BP 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

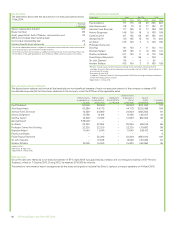

Consolidated financial statements of the BP group

Independent auditor’s report on the Annual Report and Accounts to the members of BP p.l.c.

Opinion on financial statements

In our opinion:

• the financial statements give a true and fair view of the state of the group’s and of the parent company’s affairs as at 31 December 2015 and of the

group’s loss for the year then ended;

• the group financial statements have been properly prepared in accordance with IFRS as adopted by the European Union;

• the parent company financial statements have been properly prepared in accordance with United Kingdom generally accepted accounting practice

including FRS 101; and

• the financial statements have been prepared in accordance with the requirements of the Companies Act 2006 and, as regards the group financial

statements, Article 4 of the IAS Regulation.

Separate opinion in relation to IFRS as issued by the International Accounting Standards Board

As explained in Note 1 to the consolidated financial statements, the group in addition to applying IFRS as adopted by the European Union, has also

applied IFRS as issued by the International Accounting Standards Board (IASB). In our opinion the consolidated financial statements comply with IFRS

as issued by the IASB.

What we have audited

We have audited the financial statements of BP p.l.c. for the year ended 31 December 2015 which comprise:

Group Parent company

Group balance sheet as at 31 December 2015. Balance sheet as at 31 December 2015.

Group income statement for the year then ended. Cash flow statement for the year then ended.

Group statement of comprehensive income for the year then ended. Statement of changes in equity for the year then ended.

Group statement of changes in equity for the year then ended. Related Notes 1 to 15 to the financial statements.

Group cash flow statement for the year then ended.

Related Notes 1 to 37 to the financial statements.

The financial reporting framework that has been applied in the preparation of the group financial statements is applicable law and International Financial

Reporting Standards (IFRS) as adopted by the European Union. The financial reporting framework that has been applied in the preparation of the parent

company financial statements is applicable law and United Kingdom accounting standards (United Kingdom generally accepted accounting practice)

including FRS 101.

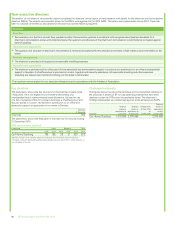

Our assessment of risks of material misstatement

We identified the risks of material misstatement described below as those that had the greatest effect on our overall audit strategy, the allocation of

resources in the audit and the direction of the efforts of the audit team. In addressing these risks, we have performed the procedures below which

were designed in the context of the financial statements as a whole and, consequently, we do not express any opinion on these individual areas.

These matters are unchanged from those we reported in our 2014 audit opinion.

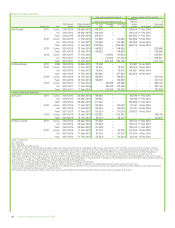

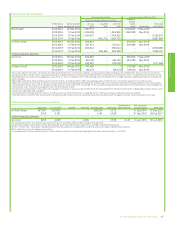

Risk Our response to the risk What we concluded to

the Audit Committee

The determination of the liabilities, contingent liabilities

and disclosures arising from the significant uncertainties

related to the Gulf of Mexico oil spill (as described on page

70 of the report of the audit committee and Notes 1 and 2 of the

financial statements).

On 2 July 2015, the group announced it had reached

agreements in principle with the United States federal

government and five Gulf states to settle all federal and state

claims arising from the incident.

The proposed Consent Decree to resolve all United States and

Gulf states natural resource damage claims and Clean Water Act

penalty claims is awaiting court approval. The United States is

expected to file a motion with the court to enter the Consent

Decree as a final settlement around the end of March, which the

court will then consider. Although there is still risk, the

agreements in principle have significantly reduced the uncertainty

associated with this element of the liability determination for 2015.

Following the agreements in principle, we concluded the

remaining uncertainties were no longer fundamental to a user’s

understanding of the financial statements and therefore we have

removed the Emphasis of Matter from our 2015 audit opinion.

There continues to be uncertainty regarding the outcome of

Plaintiffs’ Steering Committee (‘PSC’) settlements, the most

substantial category being business economic loss claims. The

8 June 2015 deadline for claims resulted in a significant number

of claims received, which have not yet been processed and

quantified. Management concluded that a reliable estimation of

the expected liability still cannot be made at 31 December 2015.

For the Gulf of Mexico oil spill the primary audit engagement

team performed the following audit procedures.

• We walked through and tested the controls designed and

operated by the group relating to the liability accounts for the

Gulf of Mexico oil spill.

• We met with the group’s legal team to understand

developments across all of the Gulf of Mexico oil spill matters

and their status. We discussed legal developments with the

group’s external lawyers and read determinations and

judgments made by the courts.

• We reviewed the agreements in principle, verifying that

specific matters were accurately reflected in the group’s

accounting and disclosures.

• With regard to PSC settlements, we engaged EY actuarial

experts to consider the analysis of available claims data

undertaken by management. We corroborated the data used

in respect of all claim categories, with specific regard to

business economic loss, this being the most complex to

estimate. Our testing included understanding and verifying

trends in the actuarial models, considering the approach in

respect of all claim categories which included comparing with

prior periods.

• We considered the accounting treatment of the liabilities,

contingent liabilities and disclosures under IFRS criteria, to

conclude whether these were appropriate in all the

circumstances.

Based on our

procedures we are

satisfied that the

amounts provided by

management are

appropriate.

We are satisfied that

management is

unable to determine

a reliable estimate

for certain

obligations as

disclosed in Note 2

of the financial

statements.

Given the

agreements in

principle signed on

2 July 2015 we

consider it

appropriate that the

Emphasis of Matter

is no longer required

in our audit opinion.

96 BP Annual Report and Form 20-F 2015

This page does not form part of BP’s Annual Report on Form 20-F as filed with the SEC.