BP 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report and

Form 20-F 2015

bp.com/annualreport

Table of contents

-

Page 1

Annual Report and Form 20-F 2015 bp.com/annualreport -

Page 2

...long-term value for shareholders by helping to meet growing demand for energy in a safe and responsible way. We strive to be a world-class operator, a responsible corporate citizen and a good employer. BP is one of the world's leading integrated oil and gas companies - based on market capitalization... -

Page 3

...corporate Gulf of Mexico oil spill Corporate responsibility Our management of risk Risk factors Strategic report 55 Corporate governance 56 60 62 63 64 65 66 66 68 Board of directors Executive team Introduction from the chairman The board in 2015 Board activity Shareholder engagement International... -

Page 4

...the date or for the periods indicated, including non-controlling interests. BP's primary share listing is the London Stock Exchange. Ordinary shares are also traded on the Frankfurt Stock Exchange in Germany and, in the US, the company's securities are traded on the New York Stock Exchange (NYSE) in... -

Page 5

... Our market outlook Our business model and strategy Lower oil and gas prices Strategic report 20 Our key performance indicators 22 Strategy, performance and pay 22 Annual statement by the remuneration committee chair 24 Our markets in 2015 26 Group performance 28 Upstream 34 Downstream 38 Rosneft... -

Page 6

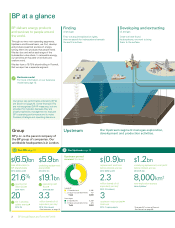

... financial, strategic and operating decisions. Group BP p.l.c. is the parent company of the BP group of companies. Our worldwide headquarters is in London. See KPIs page 20. Upstream Our Upstream segment manages exploration, development and production activities. See Upstream page 28. Upstream... -

Page 7

... the year ended 31 December 2015, unless otherwise indicated. Transporting and trading oil and gas We move hydrocarbons using pipelines, ships, trucks and trains and use our trading capability to capture value across the supply chain. Manufacturing fuels and products We refine, process and blend... -

Page 8

... four BP-operated hubs. Fuels Our fuels business is made up of regionally based integrated fuels value chains, that include refineries and fuels marketing businesses, together with global oil supply and trading activities. We supply fuel and related convenience services to consumers at around 17,200... -

Page 9

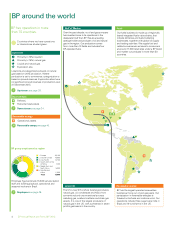

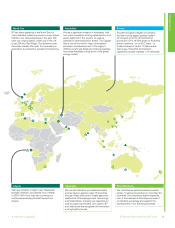

... and development of the region's offshore oil and gas fields and onshore pipelines has made Azerbaijan a focal point of the global energy market. Rosneft Rosneft is Russia's largest oil company and the world's largest publicly traded oil company in terms of hydrocarbon production. BP's 19.75% share... -

Page 10

... to achieve long-term growth and value creation. In the current weaker price environment, our aim is to rebalance our sources and uses of cash to ensure we cover capital expenditure and shareholder distributions with operating cash flow.a This will enable BP to continue to develop its business while... -

Page 11

... are set to continue supplying energy to help meet global demand while delivering value to you from a great business. Strategic report Top: The safety, ethics and environmental assurance committee (SEEAC) examine safety measures at our operations in the Khazzan field in Oman. Bottom: SEEAC members... -

Page 12

... to invest for long-term growth. Our safety record improved, along with operating reliability, while costs came down and capital discipline was maintained. The current environment has however impacted our financial results, as well as those of our competitors. So, while the oil price is beyond... -

Page 13

... We continue to support action to address the risk of climate change. Through the Oil and Gas Climate Initiative - a business coalition that accounts for over a fifth of global oil and gas production - we are sharing best practices and developing common approaches, such as on the role of natural... -

Page 14

... term. And while we anticipate supply chain deflation in 2016 and beyond, as industry costs follow oil prices with a lag, this will be a tough period of intense change for the industry as it adapts to this new reality. Our markets in 2015 See page 24 for information on oil and gas prices in 2015... -

Page 15

... self-sustaining, supported only by a carbon price. Strategic report November 2015 The BP Technology Outlook shows how technology can play a major role in meeting the energy challenge by widening energy resource choices, transforming the power sector, improving transport efficiency and helping to... -

Page 16

... with Rosneft, the world's largest listed oil company in terms of production volume, we are able to build on the experience and success we have achieved over the past quarter century and continue to grow BP's business in Russia. Global energy trading Using our knowledge and insights to help keep... -

Page 17

... the world's largest by production, although this had fallen after years of conflict and underinvestment. In 2009 BP and China National Petroleum Corporation committed to work with Iraq's South Oil Company to modernize operations and increase production. BP recovers costs, irrespective of oil price... -

Page 18

... For definitions of how we measure our performance, see Our key performance indicators on page 20. Proven expertise Strong relationships Our ability to deliver against our priorities and build the right portfolio depends on our distinctive capabilities. 14 BP Annual Report and Form 20-F 2015 -

Page 19

... emissions, tier 1 process safety events. Operating cash flow, gearing, total shareholder return, underlying replacement cost profit per ordinary share. Major project delivery. Strategy in action in 2015 Improving reliability Improvement plans are increasing UK North Sea plant reliability. See page... -

Page 20

... automated well choke control system as part of our Field of the Future technology suite in Azerbaijan in 2015. Sand can cause wells to fail, but this system is helping us manage well start-up and unsteady flow during operations, contributing to improved operational efficiency and production rates... -

Page 21

... teams of people with the skills and experience needed to address complex issues, work effectively with our partners, engage with our stakeholders and help create shared value. Banks and providers of ï¬nance National and international oil companies Universities and research institutions... -

Page 22

... as well as a wellestablished oil and gas trading function that can generate value for the group when prices are volatile. A weak environment in one part of the group can create opportunities in another. For example, we delivered record profits in our Downstream business in 2015. 18 BP Annual Report... -

Page 23

... in response to the lower oil price and also to reflect the changes to our portfolio. BP group employees (at 31 December) 70,000 65,500 65,000 60,000 55,000 59,400 64,800 2013 2014 2015 Figures exclude retail staff and agricultural, operational and seasonal workers in Brazil. BP Annual Report... -

Page 24

...2015 performance The significant reduction in underlying RC profit per ordinary share for the year compared with 2014 was mainly due to lower profit in Upstream. Operating cash flow is net cash flow provided by operating activities, as reported in the group cash flow statement. Operating activities... -

Page 25

... 2013 2014 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 Total shareholder return (TSR) represents the change in value of a BP shareholding over a calendar year. It assumes that dividends are reinvested to purchase additional shares at the closing price on the ex-dividend date... -

Page 26

... three years, leading to improvements in reliability and operations. • Strong operating cash flowâ˜... and underlying replacement cost profit relative to plan. • Net investment managed aggressively to reflect 'lower for longer' oil price environment. • Executive directors' pay outcomes reflect... -

Page 27

... reserves replacement ratio (RRR) and major project delivery over the three years. For TSR, BP was in third place. The target set in 2013 for operating cash flow in 2015 was $35 billion based on the plan assumptions .. At the start of the year, this was normalized for the change in oil and gas price... -

Page 28

... gas prices (quarterly average) Henry Hub 12 US dollars gas prices 10 8 6 4 06 07 08 09 10 11 12 13 14 15 b From IEA Oil Market Report, February 2016 ©, OECD/IEA 2016, Page 4. BP Statistical Review of World Energy 2015. Prices and margins See pages 29 and 35. 24 BP Annual Report and Form... -

