ADT 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.distribution centers are located in North America, Europe and the Asia-Pacific region. The group

occupies approximately 6 million square feet, of which 3 million square feet are owned and 3 million

square feet are leased.

In the opinion of management, our properties and equipment are in good operating condition and

are adequate for our present needs. We do not anticipate difficulty in renewing existing leases as they

expire or in finding alternative facilities. See Note 15 to Consolidated Financial Statements for a

description of our lease obligations.

Item 3. Legal Proceedings

In the normal course of business, we are subject to various legal proceedings and claims, including

product and general liability matters, environmental matters, patent infringement claims, employment

disputes, disputes on agreements and other commercial disputes.

In connection with the Separation, we entered into a liability sharing agreement regarding certain

legal actions that were pending against Tyco prior to the Separation. Under the Separation and

Distribution Agreement, we, Covidien and Tyco Electronics are jointly and severally liable for the full

amount of any judgments resulting from the actions subject to the agreement, which generally relate to

legacy matters that are not specific to the business operations of any of the companies. The Separation

and Distribution Agreement also provides that we will be responsible for 27%, Covidien 42% and Tyco

Electronics 31% of payments to resolve these matters, with costs and expenses associated with the

management of these contingencies being shared equally among the parties. In addition, under the

agreement, we will manage and control all the legal matters related to assumed contingent liabilities as

described in the Separation and Distribution Agreement, including the defense or settlement thereof,

subject to certain limitations. Additionally, at the time of the Separation, the Company, Covidien and

Tyco Electronics agreed to allocate responsibility for certain legacy tax claims pursuant to the same

formula under the Tax Sharing Agreement. See Note 6 to the Consolidated Financial Statements for a

description of our Tax Sharing Agreement.

Class Action Settlement and Legacy Securities Matters

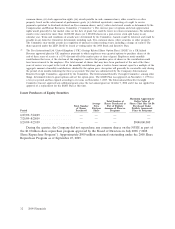

As previously reported, Tyco, and some members of the Company’s former senior corporate

management were named as defendants in a number of lawsuits alleging violations of the disclosure

provisions of the federal securities laws.

In June 2007 the Company settled 32 purported securities class action lawsuits arising from actions

alleged to have been taken by prior management for $2.975 billion. Of this amount, the Company

contributed $803 million, representing its share under the Separation and Distribution Agreement.

The June 2007 class action settlement did not purport to resolve all legacy securities cases, and

several remain outstanding, the most significant of which is Stumpf v. Tyco International Ltd., which is a

class action lawsuit in which the plaintiffs allege that Tyco, among others, violated the disclosure

provisions of the federal securities laws. The matter arises from Tyco’s July 2000 initial public offering

of common stock of TyCom Inc., and alleges that the TyCom registration statement and prospectus

relating to the sale of common stock were inaccurate, misleading and failed to disclose facts necessary

to make the registration statement and prospectus not misleading. The complaint further alleges the

defendants violated securities laws by making materially false and misleading statements and omissions

concerning, among other things, executive compensation, TyCom’s business prospects and Tyco’s and

TyCom’s finances. The matter is currently in the pre-trial stages of litigation.

In the first half of fiscal 2009, the Company settled a number of legal matters stemming from

alleged violations of federal securities laws committed by former senior management, including several

lawsuits from plaintiffs that had opted out of the June 2007 class action settlement, for an aggregate

amount of approximately $90 million. Pursuant to the Separation and Distribution Agreement, the

2009 Financials 23