BP 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our markets in 2015

A snapshot of the challenging global energy market in 2015.

The global economy struggled to return to a more

normal pace of growth in 2015 – GDP growth

estimates were revised down over the course of

the year, with latest estimates indicating that the

world economy grew by 2.5% in 2015, compared

to trend growth of around 3%. Slowing growth in

China contributed to falling commodity prices,

weak global trade and weakening emerging

market growth. The developed world also failed

to take off as expected with the US, EU and

Japan all underperforming.

Oil

Crude oil prices averaged $52.39 per barrel in

2015, as demonstrated by the industry

benchmark of dated Brent , nearly $47 per barrel

below the 2014 average of $98.95. This was the

largest oil price decline ever – in inflation-adjusted

terms – and it was the third-largest percentage

decline (behind 1873 and 1986). Prices recovered

in the second quarter, averaging nearly $62, but

fell later in the year as OPEC production increased

and inventories grew. Brent prices ended the year

near $35.

In response to the sharp decline in world oil

prices, global oil consumption increased by an

above-average 1.6 million barrels per day

(mmb/d) for the year (1.7%).a While emerging

economies accounted for the majority of

growth, the mature economies of the OECD

recorded a rare increase as well. The robust

growth in consumption was once again

exceeded by growth in global production.

Non-OPEC production growth slowed to

1.4mmb/d as US production peaked in the

second quarter in the face of a rapid contraction

in investment and drilling.a OPEC crude oil

production, however, accelerated, growing by

1.1mmb/d in 2015.a As a result, OECD

commercial oil inventories reached record levels

late in the year.

In 2014 global oil consumption grew by roughly

0.8 million barrels per day (0.8%), significantly

slower than the increase in global production

(2.3%).b Non-OPEC production once again

accounted for all the net global increase, driven

by record US growth.

Natural gas

Global price differentials in 2015 continued to

narrow. US gas prices and Asian transacted

LNG prices were more than 40% lower, while

European transacted LNG prices were 15%

lower. The Henry Hub First of the Month index

fell from $4.43 per million British thermal units

(mmBtu) in 2014 to $2.67 in 2015 as supply

growth continued to be resilient.

Transacted LNG prices in Europe and Asia fell

with rising global LNG supplies and weak

demand growth. New LNG projects in Papua

New Guinea and Australia and recovering

supplies in Africa added 1.4bcf/d of supply

capacity to the LNG market in 2015.

Moderating demand and ample supplies from

both Russia and LNG markets reduced the UK

National Balancing Point hub price to an

average of 42.61 pence per therm in 2015 (2014

50.01). The Japanese spot price fell to an average

of $7.45/mmBtu in 2015 (2014 $13.86) with

weaker demand from North Asian consumers

coinciding with rising supplies in the region.

In 2014 growth in natural gas consumption was

at its slowest rate for the last 20 years – with the

exception of the financial crisis of 2008-09.

Broad differentials between regional gas prices

narrowed considerably, as US gas prices

continued their recovery from their 2012 lows.

Global LNG supply capacity expanded further in

2014, following a small increase in 2013, while

growth in LNG demand moderated.

More than 200 of our UK BP stores have an M&S

Simply Food® outlet. This premium offer is helping

to drive overall service station sales growth.

Construction of Glen Lyon, our new 270 metre

long floating, production, storage and offloading

vessel, at a shipyard in South Korea.

a From IEA Oil Market Report, February 2016 ©, OECD/IEA

2016, Page 4.

b BP Statistical Review of World Energy 2015. Prices and margins

See pages 29 and 35.

BP Statistical Review of World Energy

See bp.com/statisticalreview for an

objective review of key global energy

trends.

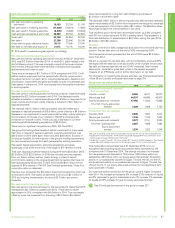

US dollars per barrel

06 07 08 09 10 11 12 13 14 15

Crude oil prices (quarterly average)

150

120

90

60

Brent dated

US dollars gas prices

06 07 08 09 10 11 12 13 14 15

Natural gas prices (quarterly average)

12

10

8

6

4

Henry Hub

BP Annual Report and Form 20-F 201524