Page 29

Strategic report BP is embedding cost efï¬ciency and simpliï¬cation into everyday activities as well as large-scale changes in response to market conditions. As with other companies within our industry, BP is taking measures to respond to the impact of a lower-price environment by limiting ... -

Page 30

... 30 2014 $ million 2013 Financial and operating performance 2015 20 10 0 Profit (loss) before interest and taxation Finance costs and net finance expense relating to pensions and other post-retirement benefits Taxation Non-controlling interests Profit (loss) for the yeara Inventory holding (gains... -

Page 31

... measure on an IFRS basis, and for further information on net debt. For information on financing the group's activities, see Financial statements - Note 28 and Liquidity and capital resources on page 219. Group reserves and production 2015 2014 2013 Strategic report Net cash provided by operating... -

Page 32

... The Upstream segment is responsible for our activities in oil and natural gas exploration, field development and production, as well as midstream transportation, storage and processing. We also market and trade natural gas, including liquefied natural gas, power and natural gas liquids. In 2015 our... -

Page 33

...about 7% year-overyear in 2015 and are expected to decline even further in 2016. Using experience to enhance our competitiveness. Financial performance 2015 2014 $ million 2013 Brent ($/bbl) 2015 150 120 90 2014 2013 Five-year range Sales and other operating revenuesa RC profit before interest... -

Page 34

...higher gas marketing and trading revenues. Replacement cost (RC) loss before interest and tax for the segment included a net non-operating charge of $2,235 million. This is primarily related to a net impairment charge associated with a number of assets, following a further fall in oil and gas prices... -

Page 35

...interest in BP Trinidad & Tobago LLC. b c Optimizing our assets The Caspian Sea is one of the world's leading hydrocarbon provinces and we have been the major presence in development of Azerbaijan's offshore oil and gas fields since our office in Baku opened in 1992. The country's gas production is... -

Page 36

..., 2013 $13.6 billion). With BP-operated plant reliability increasing from around 86% in 2011 to 95% in 2015, efficient delivery of turnarounds and strong infill drilling performance, we expect to keep the average managed base decline through 2016 at around 2% versus our 2014 baseline. Our long-term... -

Page 37

... of trading compliance and risk management processes, systems and controls. Our upstream marketing and trading activity primarily takes place in the US, Canada and Europe and supports group LNG activities, managing market price risk and creating incremental trading opportunities through the use of... -

Page 38

... with global oil supply and trading activities that make up our fuels value chains (FVCs). We sell refined petroleum products including gasoline, diesel and aviation fuel. • Lubricants - manufactures and markets lubricants and related products and services globally, adding value through brand... -

Page 39

Financial performance 2015 2014 $ million 2013 Sale of crude oil through spot and term contracts Marketing, spot and term sales of refined products Other sales and operating revenues Sales and other operating revenuesa RC profit (loss) before interest and taxb Fuels Lubricants Petrochemicals Net (... -

Page 40

... trading function is responsible for delivering value across the overall crude and oil products supply chain. This structure enables our downstream businesses to maintain a single interface with oil trading markets and operate with one set of trading compliance and risk management processes, systems... -

Page 41

... between markets. The function has trading offices in Europe, North America and Asia. Our presence in the more actively traded regions of the global oil markets supports overall understanding of the supply and demand forces across these markets. Our trading financial risk governance framework... -

Page 42

... our share of Rosneft's dividend of 8.21 Russian roubles per share for 2014. • In 2015 Rosneft met all its debt service obligations and increased total hydrocarbon production by 1%. • Bob Dudley serves on the Rosneft Board of Directors, and its Strategic Planning Committee. • A second BP... -

Page 43

... deferred gain relating to the disposal of BP's interest in TNK-BP. See Financial statements - Note 16 for further information. $ million 2015a 2014 2013b Balance sheet 2015 2014 $ million 2013 Strategic report Investments in associates (as at 31 December) Production and reserves e 5,797 2015a... -

Page 44

... efficiency relative to 2014, and in 2015, we farmed a total planted area of 127,000 hectares. BP Brazil biofuels production (million litres of ethanol equivalent) 1,000 795 800 600 403 400 200 2011 2012 2013 2014 2015 313 492 542 Sales and other operating revenues RC profit (loss) before interest... -

Page 45

...foreign exchange and interest-rate products in the financial markets, hedging group exposures and generating incremental value through optimizing and managing cash flows and the short-term investment of operational cash balances. Trading activities are underpinned by the compliance, control and risk... -

Page 46

... in relation to any new information or future developments. These could have a material impact on our consolidated financial position, results and cash flows. BP has provided for spill response costs, environmental expenditure, litigation and claims and Clean Water Act penalties that can be measured... -

Page 47

...36 2014 0.27 0.34 2015 0.20 0.28 Managing safety We are working to continuously improve personal and process safety and operational risk management across BP. Process safety is the application of good design and engineering principles, as well as robust operating and BP Annual Report and Form 20... -

Page 48

... environment, social responsibility and operational reliability, as well as related issues such as maintenance, contractor relations and organizational learning, into a common management system. We review and amend our group requirements within OMS from time to 44 BP Annual Report and Form 20-F 2015... -

Page 49

... by BP and other companies. In those cases, our OMS does not apply as the management system to be used by the operator, but is generally available as a reference point when engaging with operators and co-venturers. Safety performance 2015 2014 2013 Recordable injury frequency Day away from work... -

Page 50

...action on climate change through best practice sharing and collaboration. We also joined with seven other oil and gas companies calling on the UN and governments to put a price on carbon. See bp.com/climatechange for more information about our activities. Greenhouse gas emissions We report on direct... -

Page 51

...18 BP Energy Outlook BP Technology Outlook, page 8 How we adapt our investment strategy to changes in policy, market or technology conditions. BP Sustainability Report 2015, page 16 Information on our gas, biofuels and wind businesses, as well as our research activities. BP Annual Report 2015, pages... -

Page 52

... development that meets local needs and are relevant to our business activities. We contributed $67 million in social investment in 2015. See bp.com/society for more information about our social contribution. Staff taking part in BP's code of conduct training in Brazil. 48 BP Annual Report and Form... -

Page 53

..., UK. We are increasing the footprint of our retail presence in many European countries and actively recruiting in these markets. BP employees Number of employees at 31 Decembera 2015 2014 2013 Upstream Downstream Other businesses and corporate Total Service station staff Agricultural, operational... -

Page 54

... employees are with our strategic priorities using our group priorities index, based on questions about their perception of BP as a business and how it is managed in terms of leadership and standards. This measure fell to 69% in 2015 (2014 72%, 2013 72%). Our survey results show a strong increase... -

Page 55

...BP's annual planning process, we review the group's principal risks and uncertainties. These may be updated throughout the year in response to changes in internal and external circumstances. Facilities, assets and operations Business segments and functions Executive and corporate functions Board... -

Page 56

... teams. We also seek to maintain a positive and collaborative relationship with regulators and the industry at large. For further information see Upstream gas marketing and trading activities on page 33, Downstream supply and trading on page 36 and Financial statements - Note 28. Strategic... -

Page 57

... and capital resources on page 219 and Financial statements - Note 28. Strategic report Strategic and commercial risks Prices and markets - our financial performance is subject to fluctuating prices of oil, gas, refined products, technological change, exchange rate fluctuations, and the general... -

Page 58

... regulation of BP and other companies' oil and gas activities in the US and elsewhere, particularly relating to environmental, health and safety controls and oversight of drilling operations, which could result in increased compliance costs. In addition, we may be subjected to a higher number... -

Page 59

...64 Board activity 64 64 64 64 64 65 Board focus in 2015 Strategy Risk Performance Monitoring Training and induction 65 Shareholder engagement 66 66 66 66 Institutional investors Private investors AGM UK Corporate Governance Code compliance 66 International advisory board 66 How the board works 66... -

