ADT 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.EXECUTIVE OFFICER COMPENSATION

Compensation Discussion and Analysis

Introduction

The Compensation Discussion and Analysis section of this Proxy Statement discusses the role of

the Compensation and Human Resources Committee (the ‘‘Compensation Committee’’) in establishing

the objectives of the Company’s executive compensation plans; the Compensation Committee’s

executive compensation philosophy, and the application of this philosophy to Tyco’s executive

compensation plans. It also provides an analysis of the compensation design, and the decisions the

Compensation Committee made in fiscal 2009 with respect to the elements of compensation and the

total compensation paid to the five ‘‘named executive officers’’ of Tyco: Edward D. Breen, the

Chairman and Chief Executive Officer; Christopher J. Coughlin, the Executive Vice President and

Chief Financial Officer; George R. Oliver, President, Safety Products and Electrical & Metal Products;

Naren K. Gursahaney, President, ADT Worldwide; and John E. Evard, Jr., Senior Vice President and

Chief Tax Officer.

In designing the Company’s executive compensation programs, the Compensation Committee is

guided by its philosophy that holds that the programs must: (i) reinforce Tyco’s business objectives and

the creation of long-term shareholder value; (ii) provide for performance-based reward opportunities

that support growth and innovation without encouraging or rewarding excessive risk; (iii) align the

interests of executives and shareholders by weighting a significant portion of compensation on sustained

shareholder returns through long-term performance programs; (iv) attract, retain and motivate key

executives by providing competitive compensation with an appropriate mix of fixed and variable

compensation, short-term and long-term incentives, and cash and equity-based pay; and (v) recognize

and support outstanding individual performance and behaviors that demonstrate our core values—

Integrity, Excellence, Teamwork and Accountability.

Fiscal 2009 Summary

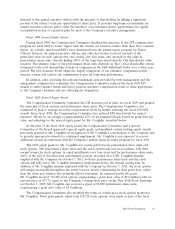

Overall, fiscal 2009 was a challenging year for the Company, as the global economic recession

adversely affected the Company’s businesses across nearly all industries and regions. The Company’s

revenue decreased by nearly $3.0 billion, or 14.7%, compared to 2008, and goodwill and intangible

asset impairment charges were largely responsible for a U.S. GAAP operating loss of $1.5 billion for

the year, compared to operating income of $1.9 billion in 2008. In response to the downturn,

management implemented a number of measures to contain general and administrative costs, including

compensation costs. Additionally, management identified key priorities that would best position the

Company to succeed in a rapidly deteriorating economy, and emerge as a stronger, more efficient

organization when the economy improved. Besides identifying ways to further reduce costs through

restructuring activities and other initiatives, management focused on strengthening the balance sheet

and on improving cash flow to gain greater operating flexibility. To reinforce these priorities the

Compensation Committee in May 2009 created an incentive program, effective at the business segment

level, to reward the attainment of performance metrics related to cash flow improvement. Through

these efforts, the Company increased its cash flow from operating activities over the fiscal 2008 level.

Thus, while the Company addressed the short-term challenges presented by adverse economic

conditions, it also took actions to enhance balance sheet flexibility and enable continued investment in

long-term growth opportunities.

2010 Proxy Statement 37