BP 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Rosneft is the largest oil company in Russia, with a

strong portfolio of existing and future opportunities.

Rosneft

Upstream

Rosneft is the largest oil company in Russia and the largest publicly traded

oil company in the world, based on hydrocarbon production volume.

Rosneft has a major resource base of hydrocarbons onshore and offshore,

with assets in all key hydrocarbon regions of Russia: West Siberia, East

Siberia, Timan-Pechora, Volga-Urals, North Caucasus, the continental shelf

of the Arctic Sea, and the Far East.

BP purchased a 20% participatory interest in Taas-Yuryakh

Neftegazodobycha, a Rosneft subsidiary that will further develop the

Srednebotuobinskoye oil and gas condensate field in East Siberia. Related

to this, Rosneft and BP will jointly undertake exploration in an adjacent area

of mutual interest. BP’s interest in Taas-Yuryakh Neftegazodobycha is

reported in the Upstream segment.

Rosneft and BP have also agreed to jointly explore two additional areas of

mutual interest in the prolific West Siberian and Yenisey-Khatanga basins,

where they will jointly appraise the Baikalovskoye discovery subject to

receipt of all relevant consents. This is in addition to the exploration

agreement announced in 2014 for an area of mutual interest in the

Volga-Urals region of Russia, where Rosneft and BP have commenced

joint study work to assess potential non-shale, unconventional tight-oil

exploration prospects.

Rosneft participates in international exploration projects or has operations

in countries including the US, Canada, Vietnam, Venezuela, Brazil, Algeria,

United Arab Emirates, Turkmenistan and Norway.

Rosneft continued to optimize its budget and to focus on new upstream

projects, including the development of the Labaganskoye, Suzun and East

Messoyakha fields. It also signed preliminary contracts for the Russkoye,

Kuyumba, Yurubcheno-Tokhomskoye and East Messoyakha fields to

deliver oil to the Transneft pipeline system.

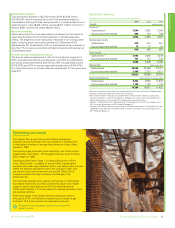

Rosneft’s estimated hydrocarbon production reached an annual record in

2015. This was due to a ramp-up in drilling, optimization of well

performance and the application of modern technologies such as

multistage fracturing, dual completion and bottomhole treatment. In 2015

estimated gas production increased by around 10% compared with 2014,

primarily driven by greenfield start-ups and commissioning of new wells.

Downstream

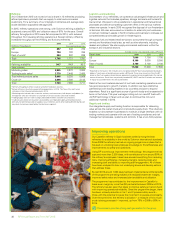

Rosneft is the leading Russian refining company based on throughputs.

It owns and operates 10 refineries in Russia. Rosneft continued to

implement the modernization programme for its Russian refineries in

2015 to significantly upgrade and expand refining capacity.

As at 31 December 2015, Rosneft owned and operated more than 2,500

retail service stations in Russia and abroad. This includes BP-branded sites

acquired as part of the TNK-BP acquisition in 2013 that, under a licence

agreement with BP, continue to operate under the BP brand. Downstream

operations also include jet fuel, bunkering, bitumen and lubricants.

On 15 January 2016 BP and Rosneft announced that they had signed

definitive agreements to dissolve the German refining joint operation

Ruhr Oel GmbH (ROG). The restructuring, which is expected to be

completed in 2016, will result in Rosneft taking ownership of ROG’s

interests in the Bayernoil, MiRO Karlsruhe and PCK Schwedt refineries. In

exchange, BP will take sole ownership of the Gelsenkirchen refinery and

the solvent production facility DHC Solvent Chemie.

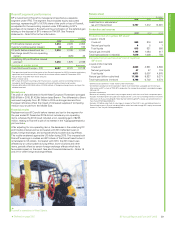

Rosneft refinery throughputs in 2015 amounted to 1,966mb/d (2014

2,027mb/d, 2013 1,818mb/d).

Taas-Yuryakh central processing facility at the Srednebotuobinskoye oil and

gas field during the Siberian winter.

BP and Rosneft

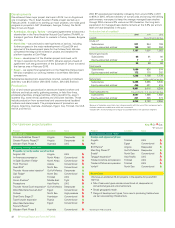

• BP’s 19.75% shareholding in Rosneft allows us to benefit from a

diversified set of existing and potential projects in the Russian oil

and gas sector.

• Russia has significant hydrocarbon resources and will continue to

play an important role in long-term energy supply to the global

economy.

• BP is positioned to contribute to Rosneft’s strategy implementation

through collaboration on technology and best practice.

• We have the potential to undertake standalone projects with

Rosneft, both in Russia and internationally.

• We remain committed to our strategic investment in Rosneft, while

complying with all relevant sanctions.

2015 summary

• In the current environment Rosneft continues to deliver solid

operational and financial performance, demonstrating the resilience

of its business model.

• BP received $271 million, net of withholding taxes, in July –

representing our share of Rosneft’s dividend of 8.21 Russian

roubles per share for 2014.

• In 2015 Rosneft met all its debt service obligations and increased

total hydrocarbon production by 1%.

• Bob Dudley serves on the Rosneft Board of Directors, and its

Strategic Planning Committee.

• A second BP nominee, Guillermo Quintero, was elected to

Rosneft’s Board of Directors at Rosneft’s annual general meeting in

June 2015 and was subsequently elected to its HR and

Remuneration Committee.

• US and EU sanctions remain in place on certain Russian activities,

individuals and entities, including Rosneft.

BP Annual Report and Form 20-F 201538