Page 60

... the SEEA, geopolitical and chairman's committees Andrew Shilston Senior independent director Member of the audit, geopolitical, remuneration, nomination and chairman's committees David Jackson Company secretary a Safety, ethics and environment assurance. 56 BP Annual Report and Form 20-F 2015 -

Page 61

...general (spending and finance), HM Treasury Financial Management Review Board Nominated for appointment by the AGM as a non-executive director of L'Air Liquide S.A. from May 2016 Member of the 100 Group Committee GB Age Group triathlete Age 54 Nationality British BP Annual Report and Form 20-F 2015... -

Page 62

...skills of a managing director with significant financial and strategic experience to the board. He has worked with and advised global organizations and companies in a wide variety of sectors including oil and gas and the public sector, enabling him to draw on knowledge of diverse issues and outcomes... -

Page 63

...Nationality British Career John Sawers spent 36 years in public service in the UK, working on foreign policy, international security and intelligence. John was Chief of the Secret Intelligence Service, MI6, from 2009 to 2014, a period of international upheaval and growing security threats as well as... -

Page 64

... disciplines including engineering, health, safety, security and the environment. In this capacity, he looks after the group-wide operating management system implementation and capability programmes. Bob has 30 years' experience in the oil and gas industry, having joined Amoco Production Company in... -

Page 65

... Dev Sanyal is responsible for the Europe and Asia regions and functionally for group strategy and long-term planning, risk management, government and political affairs, policy and group integration. Dev joined BP in 1989 and has held a variety of international roles in London, Athens, Istanbul... -

Page 66

... BP board governance principles: • BP goal • Governance process • Delegation model • Executive limitations Delegation Delegation of authority through policy with monitoring Strategy/group risks/annual plan Business integrity function External market and reputation research Independent... -

Page 67

... and risk management Food and consumer goods; leading a global business Oil, gas and extractive industry experience; leading a global business Engineering, technology and education Strategy, advisory and consulting Audit, financial services and trading Civil engineering, telecoms and banking Energy... -

Page 68

... full meeting. The board also reviewed the BP Energy Outlook, updated in February 2015, which looks at long-term energy trends and develops projections for world energy markets over the next two decades. In January the executive team presented the 2015 annual plan to describe how the strategy should... -

Page 69

... chief financial officer Engagement on remuneration and governance issues Chairman and board committee chairs meeting UKSA private shareholders' meeting SRI roadshow following the launch of BP Sustainability Report 2014 Annual general meeting First quarter results BP's response to lower oil prices... -

Page 70

... socially responsible investors as part of BP's annual SRI meeting. The meeting examined a number of operational and strategic issues, including how the board looks at risk and strategy, the group's approach to operational risk, context for the sector and BP in terms of oil price and energy supply... -

Page 71

... increase female representation to 25%. At the end of 2015, there were three female directors (2014 2, 2013 2) on our board of 15. Our nomination committee remains mindful of diversity in considering potential candidates for appointment to the board. Corporate governance BP Annual Report and Form... -

Page 72

... a review of the company's internal processes that form the group's reporting governance framework. The board's statement on the report is on page 93. Role of the committee The committee monitors the effectiveness of the group's financial reporting, systems of internal control and risk management... -

Page 73

... development in the finance function. • Pensions and post-retirement benefits assumptions. Financial disclosure System of internal control and risk management External audit • Review of effectiveness of BP's system of internal control and risk management.* • Quarterly group audit reports... -

Page 74

...-term oil and gas prices, the group's cost outlook, the capital framework in a lower oil price environment, discount rate assumptions, considerations around impairments, estimation of oil and gas reserves and resources, decommissioning, valuation of exploration assets, accounting for BP's investment... -

Page 75

... when its expertise and experience of the company is important. A two-tier system for approval of audit-related and non-audit work operates. For services relating to accounting, auditing and financial reporting matters, internal accounting and risk management control reviews or non-statutory audit... -

Page 76

... any issues arising and the quality of the meeting. Activities during the year Safety, operations and environment The committee received regular reports from the S&OR function, including quarterly reports prepared for executive management on the group's health, safety and environmental performance... -

Page 77

... and claims. • Review the environmental work to remediate or mitigate the effects of the oil spill in the waters of the Gulf of Mexico and on the affected shorelines. • Oversee management strategy and actions to restore the group's reputation in the US. • Review compliance with government... -

Page 78

... risks. The relationship of the committee with the International Advisory Board. The effect of the oil price on geopolitical matters. The company's relationships with national oil companies. The company's relationships in specific countries and regions. 74 BP Annual Report and Form 20-F 2015 -

Page 79

...a board in a global business and the committee reviewed how potential appointments meet the board's aspirations on diversity, inclusiveness and meritocracy. The committee also remained mindful of BP's commitment to Lord Davies' report and work on women on boards. BP Annual Report and Form 20-F 2015... -

Page 80

... indicator. 2016 bonus and equity plans supporting BP's strategic priorities Short term: annual bonus Long term: performance share plan Relative total shareholder return Cumulative operating cash ï¬,ow Strategic imperatives: Relative reserves replacement ratio Safety and operational risk Loss of... -

Page 81

... operating cash ï¬,ow relative to plan and major projects within the year. This resulted in a ï¬nal overall group score of 1.70 but limited to 1.50 for executive directors. Deferred bonus - 2012 deferred bonus was conditional on safety and environmental sustainability performance over the period... -

Page 82

... of the group's strategy and short-term imperatives. It focused on two key priorities: safety and value. Targets for each measure were challenging but realistic and were set in the context of the current price and industry environment. Targets for the value measures were based upon the annual plan... -

Page 83

...in the group's annual plan, the number of value measures was reduced from six in 2014 to ï¬ve in 2015. These measures were more heavily weighted on operating cash ï¬,ow and underlying replacement cost proï¬t. The economic environment was taken into account by looking at capital and cost discipline... -

Page 84

... changes in oil and gas prices. This avoids windfall gains or penal losses in periods of extreme volatility. The target set in 2013 for 2015 operating cash ï¬,ow was $35 billion based on the plan assumptions relating to oil and gas price and reï¬ning margins at that time. This target was reviewed... -

Page 85

... a further three-year retention period before they will be released to the individuals in 2019. 2013-2015 performance shares preliminary outcome Shares awarded Shares vested including dividends Value of vested shares accounts and assessed that BP was in ï¬rst place relative to other oil majors and... -

Page 86

... pay formulas for certain employees of companies acquired by BP (including Amoco) who participated in these predecessor company pension plans. The TNK-BP Supplemental Retirement Plan is based on the same calculation as the beneï¬t under the US pension plan but reï¬,ecting service and earnings... -

Page 87

... of BP remuneration strategy Salary review Corporate governance Executive directors Executive team and leadership group Annual bonus Assess performance Determine bonus for 2014 Agree measures and targets for 2015 Review measures for 2016 Consider measures and targets for 2016 Long-term equity plan... -

Page 88

... vote 'for' % vote 'against' Votes withheld 2014 96.4% 3.6% 125,217,443 The shareholder approved policy now governs the remuneration of the directors for a period of three years expiring in 2017. See bp.com/remuneration for a copy of the approved policy. 84 BP Annual Report and Form 20-F 2015 -

Page 89

... includes both scrip dividends as well as those paid in cash. See Financial statements - Note 9 for further information. a At 22 February 2016, the following directors held the numbers of options under the BP group share option schemes over ordinary shares or their calculated equivalent set out... -

Page 90

...the relevant performance period based on performance achieved under rules of the plan and includes reinvested dividends on the shares vested. The market price of each share used to determine the total value at vesting on the vesting dates of 15 January 2015, 11 February 2015 and 9 February 2016 were... -

