ADT 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290

|

|

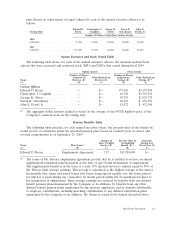

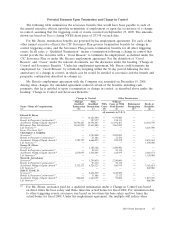

Mr. Breen’s benefit is payable as an actuarially equivalent lump sum at the later of (i) age 60 and

(ii) the actual date of his termination of employment other than as a result of death or upon a

change in control (subject to any applicable 6-month delay pursuant to Internal Revenue Code

Section 409A).

(2) The amount in column (d) is calculated as the discounted present value of normal retirement

benefits earned as of September 25, 2009, payable as a lump sum at ‘‘Normal Retirement Date’’

(without regard to projected service, projected salary increases, pre-retirement mortality or other

decrements). The assumptions used in determining the discounted present value are consistent

with those used to calculate the Company’s retirement plan liabilities as described in Note 16 to

the Company’s audited consolidated financial statements for the fiscal year ended September 25,

2009, and include:

• A discount rate of 5.5%;

• Payment as a lump sum;

• A prime rate of 3.25% (used to accumulate the Company’s defined contribution match balance);

• An assumed retirement age of 60.

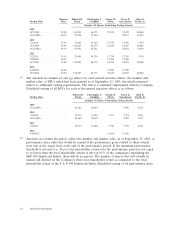

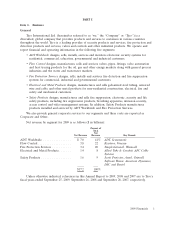

Non-Qualified Deferred Compensation Table at Fiscal Year-End 2009

The following table presents information on the non-qualified deferred compensation accounts of

each named executive officer at September 25, 2009.

Aggregate

Executive Registrant Aggregate Aggregate Balance

Contributions in Contributions in Earnings in Last Withdrawals/ at Last

Last Fiscal Year Last Fiscal Year Fiscal Year Distributions Fiscal Year End

Name ($)(1) ($)(1) ($)(2) ($)(3) ($)

(a) (b) (c) (d) (e) (f)

Current Officers

Edward D. Breen ....... — $224,729 $(16,260) — $1,415,783

Christopher J. Coughlin . . — $104,417 $ 9,908 — $ 373,567

George R. Oliver ....... $ 12,960 $ 72,050 $ 13,350 — $ 191,360

Naren K. Gursahaney .... $375,320 $ 48,817 $ 10,982 — $2,034,829

John E. Evard, Jr. ...... — $ 43,333 $(25,185) — $ 195,743

(1) Amounts in columns (b) and (c) include employee and Company contributions, respectively, under

the Company’s Supplemental Savings and Retirement Plan (the ‘‘SSRP’’), a non-qualified

retirement savings plan. All of the amounts shown in column (c) are included in the Summary

Compensation Table under the column heading ‘‘All Other Compensation.’’ Under the terms of the

SSRP, an eligible executive may choose to defer up to 50% of his or her base salary and up to

100% of his or her performance bonus.

(2) Amounts in column (d) include earnings or (losses) on the named executive officer’s notional

account in the SSRP and in the Company’s Supplemental Executive Retirement Plan (the

‘‘SERP’’). The SERP was frozen with respect to additional contributions on December 31, 2004.

Except for the Tyco stock fund and the Fidelity Freedom Funds, investment options under the

SSRP are the same as those available under the Company’s tax-qualified 401(k) retirement plans.

Investment options under the SERP are the same as those available under the SSRP.

(3) Under both the SSRP and the SERP, participants may elect to receive distributions in a single

lump sum payment or in up to 15 annual installments. A participant who is still employed by Tyco

may begin receiving distributions under each plan after a minimum of five years have elapsed from

the plan year for which contributions have been made. A participant who has left Tyco may begin

receiving distributions upon his or her termination of employment or retirement.

64 2010 Proxy Statement