BP 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

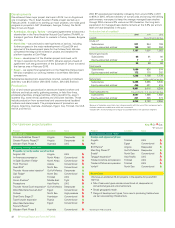

Financial update

1

6

2

3

4

5

■

2. Environmental 8.6■

1. Spill response 14.3

■ 3. Litigation and claimsb

■ 4. Clean Water Act penalties

■ 5. Other fines 4.5

a The cumulative income statement charge does not include

amounts that BP considers are not possible to measure

reliably at this time.

b The litigation and claims cost is net of recoveries of $5.7 billion.

Analysis of cumulative $55.5 billiona charge to the

income statement

($ billion)

22.6

4.1

■ 6. Functional costs 1.4

Total55.5

The group income statement for 2015 includes a pre-tax charge of

$12.0 billion in relation to the incident. The charge for the year reflects the

amounts provided for the proposed Consent Decree; the Settlement

Agreement with the five Gulf states and local government claims as

described above; additional provisions made for business economic loss

claims under the PSC settlement and other items. As at 31 December

2015, the total cumulative charges recognized to date amounted to $55.5

billion. The total amounts that will ultimately be paid by BP in relation to all

the obligations relating to the incident are subject to uncertainty, and the

ultimate exposure and cost to BP and the timing of such costs will be

dependent on many factors, including in relation to any new information or

future developments. These could have a material impact on our

consolidated financial position, results and cash flows.

BP has provided for spill response costs, environmental expenditure,

litigation and claims and Clean Water Act penalties that can be measured

reliably. There continues to be uncertainty regarding the extent and timing

of the remaining costs and liabilities not covered by the proposed Consent

Decree and Settlement Agreement, including:

• Claims asserted in civil litigation, including any further litigation by parties

excluded from, or parties who opted out of, the PSC settlement, and the

private securities litigation pending in MDL 2185.

• The cost of business economic loss claims under the PSC settlement

not yet processed or processed but not yet paid (except where an

eligibility notice has been issued before the end of the month following

the balance sheet date and is not subject to appeal by BP within the

claims facility).

• Any obligation that may arise from securities-related litigation.

Payments made out of the $20-billion Deepwater Horizon Oil Spill Trust

(the Trust) during 2015 totalled $3.2 billion. As at 31 December 2015, the

aggregate cash balances in the Trust and the associated qualified

settlement funds amounted to $1.4 billion, nearly all of which was

committed to specific purposes including the seafood compensation fund

and natural resource damage early restoration projects. As of January

2016, payments in respect of claims and other costs previously funded

from the Trust are now being made by BP.

More details regarding the impacts and uncertainties relating to the

Gulf of Mexico oil spill can be found in Risk factors on page 53, Legal

proceedings on page 237 and Financial statements – Note 2.

Plaintiffs’ Steering Committee settlements

The Plaintiffs’ Steering Committee (PSC) was established to act on

behalf of individual and business plaintiffs in the multi-district litigation

proceedings in federal court in New Orleans (MDL 2179). In 2012 BP

reached settlements to resolve the substantial majority of legitimate

individual and business claims and medical claims stemming from the

incident. Approximately $2.3 billion was paid out under the PSC

settlements during 2015. Claims continue to be assessed and paid.

The medical benefits class action settlement provides for claims to be paid

to qualifying class members. The deadline for submitting claims under the

settlement was 12 February 2015.

Securities litigation and other legal proceedings

The multi-district litigation proceedings pending in federal court in

Houston (MDL 2185), including a purported class action on behalf of

purchasers of American depositary shares under US federal securities

law, are continuing. A jury trial is scheduled to begin in July 2016.

In MDL 2179, claims by individuals and businesses that opted out of the

PSC settlements or whose claims were excluded from them, including

claims for recovery of losses allegedly resulting from the 2010 federal

deepwater drilling moratoria and the related permitting processes, are

continuing.

BP is subject to additional legal proceedings in connection with the

incident. For more information see Legal proceedings on page 237.

Environmental restoration

In April 2011 BP committed to provide $1 billion in early restoration

funding to expedite recovery of natural resources injured as a result

of the incident. By the end of 2015 BP had provided approximately $762

million to support restoration projects, with the remaining $238 million

expected to be funded in 2016. The federal and state settlements referred

to above include more than $7 billion to resolve all natural resource damage

claims, which is in addition to this $1 billion.

In May 2010 BP committed $500 million over 10 years to fund independent

scientific research through the Gulf of Mexico Research Initiative. BP had

contributed $278 million to the programme by the end of 2015.

See bp.com/gulfofmexico for further information on environmental and

economic restoration.

Process safety and ethics monitors

Two independent monitors – an ethics monitor and a process safety

monitor – were appointed under the terms of the criminal plea agreement

BP reached with the US government in 2012. Under the terms of the

agreement, BP is taking additional actions to further enhance ethics and

compliance and the safety of its drilling operations in the Gulf of Mexico.

The ethics monitor delivered an initial report early in 2015. He delivered a

second report later in the year under a separate administrative agreement

with the US Environmental Protection Agency. Recommendations from

the two reports largely relate to BP’s ethics and compliance programme

and code of conduct, including its implementation and enforcement. The

recommendations have been agreed and BP is now in the process of

implementing them. The ethics monitor is meanwhile conducting a

follow-up review as the next phase of his engagement.

The process safety monitor reviews and provides recommendations

concerning BPXP’s process safety and risk management procedures for

deepwater drilling in the Gulf of Mexico. BPXP is the BP group company

that conducts exploration and production operations in the Gulf of Mexico.

The process safety monitor also submitted a report in 2015. Following

discussions between BPXP, the process safety monitor and the US

Department of Justice, the recommendations have now been finalized and

implementation by BPXP is underway.

BP Annual Report and Form 20-F 201542