Page 91

... Corporate governance - - 1,071,609 - - Former executive directors Iain Conn Dr Byron Groteb a For awards under the 2012-2014, 2013-2015, 2014-2016 and 2015-2017 plans, performance conditions are measured one third on TSR against ExxonMobil, Shell, Total and Chevron; one third on operating cash... -

Page 92

... of the executive director and reviewed annually. • Salary levels and total remuneration of oil and other top European multinationals, and related US corporations, are considered by the committee. Internally, increases for the group leaders as well as all employees in relevant countries are... -

Page 93

... safety and environmental management then the committee, with advice ï¬,ow, replacement cost operating proï¬t and cost management, as well as operating measures such as major project delivery, Downstream net income per barrel and Upstream unplanned deferrals. The speciï¬c metrics chosen each year... -

Page 94

... the applicable dates. The chairman's holdings represented as a percentage against policy achieved are 944%. Ordinary Ordinary shares or shares or equivalents at equivalents at 1 Jan 2015 31 Dec 2015 Change from 31 Dec 2015 to 22 Feb 2016 Ordinary shares or equivalents total at 22 Feb 2016 Chairman... -

Page 95

Non-executive directors Basic fee • Remuneration is in the form of cash fees, payable monthly. Remuneration practice is consistent with recognized best practice standards for nonexecutive directors' remuneration and as a UK-listed company, the quantum and structure of NED director remuneration ... -

Page 96

... to the company under the DTRs as at the applicable dates. Ordinary shares or equivalents at 1 Jan 2015 Ordinary shares or equivalents at 31 Dec 2015 Change from 31 Dec 2015 to 22 Feb 2016 Ordinary shares or equivalents total at 22 Feb 2016 Value of current shareholding % of policy achieved Paul... -

Page 97

... 2016 Risk management and internal control Under the UK Corporate Governance Code, the board is responsible for the company's risk management and internal control systems. In discharging this responsibility, the board through its governance principles, requires the group chief executive to operate... -

Page 98

... period of three years is appropriate based on management's reasonable expectations of the position and performance of the company over this period, taking account of its short-term and longer-range plans. Taking into account the company's current position and its principal risks, the directors... -

Page 99

... gas exploration and production activities Movements in estimated net proved reserves 170 176 Standardized measure of discounted future net cash flows and changes therein relating to proved oil and gas reserves Operational and statistical information 191 194 196 Parent company financial statements... -

Page 100

...the International Accounting Standards Board (IASB). In our opinion the consolidated financial statements comply with IFRS as issued by the IASB. What we have audited We have audited the financial statements of BP p.l.c. for the year ended 31 December 2015 which comprise: Group Parent company Group... -

Page 101

... commodity prices have had a significant effect on the carrying value of the group's assets, as evidenced by the impairments recognized in the 2015 financial statements and in the prior year. The principal risk is in relation to management's assessment of future cash flows, which are used to project... -

Page 102

... on the consolidated financial statements. We take into account size, risk profile, the organization of the group and effectiveness of group-wide controls, changes in the business environment and other factors such as recent internal audit results when assessing the level of work to be performed... -

Page 103

... cost profit before interest and taxation is the most appropriate measure upon which to calculate materiality, due to the fact it excludes the impact of both changes in crude oil and product prices and items disclosed as non-operating items that can significantly distort the group's results... -

Page 104

... and the directors' statement that they consider the annual report and accounts taken as a whole is fair, balanced and understandable and provides the information necessary for shareholders to assess the entity's position and performance, business model and strategy; and whether the annual report... -

Page 105

... Public Company Accounting Oversight Board (United States), BP p.l.c.'s internal control over financial reporting as of 31 December 2015, based on criteria established in the UK Financial Reporting Council's Guidance on Risk Management, Internal Control and Related Financial and Business Reporting... -

Page 106

...on the UK Financial Reporting Council's Guidance. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the group balance sheets of BP p.l.c. as of 31 December 2015 and 2014, and the related group income statement, group statement of... -

Page 107

Group income statement For the year ended 31 December Note 2015 2014 $ million 2013 Sales and other operating revenues Earnings from joint ventures - after interest and tax Earnings from associates - after interest and tax Interest and other income Gains on sale of businesses and fixed assets Total... -

Page 108

... further information. Group statement of changes in equitya $ million Share capital and capital reserves Foreign Fair currency value Treasury translation shares reserve reserves Profit and loss account BP Nonshareholders' controlling interests equity Total equity At 1 January 2015 Profit (loss... -

Page 109

... financial instruments Accruals Finance debt Deferred tax liabilities Provisions Defined benefit pension plan and other post-retirement benefit plan deficits Total liabilities Net assets Equity BP shareholders' equity Non-controlling interests Total equity C-H Svanberg Chairman R W Dudley Group... -

Page 110

Group cash flow statement For the year ended 31 December Note 2015 2014 $ million 2013 Operating activities Profit (loss) before taxation Adjustments to reconcile profit (loss) before taxation to net cash provided by operating activities Exploration expenditure written off Depreciation, depletion ... -

Page 111

... Reporting Standards The consolidated financial statements of the BP group for the year ended 31 December 2015 were approved and signed by the group chief executive and chairman on 4 March 2016 having been duly authorized to do so by the board of directors. BP p.l.c. is a public limited company... -

Page 112

... the Rosneft board's Strategic Planning Committee. During 2015, a second BP-nominated director, Guillermo Quintero, was elected to the Rosneft board. BP also holds the voting rights at general meetings of shareholders conferred by its 19.75% stake in Rosneft. In management's judgement, the group has... -

Page 113

... to have exploration wells and exploratory-type stratigraphic test wells remaining suspended on the balance sheet for several years while additional appraisal drilling and seismic work on the potential oil and natural gas field is performed or while the optimum development plans and timing are... -

Page 114

... cash flows are adjusted for the risks specific to the asset group and are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money. Fair value less costs of disposal is the price that would be received to sell the asset... -

Page 115

... on operating expenses, discount rates, production profiles and the outlook for global or regional market supply-and-demand conditions for crude oil, natural gas and refined products. For oil and natural gas properties, the expected future cash flows are estimated using management's best estimate... -

Page 116

... the present value of estimated future cash flows discounted at the financial asset's original effective interest rate. The carrying amount of the asset is reduced, with the amount of the loss recognized in the income statement. Significant estimate or judgement: recoverability of trade receivables... -

Page 117

...'s financial statements. Cash flow and fair value hedge accounting is applied to certain finance debt-related instruments in the normal course of business and cash flow hedge accounting is applied to certain highly probable foreign currency transactions as part of the management of currency risk... -

Page 118

...constantly changing, as well as political, environmental, safety and public expectations. BP believes that the impact of any reasonably foreseeable change to these provisions on the group's results of operations, financial position or liquidity will not be material. If oil and natural gas production... -

Page 119

... to the price of the shares of the company (market conditions). Non-vesting conditions, such as the condition that employees contribute to a savings-related plan, are taken into account in the grant-date fair value, and failure to meet a non-vesting condition, where this is within the control of the... -

Page 120

...the rules established by the applicable taxation authorities. It therefore excludes items of income or expense that are taxable or deductible in other periods as well as items that are never taxable or deductible. The group's liability for current tax is calculated using tax rates and laws that have... -

Page 121

... Impact upon the group income statement below. The cumulative income statement charge does not include amounts for obligations that BP considers are not possible, at this time, to measure reliably. For further information, including developments in relation to business economic loss claims under the... -

Page 122

... in relation to any new information or future developments. These uncertainties could have a material impact on our consolidated financial position, results and cash flows. The impacts of the Gulf of Mexico oil spill on the income statement, balance sheet and cash flow statement of the group are... -

