred bonus

2015 outcomes

Both Bob Dudley and Dr Brian Gilvary deferred two thirds of their 2012

annual bonus in accordance with the terms of the policy then in place.

The three-year performance period concluded at the end of 2015. The

committee reviewed safety and environmental sustainability performance

over this period and sought the input of the safety, ethics and environment

assurance committee (SEEAC). Over the three-year period 2013-15 safety

performance showed steady improvement on a range of measures. All

performance hurdles were met and the group-wide operating

management system★ is now sufficiently embedded throughout the

organization to continue driving improvement in environmental as well as

safety areas.

Following the committee’s review, full vesting of the deferred and matched

shares for the 2012 deferred bonus was approved, as shown in the

following table (as well as in the single figure table on page 77).

2012 deferred bonus vesting

Name

Shares

deferred

Vesting

agreed

Total shares

including

dividends

Total

value

at vesting

Bob Dudley 458,760 100% 539,424 $2,602,721

Dr Brian Gilvary 315,260 100% 380,905 £1,272,223

Details of the deferred bonus awards made to the executive directors in

early 2015, in relation to 2014 annual bonuses, were set out in last year’s

report. A summary of these awards is included on page 86.

2016 implementation

The committee has determined that the safety and environmental

sustainability hurdle will continue to apply to shares deferred from the

2015 bonus. All matched shares that vest in 2019 will, after sufficient

shares have been sold to pay tax, be subject to an additional three-year

retention period before being released to the individual in 2022. This further

reinforces long-term shareholder alignment and the nature of the

group’s business.

Defined on page 256.BP Annual Report and Form 20-F 2015 79