BP 2015 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our financial framework

How we are putting this into action

Our financial framework is designed

to re-establish a balance where

operating cash flow (excluding

payments related to the Gulf of

Mexico oil spill) covers organic

capital expenditure★ and the current

level of dividend per share by 2017,

based on an average Brent★ price of

around $60 per barrel.

If prices remain lower for longer

than anticipated, we expect to

continue to recalibrate for the

weaker environment and to capture

more deflation. We would expect

this to drop the balance point below

$60 per barrel.

We will keep our financial framework

under review as we monitor oil

and gas prices and their impact on

industry costs as we move through

2016 and beyond.

★ Defined on page 256.

Looking ahead

2015 achievement

Principle

Figures exclude retail staff and agricultural, operational and

seasonal workers in Brazil.

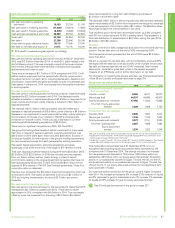

Our financial framework – through 2017

Underpinning our commitment to sustain the dividend for our shareholders

2013 2014 2015

70,000

65,000

60,000

55,000

B

P group employees (at 31 December)

65,500 64,800

59,400

Upstream

We are focusing on the timing of investments

to capture deflation in the supply chain, paring

back access and exploration spend and

prioritizing activity in our base operations.

Where we are not the operator, we are

influencing partners to focus on third-party

costs.

We reduced unit production costs by more

than 20% compared with 2013 and achieved

an average reduction of 15% in upstream

third-party costs in 2015. By the end of 2016,

we expect to re-bid 40% of our third-party

spend, including a significant proportion of our

well services contracts.

Our total upstream workforce – including

employees and contractors – is now 20%

smaller than it was in 2013, with a reduction of

around 4,000 expected in 2016. We are aiming

for an upstream workforce of approximately

20,000 by the end of 2016.

Downstream

In 2015 we reorganized our fuels business

from nine regions to three, streamlined the

lubricants business and started restructuring

petrochemicals. We are implementing

site-by-site improvement programmes to drive

manufacturing efficiency in refining and

petrochemicals. Our focus on third-party

spend has resulted in significant cost

reductions and we have reduced head office

related costs by around 40%.

These simplification and efficiency actions

have significantly contributed to the group’s

cash cost reductions in 2015.

We expect to reduce our downstream

workforce roles by more than 5,000 by the

end of 2017 compared with 2014, and by the

end of 2015 had already achieved a reduction

of more than 2,000.

Other businesses and corporate

We made significant progress in reducing

corporate and functional costs in 2015. We are

focusing on third-party spend and headcount

both in response to the lower oil price and also

to reflect the changes to our portfolio.

Optimize capital

expenditure

2015 organic capital expenditure

was $18.7 billion.

This is 18% down from the

2011-2014 period average.

We expect capital expenditure

of $17-19 billion per year in 2016

and 2017 as a result of reducing

costs and activity, with 2016

spend towards the lower end

of this range.

Reduce cash

costs

We made significant progress in

reducing cash costs compared with

2014.

We anticipate the reduction in

our cash costs to be close to

$7 billion versus 2014 by the

end of 2017.

Make selective

divestments

We completed the $10-billion

divestment programme

announced for 2014-2015.

We expect divestments of

$3-5 billion in 2016 and $2-3 billion

per year from 2017 to help manage

oil price volatility and fund the

ongoing Gulf of Mexico

commitments.

Maintain flexibility

around gearing

Gearing★ at the end of 2015 was

21.6% against a 2011-2014

average of 18%.

Looking ahead, we aim to

manage gearing with some

flexibility at around 20%. While

oil prices remain weak, we

expect gearing to be above 20%.

BP Annual Report and Form 20-F 2015

Strategic report

19