Page 123

... of Mexico oil spill in relation to environmental expenditure (including spill response costs), litigation and claims, and Clean Water Act penalties that can be measured reliably at this time. Movements in each class of provision during the year and cumulatively since the incident are presented in... -

Page 124

... of state claims is payable over 18 years from the date the court approves the Consent Decree, of which $1 billion is due following the court approval of the Consent Decree. The vast majority of local government entities who filed claims have issued releases, which were accepted by BP; amounts... -

Page 125

... upon the group income statement The amount of the provision recognized during the year can be reconciled to the charge to the income statement as follows: $ million 2015 2014 2013 Cumulative since the incident Net increase in provision Change in discount rate relating to provisions Costs charged... -

Page 126

... post-retirement benefit plan deficits Liabilities directly associated with assets classified as held for sale 360 3 215 578 (97) (97) The assets classified as held for sale are reported in the Downstream segment. The associated pension liabilities are reported in Other businesses and corporate... -

Page 127

... as business disposals in 2013 were the sales of the Texas City and Carson refineries with their associated marketing and logistics assets. Information relating to sales of fixed assets is excluded from the table. $ million 2015 2014 2013 Financial statements Non-current assets Current assets Non... -

Page 128

... 2015, BP had three reportable segments: Upstream, Downstream and Rosneft. Upstream's activities include oil and natural gas exploration, field development and production; midstream transportation, storage and processing; and the marketing and trading of natural gas, including liquefied natural gas... -

Page 129

... expense relating to pensions and other post-retirement benefits Profit (loss) before taxation Other income statement items Depreciation, depletion and amortization US Non-US Charges for provisions, net of write-back of unused provisions, including change in discount rate Segment assets Investments... -

Page 130

... 2014 Other businesses and corporate Gulf of Mexico oil spill response Consolidation adjustment and eliminations By business Upstream Downstream Rosneft Total group Segment revenues Sales and other operating revenues Less: sales and other operating revenues between segments Third party sales... -

Page 131

... 2013 Other businesses and corporate Gulf of Mexico oil spill response Consolidation adjustment and eliminations By business Upstream Downstream Rosneft TNK-BP Total group Segment revenues Sales and other operating revenues Less: sales and other operating revenues between segments Third... -

Page 132

... assets; investments in joint ventures; investments in associates; and non-current prepayments. $ million 2014 By geographical area US Non-US Total Revenues Third party sales and other operating revenuesa Other income statement items Production and similar taxes Results Replacement cost profit... -

Page 133

...evaluation of oil and natural gas resources. All such activity is recorded within the Upstream segment. For information on significant estimates and judgements made in relation to oil and natural gas accounting see Intangible assets within Note 1. $ million 2015 2014 2013 Exploration and evaluation... -

Page 134

...: Income statement 2015 2014 2013 2015 Balance sheet 2014 Deferred tax liability Depreciation Pension plan surpluses Derivative financial instruments Other taxable temporary differences Deferred tax asset Pension plan and other post-retirement benefit plan deficits Decommissioning, environmental... -

Page 135

... shown in the table below. 2015 2014 2013 Number of shares issued (thousand) Value of shares issued ($ million) 102,810 642 165,644 1,318 202,124 1,470 The financial statements for the year ended 31 December 2015 do not reflect the dividend announced on 2 February 2016 and expected to be paid... -

Page 136

... of these financial statements, there was a net increase of 12,765,658 in the number of ordinary shares outstanding as a result of share issues in relation to employee share-based payment plans. Employee share-based payment plans The group operates share and share option plans for directors and... -

Page 137

...December 2014 a For information on significant estimates and judgements made in relation to the estimation of oil and natural reserves see Property, plant and equipment within Note 1. 12. Capital commitments Authorized future capital expenditure for property, plant and equipment by group companies... -

Page 138

...by BP management. Capital expenditure, operating costs and expected hydrocarbon production profiles are derived from the business segment plan adjusted for assumptions reflecting the price environment at the time that the test was performed. Estimated production volumes and cash flows up to the date... -

Page 139

... each field and take into account development plans agreed by management as part of the long-term planning process. The average production for the purposes of goodwill impairment testing over the next 15 years is 911mmboe per year (2014 847mmboe per year). It is estimated that if production volume... -

Page 140

... to the group at both 31 December 2015 and 2014 is Rosneft. In 2013, BP sold its 50% interest in TNK-BP to Rosneft and increased its investment in Rosneft. The net cash inflow in 2013 relating to the transaction included in Net cash used in investing activities in the cash flow statement was $11... -

Page 141

...Since 21 March 2013, BP has owned 19.75% of the voting shares of Rosneft. Rosneft shares are listed on the MICEX stock exchange in Moscow and its global depository receipts are listed on the London Stock Exchange. The Russian federal government, through its investment company OJSC Rosneftegaz, owned... -

Page 142

16. Investments in associates - continued Summarized financial information for the group's share of associates is shown below. $ million BP share 2015 Rosnefta Other Total Rosnefta Other 2014 Total Rosneft Other 2013 Total Sales and other operating revenues Profit before interest and taxation ... -

Page 143

... designated as financial assets at fair value through profit and loss and their valuation methodology is in level 3 of the fair value hierarchy. 18. Inventories $ million 2015 2014 Crude oil Natural gas Refined petroleum and petrochemical products Supplies Trading inventories Cost of inventories... -

Page 144

... their pension benefit in the form of a lump sum payment upon retirement. The plan is funded and its assets are overseen by a fiduciary investment committee composed of six BP employees appointed by the president of BP Corporation North America Inc. (the appointing officer). The investment committee... -

Page 145

...length of service. The returns on the notional contributions made by both the company and employees are set out in German tax law. Retired German employees take their pension benefit typically in the form of an annuity. The German plan is governed by legal agreements between BP and the works council... -

Page 146

...UKa USb Eurozone Other Total Fair value of pension plan assets At 31 December 2015 Listed equities - developed markets - emerging markets Private equity Government issued nominal bonds Government issued index-linked bonds Corporate bonds Property Cash Other Debt (repurchase agreements) used to fund... -

Page 147

23. Pensions and other post-retirement benefits - continued $ million 2015 UK US Eurozone Other Total Analysis of the amount charged to profit (loss) before interest and taxation Current service costa Past service costb Settlement Operating charge relating to defined benefit plans Payments to ... -

Page 148

23. Pensions and other post-retirement benefits - continued $ million 2014 UK US Eurozone Other Total Analysis of the amount charged to profit (loss) before interest and taxation Current service costa Past service costb Settlementc Operating charge relating to defined benefit plans Payments to ... -

Page 149

...discount rate is used to determine the asset interest income as well as the interest cost on the obligation. The amounts presented reflect the total impact of an inflation rate change on the assumptions for rate of increase in salaries, pensions in payment and deferred pensions. One additional year... -

Page 150

... in active markets are used and such measurements are therefore categorized in level 2 of the fair value hierarchy. The fair value of the group's finance lease obligations is estimated using discounted cash flow analyses based on the group's current incremental borrowing rates for similar types and... -

Page 151

... accounting is applied, less cash and cash equivalents. Net debt and net debt ratio are nonGAAP measures. BP believes these measures provide useful information to investors. Net debt enables investors to see the economic effect of gross debt, related hedges and cash and cash equivalents in total... -

Page 152

... oil, natural gas and power prices that could adversely affect the value of the group's financial assets, liabilities or expected future cash flows. The group enters into derivatives in a well-established entrepreneurial trading operation. In addition, the group has developed a control framework... -

