BP 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

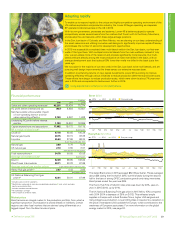

Strategy, performance and pay

In a difficult environment, BP’s leadership delivered strong operating performance,

based on a sound strategy and consistently improved safety performance. They have

acted early and decisively in response to low oil prices to preserve future growth.

In an ever more challenging world BP executives

performed strongly in 2015 in managing the

things they could control and for which they

were accountable. BP was one of the first to

recognize the shift to a ’lower for longer’ price

environment and through early action delivered

distinctive competitive performance on costs.

Momentum built through the year in

simplification and efficiencies, such that

operating cash flow significantly exceeded plan.

Assets ran well and major projects★ were

commissioned on time. Good performance on

safety has led to sound and reliable operations.

There has been a high quality of execution.

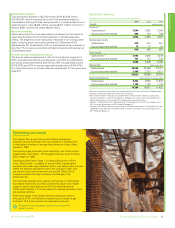

Our pay structure is relatively simple and reflects

a number of key overriding principles. It is

long-term, performance-based and tied directly

to strategy and delivery. It is biased towards

equity with long retention periods. This is

reflected in the policy framework that was

approved by shareholders in 2014. Variable

remuneration is primarily based on true

underlying performance and not driven by

factors over which the executives have no

control. Consistent with past practice, we

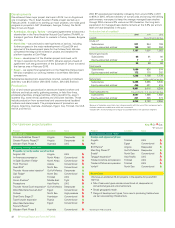

Highlights of the year

Strong safety and operational performance in a difficult environment

• Responded early and decisively to lower oil price environment.

• Excellent safety standards with continuous improvement over the past three years, leading to

improvements in reliability and operations.

• Strong operating cash flow★ and underlying replacement cost profit relative to plan.

• Net investment managed aggressively to reflect ‘lower for longer’ oil price environment.

• Executive directors’ pay outcomes reflect strong operating performance relative to plan.

• Alignment between executives and shareholders with the majority of executive director

remuneration paid in equity with lengthy retention requirements.

These pages constitute the remuneration

committee chair’s annual statement which

forms part of the Directors’ remuneration

report, the rest of which can be found on

page 76.

For more information on the group’s key

performance indicators see page 20.

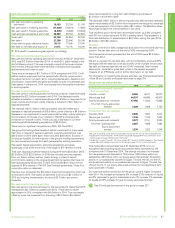

Short-term: annual bonus

Measure Result Target Outcome

Safety and operational risk

Loss of primary containment Spills and leaks declined.≤ 253 events 208 eventsa

Process safety tier 1 events The most serious process

safety events were reduced.

≤ 29 events 20 events

Recordable injury frequency Number of work-related

recordable injuries per 200k

hours fell.

≤ 0.261/200k

hoursb

0.223/200k

hoursb

Value

Operating cash flow Significantly ahead of plan. $17.2bn $19.1bn

Underlying replacement

cost profit

Significantly ahead of plan. $4.2bn $5.9bn

Net investment (organic) Significantly ahead of plan. 18% 27%

Corporate and functional costs Significantly ahead of plan.5.9% 17.6%

Major project delivery On target. 44

a Adjusted in accordance with the treatment of the loss of primary containment key performance indicator on page 20.

b Excludes biofuels.

normalize for changes in oil and gas price and

refining margins. This avoids both windfall gains

and punitive losses in periods of extreme

volatility such as we are currently experiencing.

Against this background, I am pleased to give

an overview of key elements of executive

remuneration for 2015. All of the detail is set out

in the Directors’ remuneration report on page 76.

Short-term performance

The annual cash bonus is based on safety (30%)

and value (70%) measures directly linked to our

KPIs and strategy. In setting annual safety

targets, the committee reviews the three-year

performance and in each case aims for

improvement. We measure value by reference to

operating cash flow and underlying replacement

cost profit. In addition, two value measures,

reductions in corporate and functional costs and

net investment (organic)★, reflect progress in

simplification. Targets were based on the

board’s plan set in January 2015, with the

maxima tested for stretch. Results were strong

across all measures.

BP Annual Report and Form 20-F 201522