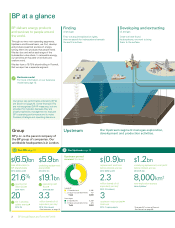

BP 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group chief executive’s letter

Dear fellow shareholder,

In 2015 we continued to adapt to the tough environment created by the dramatic drop in oil

prices. We have seen prices crash before, but this fall has been particularly steep, from

over $100 a barrel in mid-2014 to below $30 by January 2016. The work we have done to

reshape and strengthen BP after 2010 stood us in good stead to withstand these

conditions and last year we took further action to make the business more resilient in the

short term. We also continue to invest for long-term growth. Our safety record improved,

along with operating reliability, while costs came down and capital discipline was

maintained. The current environment has however impacted our financial results, as well

as those of our competitors. So, while the oil price is beyond our control, we have

performed strongly on the factors that we can control.

A safer, more reliable, more resilient BP

In terms of safety, our top priority, we achieved improvements year-on-year in all of our key

safety measures – process safety events, leaks, spills and other releases, and recordable

injuries. This performance is at a much better level than five years ago and in line with the

best among our peers. Safety is also good business. When we operate safely, our

operations are more reliable. When the assets run reliably, they operate more continuously.

When our operations run efficiently, we have better financial results.

In the current business environment, competitiveness depends on minimizing our costs

and being disciplined in our use of limited capital – as demonstrated by our organic capital

expenditure in 2015 of $18.7 billion, down from nearly $23 billion in 2014. And we continue

to focus our portfolio on the highest quality projects and operations, divesting $10 billion

worth of assets in 2014 and 2015, in line with our target.

2015 was a challenging year for our Upstream business, with weaker oil and gas

realizations leading to a significantly lower underlying pre-tax replacement cost profit of

$1.2 billion. However, efficiency and reliability improved across the business in 2015.

Upstream unit production costs were down 20% on 2013, and BP-operated plant reliability

increased to 95% from 86% in 2011. We have made our base production more resilient by

improving our reservoir management and increasing efficiencies in our drilling and

operations – lowering the decline rate and reducing non-productive time in drilling to its

lowest level since 2011. And the decision to manage our US Lower 48 business separately

is starting to deliver improvements in performance and competitiveness.

Our Downstream business had a record year, delivering $7.5 billion of underlying pre-tax

replacement cost profit, demonstrating the benefit of being an integrated business. Our

refining business is ranked among the top performers based on net cash margin in the

most recent industry benchmark. We made improvements in safety, efficiency and

operational performance, and continued to develop a portfolio of highly competitive assets

and products. These include the launch in Spain of a new range of fuels with engine-

cleaning and fuel-economy benefits, the unveiling of Nexcel from Castrol – a technology

with the potential to revolutionize the oil changing process in vehicles, and the start-up of

Zhuhai 3 in China – one of the most efficient purified terephthalic acid production units in

the world.

94.7%

2015 refining availability

95%

Upstream BP-operated plant reliability

By focusing on our distinctive

areas of strength, BP has

become an increasingly agile

business, able to respond

quickly to changing conditions.

Bob Dudley

BP Annual Report and Form 20-F 20158