Page 153

...its trading positions in liquid periods using value-at-risk techniques. These techniques make a statistical assessment of the market risk arising from possible future changes in market prices over a one-day holding period. The value-at-risk measure is supplemented by stress testing. Trading activity... -

Page 154

... 2015 with 26 international banks, and borrowings under them would be at pre-agreed rates. The group also has committed letter of credit (LC) facilities totalling $6,850 million with a number of banks, allowing LCs to be issued for a maximum two-year duration. There were also uncommitted secured... -

Page 155

... manage its normal business exposures in relation to commodity prices, foreign currency exchange rates and interest rates, including management of the balance between floating rate and fixed rate debt, consistent with risk management policies and objectives. An outline of the group's financial risks... -

Page 156

... business objective, and are recognized at fair value with changes in fair value recognized in the income statement. Trading activities are undertaken by using a range of contract types in combination to create incremental gains by arbitraging prices between markets, locations and time periods... -

Page 157

... period and by methodology of fair value estimation. This information is presented on a gross basis, that is, before netting by counterparty. $ million 2015 Less than 1 year 1-2 years 2-3 years 3-4 years 4-5 years Over 5 years Financial statements Total Fair value of derivative assets Level... -

Page 158

...floating rate finance debt. Note 28 outlines the group's approach to foreign currency exchange risk management. For cash flow hedges the group only claims hedge accounting for the intrinsic value on the currency with any fair value attributable to time value taken immediately to the income statement... -

Page 159

...meet the requirements of employee share-based payment plans in the US. For each year presented, the balance at 1 January represents the maximum number of shares held in treasury by BP during the year, representing 8.9% (2014 8.8% and 2013 8.7%) of the called-up ordinary share capital of the company... -

Page 160

... not be reclassified to profit or loss Remeasurements of the net pension and other post-retirement benefit liability or asset Share of items relating to equity-accounted entities, net of tax Total comprehensive income Dividends Repurchases of ordinary share capital Share-based payments, net of taxb... -

Page 161

...642 Financial statements Treasury shares Availablefor-sale investments Cash flow hedges Total fair value reserves Profit and loss account BP shareholders' equity Noncontrolling interests Total equity ...3,243 2 22,866 (5,910) (6,923) 473 73 76 130,407 BP Annual Report and Form 20-F 2015 157 -

Page 162

... a cash flow hedge that is determined to be an effective hedge. For further information see Note 1 - Derivative financial instruments and hedging activities. Profit and loss account The balance held on this reserve is the accumulated retained profits of the group. 158 BP Annual Report and Form 20... -

Page 163

...-for-sale investments (including recycling) Cash flow hedges (including recycling) Share of items relating to equity-accounted entities, net of tax Other Items that will not be reclassified to profit or loss Remeasurements of the net pension and other post-retirement benefit liability or asset Share... -

Page 164

... 76. Remuneration of directors and senior management $ million 2015 2014 2013 Total for senior management and non-executive directors Short-term employee benefits Pensions and other post-retirement benefits Share-based payments Total Senior management comprises members of the executive team, see... -

Page 165

... share-based payment arrangements are equity-settled. Reported to the nearest 100. Includes 15,000 (2014 14,200 and 2013 14,100) service station staff. Around 2,000 employees from the global business services organization were reallocated from Downstream to Other businesses and corporate during 2015... -

Page 166

... BP Trinidad and Tobago UK BP Capital Markets US *BP Holdings North America Atlantic Richfield Company BP America BP America Production Company BP Company North America BP Corporation North America BP Exploration & Production BP Exploration (Alaska) BP Products North America Standard Oil Company BP... -

Page 167

... also fully and unconditionally guarantees securities issued by BP Capital Markets p.l.c. and BP Capital Markets America Inc. These companies are 100%-owned finance subsidiaries of BP p.l.c. Income statement $ million For the year ended 31 December Issuer BP Exploration (Alaska) Inc. Guarantor Other... -

Page 168

...losses on sale of businesses and fixed assets Exploration expense Distribution and administration expenses Profit (loss) before interest and taxation Finance costs Net finance (income) expense relating to pensions and other post-retirement benefits Profit (loss) before taxation Taxation Profit (loss... -

Page 169

...losses on sale of businesses and fixed assets Exploration expense Distribution and administration expenses Profit (loss) before interest and taxation Finance costs Net finance (income) expense relating to pensions and other post-retirement benefits Profit (loss) before taxation Taxation Profit (loss... -

Page 170

... Non-current liabilities Other payables Derivative financial instruments Accruals Finance debt Deferred tax liabilities Provisions Defined benefit pension plan and other post-retirement benefit plan deficits Total liabilities Net assets Equity BP shareholders' equity Non-controlling interests 8,306... -

Page 171

... Non-current liabilities Other payables Derivative financial instruments Accruals Finance debt Deferred tax liabilities Provisions Defined benefit pension plan and other post-retirement benefit plan deficits Total liabilities Net assets Equity BP shareholders' equity Non-controlling interests 7,787... -

Page 172

... information on certain US subsidiaries - continued Cash flow statement $ million For the year ended 31 December Issuer BP Exploration (Alaska) Inc. Guarantor Other subsidiaries 2015 BP p.l.c. BP group Net cash provided by operating activities Net cash provided by (used in) investing activities... -

Page 173

... reserves and production compliance and governance processes, see pages 227-232. a Financial statements 2013 equity-accounted entities information includes BP's share of TNK-BP from 1 January to 20 March, and Rosneft for the period 21 March to 31 December. BP Annual Report and Form 20-F 2015... -

Page 174

Oil and natural gas exploration and production activities $ million 2015 Europe North America Rest of North America South America Africa Asia Australasia Total UK Rest of Europe US Russia Rest of Asia Subsidiaries Capitalized costs at 31 Decembera b Gross capitalized costs Proved properties ... -

Page 175

... reported for Russia include BP's share of Rosneft's worldwide activities, including insignificant amounts outside Russia. These tables contain information relating to oil and natural gas exploration and production activities of equity-accounted entities. Amounts relating to the management and... -

Page 176

...natural gas exploration and production activities - continued $ million 2014 Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia Subsidiaries Capitalized costs at 31 Decembera b Gross capitalized costs Proved properties... -

Page 177

... reported for Russia include BP's share of Rosneft's worldwide activities, including insignificant amounts outside Russia. These tables contain information relating to oil and natural gas exploration and production activities of equity-accounted entities. Amounts relating to the management and... -

Page 178

...natural gas exploration and production activities - continued $ million 2013 Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total UK US Russia Rest of Asia Subsidiaries Capitalized costs at 31 Decembera b Gross capitalized costs Proved properties... -

Page 179

... include BP's share of Rosneft's worldwide activities, including insignificant amounts outside Russia. These tables contain information relating to oil and natural gas exploration and production activities of equity-accounted entities. They do not include amounts relating to assets held for sale... -

Page 180

... be payable over the life of the field under the terms of the BP Prudhoe Bay Royalty Trust. Includes 8 million barrels of crude oil in respect of the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of... -

Page 181

... in respect of the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Total proved NGL reserves held as part of our equity interest in Rosneft is 47 million barrels, comprising less than... -

Page 182

... Sales of reserves-in-place At 31 Decembere Developed Undeveloped Equity-accounted entities (BP share)f At 1 January Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Production Sales of reserves... -

Page 183

...the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 129 billion cubic feet of natural gas in respect of the 0.23% non-controlling interest in Rosneft including 5 billion cubic... -

Page 184

... of the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 70 million barrels of oil equivalent in respect of the non-controlling interest in Rosneft, including 28 mmboe held... -

Page 185

... of North America South America Africa Asia Australasia 2014 Total UK USc Russia Rest of Asia Subsidiaries At 1 January Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Productiond Sales of... -

