BP 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

First, it seeks to identify the best markets and prices for our crude oil,

source optimal raw materials for our refineries and provide competitive

supply for our marketing businesses. We will often sell our own crude and

purchase alternative crudes from third parties for our refineries where this

will provide incremental margin.

Second, it aims to create and capture incremental trading opportunities by

entering into a full range of exchange-traded commodity derivatives,

over-the-counter contracts and spot and term contracts. In combination

with rights to access storage and transportation capacity, this allows it to

access advantageous price differences between locations and time

periods, and to arbitrage between markets.

The function has trading offices in Europe, North America and Asia. Our

presence in the more actively traded regions of the global oil markets

supports overall understanding of the supply and demand forces across

these markets.

Our trading financial risk governance framework is described in Financial

statements – Note 28 and the range of contracts used is described in

Glossary – commodity trading contracts on page 256.

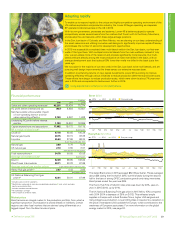

Aviation

Air BP’s strategic aim is to continue to hold strong positions in our core

locations of Europe and the US, while expanding our portfolio in airports

that offer long-term competitive advantage in material growing markets

such as Asia and South America. We are one of the world’s largest global

aviation fuels suppliers. Air BP serves many major commercial airlines as

well as the general aviation sectors. We have marketing sales of more than

430,000 barrels per day and we added more than 70 airports to our global

network with the acquisition of Statoil Fuel & Retail’s aviation business.

Our lubricants business

Our lubricants strategy is to focus on our premium brands and growth

markets while leveraging technology and customer relationships. With

more than 50% of profit generated from growth markets and continued

growth in premium lubricants, we have an excellent base for further

expansion and sustained profit growth.

Our lubricants business manufactures and markets lubricants and related

products and services to the automotive, industrial, marine and energy

markets across the world. Our key brands are Castrol, BP and Aral. Castrol

is a recognized brand worldwide that we believe provides us with

significant competitive advantage. In technology, we apply our expertise to

create differentiated, premium lubricants and high-performance fluids for

customers in on-road, off-road, sea and industrial applications globally.

We are one of the largest purchasers of base oil in the market, but have

chosen not to produce it or manufacture additives at scale. Our

participation choices in the value chain are focused on areas where we can

leverage competitive differentiation and strength, such as:

• Applying cutting-edge technologies in the development and formulation

of advanced products.

• Creating and developing product brands and clearly communicating their

benefits to customers.

• Building and extending our relationships with customers to better

understand and meet their needs.

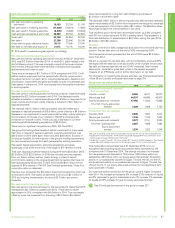

The lubricants business delivered an underlying RC profit before interest

and tax which was higher than 2014 and 2013. The 2015 result reflected

strong performance in growth markets and premium brands and lower

costs from simplification and efficiency programmes. These factors

contributed to around a 20% year-on-year improvement in results, which

was partially offset by adverse foreign exchange impacts. The 2014 result

benefited from improved margins across the portfolio, offset by adverse

foreign exchange impacts.

Our petrochemicals business

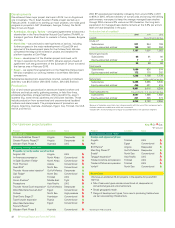

Our petrochemicals strategy is to improve our earnings potential and make

the business more resilient to a bottom-of-cycle environment. We develop

proprietary technology to deliver leading cost positions compared with our

competition. We manufacture and market four main product lines:

• Purified terephthalic acid (PTA).

• Paraxylene (PX).

• Acetic acid.

• Olefins and derivatives.

We also produce a number of other specialty petrochemicals products.

We aim to reposition our portfolio, improve operating performance and

create efficiency benefits. We are taking steps to significantly improve the

resilience of the business to a bottom-of-cycle environment by:

• Restructuring a significant portion of our portfolio, primarily in our

aromatics business, to shut down older capacity in the US and Asia and

assess disposal options for less advantaged assets.

• Retrofitting our best technology in our advantaged sites to reduce overall

operating costs.

• Growing third-party licensing income to create additional value.

• Delivering operational improvements focused on turnaround efficiency

and improved reliability.

• Delivering value through simplification and efficiency programmes.

In addition to the assets we own and operate, we have also invested in a

number of joint arrangements in Asia, where our partners are leading

companies in their domestic market. We are licensing our distinctive

technologies, including recently announced licensing agreements for our

latest generation PTA technology in Oman and China.

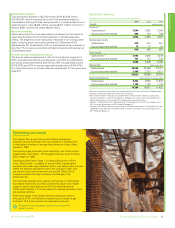

In 2015 the petrochemicals business delivered a higher underlying RC

profit before interest and tax compared with 2014 and 2013. The result

reflected improved operational performance and benefits from our

simplification and efficiency programmes leading to lower costs.

Compared with 2013, the 2014 result was lower, reflecting a continuation

of the weak margin environment, particularly in the Asian aromatics sector,

and unplanned operational events.

Our petrochemicals production of 14.8 million tonnes in 2015 was

higher than 2014 and 2013 (2014 14.0mmte, 2013 13.9mmte), with the low

margin environment in 2014 and 2013 driving reduced output.

In 2015, our Zhuhai 3 PTA plant in China was fully commissioned adding

1.25 million tonnes of production capacity to our petrochemicals portfolio.

During the year we also shut down older capacity of certain units in the US

and Asia.

We are upgrading our PTA plants at Cooper River in South Carolina, US and

Geel in Belgium using our latest proprietary technology. We expect these

investments to significantly increase manufacturing efficiency at these

facilities. We plan to continue deploying our technology in new asset

platforms to access Asian demand and advantaged feedstock sources.

We announced in January 2016 that we had reached an agreement to

sell our Decatur petrochemicals complex in Alabama, US, as part of

our strategy to refocus our global petrochemicals business for

long-term growth.

Defined on page 256.BP Annual Report and Form 20-F 2015 37

Strategic report