BP 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension

Framework

Executive directors are eligible to participate in group pension schemes

that apply in their home countries which follow national norms in terms

of structure and levels.

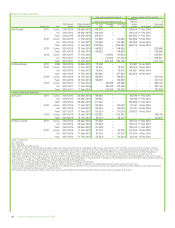

US pension and retirement savings

Bob Dudley participates in US pension and retirement savings plans. These

involve a combination of tax-qualified and non-qualified plans, consistent

with applicable US tax regulations. Benefits payable under non-qualified

plans are unfunded and therefore paid from corporate assets.

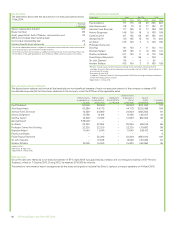

Details of the pension plans in which Mr Dudley participates are as follows.

The BP Retirement Accumulation Plan (US pension plan) is a US tax-qualified

plan that features a cash-balance formula and includes grandfathering

provisions under final average pay formulas for certain employees of

companies acquired by BP (including Amoco) who participated in these

predecessor company pension plans. The TNK-BP Supplemental Retirement

Plan is based on the same calculation as the benefit under the US pension

plan but reflecting service and earnings at TNK-BP.

The BP Excess Compensation (Retirement) Plan (ECRP) provides a

supplemental benefit which is the difference between (1) the benefit

accrual under the US Pension Plan and the TNK-BP Supplemental

Retirement Plan without regard to the Internal Revenue Service (IRS)

compensation limit (including for this purpose base salary, cash bonus and

bonus deferred into a compulsory or voluntary award under the deferred

matching element of the EDIP), and (2) the actual benefit payable under

the US pension plan and the TNK-BP Supplemental Retirement Plan,

applying the IRS compensation limit. The benefit calculation under the

Amoco formula includes a reduction of 5% per year if taken before age 60.

The BP Supplemental Executive Retirement Benefit Plan (SERB) is a

non-qualified supplemental plan which provides a benefit of 1.3% of final

average earnings (including, for this purpose, base salary plus cash bonus

and bonus deferred into a compulsory or voluntary award under the

deferred matching element of the EDIP) for each year of service (without

regard for tax limits) less benefits paid under all other BP (US) qualified and

non-qualified pension arrangements. The benefit payable under SERB is

unreduced at age 60 but reduced by 5% per year if separation occurs

before age 60.

Mr Dudley also participates in US retirement savings plans on the same

terms as those available to all eligible US employees. These savings plans

provide benefits to employees on or after their retirement. These are

provided through a tax-qualified plan and a non-qualified plan. The BP

Employee Savings Plan (ESP) is a US tax-qualified section 401(k) plan to

which both Mr Dudley and BP contribute within limits set by US tax

regulations. The BP Excess Compensation (Savings) Plan (ECSP) is a

non-qualified, unfunded plan under which BP provides a notional match in

respect of eligible pay that exceeds the limit under the ESP. Mr Dudley

does not contribute to the ECSP. For the purposes of the plans, eligible pay

includes base salary, cash bonus and bonus deferred into a compulsory or

voluntary award under the deferred matching element of the EDIP. Under

both plans, participants are entitled to make investment elections, involving

an investment in the relevant fund in the case of the ESP and a notional

investment (the return on which would be delivered by BP under its

unfunded commitment) in the case of the ECSP.

These retirement savings arrangements pre-date Mr Dudley’s appointment as

a director and are grandfathered as a pre-27 June 2012 obligation for the

purposes of the remuneration policy approved by shareholders in April 2014.

The cost to the company has been fully provided for within the amounts

disclosed for pensions and other post-retirement benefits in the financial

statements. Previous remuneration reports have not disclosed details of Mr

Dudley’s participation in these arrangements but following a review, BP has

determined that disclosure of the company’s contribution to these plans

should now be included in this report.

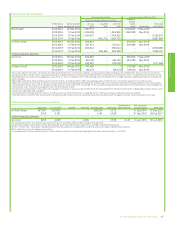

UK pension

Dr Brian Gilvary participates in a UK final salary pension plan in respect of

service prior to 1 April 2011. This plan provides a pension relating to length

of pensionable service and final pensionable salary. The disclosure of total

pension includes any cash in lieu of additional accrual that is paid to

individuals in the UK plan who have exceeded the annual allowance or

lifetime allowance under UK regulations, and have chosen to cease future

accrual of pension. Dr Gilvary falls into this category and in 2015 received a

cash supplement of 35% of salary in lieu of future service accrual.

In the event of retirement before age 60, the following early retirement

terms would apply:

• On retirement between 55 and 60, in circumstances approved by the

committee, an immediate unreduced pension in respect of the

proportion of benefit for service up to 30 November 2006, and subject

to such reduction as the plan actuary certifies in respect of the period of

service after 1 December 2006. The plan actuary has, to date, applied a

reduction of 3% per annum for each year retirement precedes 60 in

respect of the period of service from 1 December 2006 up to the leaving

date; however a greater reduction can be applied in other circumstances.

• On leaving before age 55, in circumstances approved by the committee,

a deferred pension payable from 55 or later, with early retirement terms

if it is paid before 60 as set out above.

Irrespective of this, on leaving in circumstances of total incapacity, an

immediate unreduced pension is payable from his leaving date.

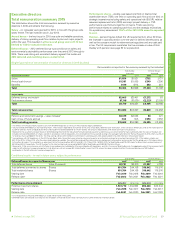

2015 outcomes

Mr Dudley participates in the US pension and retirement savings plans

described above. The pension plans are aimed at an overall accrual rate

of 1.3% of final earnings (which include salary and bonus), for each year

of service. In 2015, Mr Dudley’s accrued pension increased, net of

inflation, by $309,000. This increase has been reflected in the single

figure table on page 77 by multiplying it by a factor of 20 in accordance

with the requirements of the UK regulations (giving $6,176,000). The

committee will continue to make the required disclosures in accordance

with the UK regulations; however, given the issues and differences set

out below, it would note that around 14 would be a typical annuity

factor in the US compared with the factor of 20 upon which the UK

regulations are based.

In relation to the retirement savings plans, Mr Dudley made pre-tax and

post-tax contributions in 2015 to the ESP totalling $26,500 (2014:

$26,000). For 2015 the total value of BP matching contributions in

respect of Mr Dudley to the ESP and notional matching contributions to

the ECSP was $341,000, 7% of eligible pay (2014: $374,000, 7% of

eligible pay). After adjusting for investment gains within his

accumulating unfunded ECSP account (aggregating the unfunded

arrangements relating to his overall service with BP and TNK-BP) the

amount included in the single figure table on page 77 is $343,000. The

equivalent figure for 2014 has been restated (an increase of $427,000)

to reflect the revised disclosure treatment.

Dr Gilvary participates in the UK pension arrangements described

above. In 2015 Dr Gilvary’s accrued pension did not increase and

therefore net of inflation it reduced. In accordance with the

requirements of the UK regulations, the value shown in the single figure

table on page 77 is zero. He has exceeded the lifetime allowance under

UK pension legislation and, in accordance with the policy, receives a

cash supplement of 35% of salary, which has been separately identified

in the single figure table on page 77.

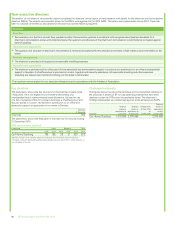

The committee continues to keep under review the increase in the

value of pension benefits for individual directors. There are significant

differences in calculation of pensions between the UK and the US. US

pension benefits are not subject to cost of living adjustments after

retirement as they are in the UK.

BP Annual Report and Form 20-F 201582