Page 186

... of North America South America Africa Asia Australasia 2014 Total UK US Russia Rest of Asia Subsidiaries At 1 January Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Productionc Sales of... -

Page 187

... of the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 38 million barrels in respect of the non-controlling interest in Rosneft. Total proved liquid reserves held as part of... -

Page 188

...% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 91 billion cubic feet of natural gas in respect of the 0.18% non-controlling interest in Rosneft. Total proved gas reserves held... -

Page 189

... 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 54 million barrels of oil equivalent in respect of the non-controlling interest in Rosneft. Total proved reserves held as part... -

Page 190

... America Africa Asia Australasia 2013 Total UK Rest of Europe USc Russia Rest of Asia Subsidiaries At 1 January Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Production Sales of reserves... -

Page 191

...from processing plants in which an interest is held of 5,500 barrels per day. Includes 13 million barrels of NGL in respect of the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Total... -

Page 192

... of the 30% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 23 million barrels in respect of the non-controlling interest in Rosneft. Total proved liquid reserves held as part of... -

Page 193

...% non-controlling interest in BP Trinidad and Tobago LLC. Volumes of equity-accounted entities include volumes of equity-accounted investments of those entities. Includes 41 billion cubic feet of natural gas in respect of the 0.44% non-controlling interest in Rosneft. Total proved gas reserves held... -

Page 194

...of North America South America Africa Asia Australasia 2013 Total UK USd Russia Rest of Asia Subsidiaries At 1 January Developed Undeveloped Changes attributable to Revisions of previous estimates Improved recovery Purchases of reserves-in-place Discoveries and extensions Productione f Sales of... -

Page 195

... computed using appropriate year-end statutory corporate income tax rates. Future net cash flows from oil and natural gas production are discounted at 10% regardless of the group assessment of the risk associated with its producing activities. Non-controlling interests in BP Trinidad and Tobago LLC... -

Page 196

... computed using appropriate year-end statutory corporate income tax rates. Future net cash flows from oil and natural gas production are discounted at 10% regardless of the group assessment of the risk associated with its producing activities. Non-controlling interests in BP Trinidad and Tobago LLC... -

Page 197

... computed using appropriate year-end statutory corporate income tax rates. Future net cash flows from oil and natural gas production are discounted at 10% regardless of the group assessment of the risk associated with its producing activities. Non-controlling interests in BP Trinidad and Tobago LLC... -

Page 198

...of their component parts. Amounts reported for Russia include BP's share of Rosneft worldwide activities, including insignificant amounts outside Russia. Crude oil includes condensate. Natural gas production excludes gas consumed in operations. Productive oil and gas wells and acreage The following... -

Page 199

...production activities in progress The following table shows the number of exploratory and development oil and natural gas wells in the process of being drilled by the group and its equity-accounted entities as of 31 December 2015. Suspended development wells and long-term suspended exploratory wells... -

Page 200

Parent company financial statements of BP p.l.c. Company balance sheet At 31 December Note 2015 2014 $ million 2013 Fixed assets Investments Defined benefit pension plan surplus Total fixed assets Current assets Debtors - amounts falling due within one year Deferred tax asset Cash at bank and in ... -

Page 201

... reconcile profit before taxation to net cash provided by operating activities Gain on sale of businesses and fixed assets Interest receivable Interest received Finance cost Net finance (income) expense relating to pensions and other post-retirement benefits Share-based payments Net operating charge... -

Page 202

... into US dollars using the average exchange rate for the reporting period. Share-based payments Equity-settled transactions The cost of equity-settled transactions with employees of the company and other members of the BP group is measured by reference to the fair value at the date at which... -

Page 203

... comprises the total for each plan of the present value of the defined benefit obligation (using a discount rate based on high quality corporate bonds), less the fair value of plan assets out of which the obligations are to be settled directly. Fair value is based on market price information and, in... -

Page 204

... holding Integrated oil operations Lubricants Investment holding Investment holding The carrying value of BP International Limited in the accounts of the company at 31 December 2015 was $70,425 million (2014 $67,625 million and 2013 $62,625 million). The parent company financial statements of BP... -

Page 205

...), with the company also making dividend payments as set out in Note 9 to the consolidated financial statements. 5. Creditors $ million 2015 Within 1 year After 1 year Within 1 year 2014 After 1 year Within 1 year 2013 After 1 year Group undertakings Accruals and deferred income Other creditors... -

Page 206

... rate changes and inflation assumption changes on the projected benefit obligation. The company's current asset allocation policy for the main plan is as follows: Asset category % Total equity (including private equity) Bonds/cash (including LDI) Property/real estate 62 31 7 The amounts invested... -

Page 207

... 2015 2014 2013 Fair value of pension plan assets Listed equities - developed markets - emerging markets Private equity Government issued nominal bondsa Government issued index-linked bondsa Corporate bondsa Propertyb Cash Other Debt (repurchase agreements) used to fund liability driven investments... -

Page 208

...discount rate is used to determine the asset interest income as well as the interest cost on the obligation. The amounts presented reflect the total impact of an inflation rate change on the assumptions for rate of increase in salaries, pensions in payment and deferred pensions. One additional year... -

Page 209

...meet the requirements of employee share-based payment plans in the US. For each year presented, the balance at 1 January represents the maximum number of shares held in treasury by BP during the year, representing 8.9% (2014 8.8% and 2013 8.7%) of the called-up ordinary share capital of the company... -

Page 210

...of the financial information of the foreign branch. Upon disposal of foreign operations, the related accumulated exchange differences are recycled to the income statement. Profit and loss account The balance held on this reserve is the accumulated retained profits of the company. The profit and loss... -

Page 211

... 2014, the company's date of transition to FRS 101, and made those changes in accounting policies and other restatements required for the first time adoption of FRS 101. Pensions Under previous UK GAAP the interest cost was determined by applying the discount rate to the opening present value... -

Page 212

...are controlled by the group and their results are fully consolidated in the group's financial statements. The percentage of share capital owned by the group is 100% unless otherwise noted below. Subsidiaries 200 PS Overseas Holdings Inc. (United States) 4321 North 800 West LLC (United States) 563916... -

Page 213

... (Chile) BP China Exploration and Production Company (United States) BP China Limited (United Kingdom)f BP Company North America Inc. (United States)j BP Containment Response Limited (United Kingdom) BP Containment Response System Holdings LLC (United States) BP Continental Holdings Limited (United... -

Page 214

...) BP West Papua III Limited (United Kingdom) BP Wind Energy North America Inc. (United States) BP Wiriagar Ltd. (United States) BP World-Wide Technical Services Limited (United Kingdom) BP Zhuhai Chemical Company Limited (China, 85.00%) BP+Amoco International Limited (United Kingdom)f BPA Investment... -

Page 215

...) Telcom General Corporation (United States, 99.96%) Terrapin Creek Wind Energy LLC (United States) Terre de Grace Partnership (Canada, 75.00%) The Anaconda Company (United States) The BP Share Plans Trustees Limited (United Kingdom)f The Burmah Oil Company (Pakistan Trading) Limited (United Kingdom... -

Page 216

.... (Singapore, 50.00%) BP YPC Acetyls Company (Nanjing) Limited (China, 50.00%) BP-Husky Refining LLC (United States, 50.00%) BP-Japan Oil Development Company Limited (United Kingdom, 50.00%) Braendstoflageret Kobenhavns Lufthavn I/S (Denmark, 33.33%)c BTC International Investment Co. (Cayman Islands... -

Page 217

... States, 25.30%) Wiri Oil Services Limited (New Zealand, 27.78%) Xact Downhole Telementry Inc (Canada, 25.70%)m Yangtze River Acetyls Co., Ltd (China, 51.00%) Financial statements The parent company financial statements of BP p.l.c. on pages 196-213 do not form part of BP's Annual Report on Form... -

Page 218

THIS PAGE HAS BEEN LEFT BLANK INTENTIONALLY 214 BP Annual Report and Form 20-F 2015 -

Page 219

...216 Selected financial information 219 Liquidity and capital resources 221 Upstream analysis by region 225 Downstream plant capacity 227 Oil and gas disclosures for the group 233 Environmental expenditure 233 Regulation of the group's business 237 Legal proceedings 242 International trade sanctions... -

Page 220

... to pensions and other post-retirement benefits Taxation Profit (loss) for the year Profit (loss) for the year attributable to BP shareholders Inventory holding (gains) losses, net of taxation RC profit (loss) for the year attributable to BP shareholders Non-operating items and fair value accounting... -

Page 221

... subsidiaries, tax is calculated using the group's discrete quarterly effective tax rate (adjusted for the items noted above, equity-accounted earnings and certain deferred tax adjustments relating to changes in UK taxation). * Defined on page 256. BP Annual Report and Form 20-F 2015 217 -

Page 222

...calculated using the group's discrete quarterly effective tax rate (adjusted for certain non-operating items, equity-accounted earnings and certain deferred tax adjustments relating to changes in UK taxation). Reconciliation of non-GAAP information $ million 2015 2014 2013 Upstream RC profit (loss... -

Page 223

... in Financial statements - Note 27. Financing the group's activities The group's principal commodities, oil and gas, are priced internationally in US dollars. Group policy has generally been to minimize economic exposure to currency movements by financing operations with US dollar debt. Where debt... -

Page 224

... purchase commitments existing at 31 December 2015 entered into principally to meet the group's short-term manufacturing and marketing requirements. The price risk associated with these crude oil, natural gas and power contracts is discussed in Financial statements - Note 28. The following table... -

Page 225

...lower price environment. These were however more than offset by impairment reversals of $945 million in relation to other assets in the region arising as a result of decreases in cost estimates and a reduction in the discount rate applied. In the UK North Sea, BP operates the Forties Pipeline System... -

Page 226

... have an effective date of 15 January 2016. BP has a 33% share in the NL15-01-06 and NL15-01-07 licences and a 50% share in the NL15-01-08 licence. South America BP has upstream activities in Brazil and Trinidad & Tobago, as well as in Argentina, Bolivia, and Chile through an equity-accounted joint... -

Page 227

... in the North Damietta offshore concession in the East Nile Delta at the Atoll-1 Deepwater exploration well (BP 100%). A Heads of Agreement was signed with the Egyptian government in November securing gas prices and key terms for the acceleration of Atoll development, with an estimated investment of... -

Page 228

...north and west of the country, BP operations continued as planned in the south. In Russia, we acquired a 20% participatory interest in a Rosneft subsidiary, Taas-Yuryakh Neftegazodobycha, in 2015, that will further develop the Srednebotuobinskoye oil and gas condensate field in East Siberia. Related... -

Page 229

...as the highest average sustained unit rate for a consecutive 30-day period. BP share of equity, which is not necessarily the same as BP share of processing entitlements. Indicates refineries not operated by BP. Additional disclosures * Defined on page 256. BP Annual Report and Form 20-F 2015 225 -

Page 230

... Gelsenkirchen refinery, the income and expenditure of these plants is managed and reported through the fuels business. g Group interest varies by product. h BP Zhuhai Chemical Company Ltd is a subsidiary* of BP, the capacity of which is shown above at 100%. 226 BP Annual Report and Form 20-F 2015 -

Page 231

... equity-accounted entities). The major areas with progressed volumes in 2015 were Angola, Azerbaijan, Russia, UK and US. Revisions of previous estimates for proved undeveloped reserves are due to changes relating to field performance, well results or changes in commercial conditions including price... -

Page 232

... is always some risk involved in the ultimate development and production of proved reserves including, but not limited to: final regulatory approval; the installation of new or additional infrastructure, as well as changes in oil and gas prices; changes in operating and development costs; and the... -

Page 233

...activity in Alaska and the US Lower 48. Lower prices impacted the reserves in a number of regions, but these were largely offset by increases in reserves in our PSAs. In some cases, cost recovery in PSAs may be limited by production or revenue caps. * Defined on page 256. BP Annual Report and Form... -

Page 234

...BP net share of productionb Crude oil 2013 Natural gas liquids 2013 2014 2015 2014 2015 Subsidiaries UKc d Norway Total Rest of Europe Total Europe Alaskac Lower 48 onshorec Gulf of Mexico deepwaterc Total US Canada Total Rest of North America Total North America Trinidad & Tobagoc Brazilc Total... -

Page 235

BP's net production by country - natural gas million cubic feet per day BP net share of productiona 2015 2014 2013 Subsidiaries UKb Norway Total Rest of Europe Total Europe Lower 48 onshoreb Gulf of Mexico deepwaterb Alaska Total US Canada Total Rest of North America Total North America Trinidad & ... -

Page 236

...disclosures in relation to our oil and gas operations. Average sales price per unit of productiona $ per unit of production Europe North America Rest of Europe Rest of North America South America Africa Asia Australasia Total group average UK US Russiab Rest of Asia Subsidiaries 2015 Crude oilc... -

Page 237

...environmental activities in relation to the Gulf of Mexico oil spill, see Financial statements - Note 2. Regulation of the group's business BP's activities, including its oil and gas exploration and production, pipelines and transportation, refining and marketing, petrochemicals production, trading... -

Page 238

... and revenue taxes. The taxes imposed on oil and gas production profits and activities may be substantially higher than those imposed on other activities, for example in Abu Dhabi, Angola, Egypt, Norway, the UK, the US, Russia and Trinidad & Tobago. developments, such as stricter environmental laws... -

Page 239

... Standard regulations impose security compliance regulations on around 15 BP facilities. • OPA 90 is implemented through regulations issued by the EPA, the US Coast Guard, the DOT, OSHA, the Bureau of Safety and Environmental Enforcement and various states. Alaska and the West Coast states... -

Page 240

...assessing information about each country's 'Intended Nationally Determined Contributions' towards reaching the overall ambition. The world's three largest emitters - China, the US and the EU - have all announced their intentions to limit their GHG emissions. 236 BP Annual Report and Form 20-F 2015 -

Page 241

...required to report product volumes and notional GHG emissions as if these products were fully combusted. The EPA proposed regulations establishing GHG emission limits for new and modified power plants in September 2013. In June 2014, the EPA proposed a 'Clean Energy Plan' Regulation that establishes... -

Page 242

...OPA 90 seeking damages for removal costs, natural resource damages, property damage, lost tax and other revenue and damages for providing increased public services during or after removal activities; and various state law claims. On 17 May 2013, the State of Texas filed suit against BP and others in... -

Page 243

... on 11 January 2013. The effective date was 12 February 2014 and the deadline for submitting claims was 12 February 2015. The total number of claims estimated by the Medical Claims Administrator is approximately 37,200. At year end, approximately 7,600 SPC claims, totalling approximately $17 million... -

Page 244

...5 July 2016. Individual securities litigation From April 2012 to September 2015, 37 cases were filed in state and federal courts by pension funds and investment funds and advisers against BP entities and several current and former officers and directors seeking damages for alleged losses those funds... -

Page 245

... 2013, January 2014, January 2015 and January 2016 totalling $2.1 billion. BP was required to serve a term of five years' probation and agree to certain equitable relief relating to BP's risk management processes in order to further enhance the safety of drilling operations in the Gulf of Mexico. BP... -

Page 246