ADT 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interests of the named executive officers with the interests of shareholders by linking a significant

portion of the officer’s total pay opportunity to share price. It provides long-term accountability for

named executive officers, and it offers the incentive of performance-based opportunities for capital

accumulation in lieu of a pension plan for most of the Company’s executive management.

Fiscal 2009 Annual Equity Award

During fiscal 2008, the Compensation Committee modified the structure of the LTI compensation

program for fiscal 2009 to better align it with the returns our investors realize from their Tyco common

shares. As a result, time-based RSUs were eliminated from the annual equity program for Senior

Officers. Instead, our named executive officers and other key leaders received one-half of the

grant-date value in stock options that vest ratably over four years, and one-half of the value in

performance share units, thereby linking 100% of the long-term award directly with shareholder value

creation. The ultimate value of the performance share units depends on Tyco’s total shareholder return

compared to the total shareholder returns of companies in the S&P Industrials Index over a three-year

period. The new structure better aligns the largest component of our executive compensation with

investor returns and reflects our commitment to pay for long-term performance.

In addition, after reviewing the relevant benchmark data provided by both management and the

independent compensation consultant, the Compensation Committee reduced the fiscal 2009 LTI

awards to reflect market trends and better position executive compensation levels to those appropriate

to the Company’s business and size following the Separation.

Fiscal 2010 Annual Equity Award

The Compensation Committee continued the LTI structure put in place for fiscal 2009 and granted

the same mix of stock options and performance share units. The Compensation Committee also

continued its plan to manage executive compensation levels by further reducing the fiscal 2010 LTI

awards. Since fiscal 2008, the Compensation Committee has reduced LTI award levels for named

executive officers by an average of approximately 25% on an annualized basis, based on grant date fair

value and adjusting for the special equity grant for Mr. Coughlin, described below.

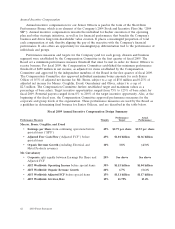

At the time of the fiscal 2010 equity award, the Compensation Committee and a special

Committee of the Board approved a special equity grant, and modified certain existing equity awards

previously granted to Mr. Coughlin, in recognition of Mr. Coughlin’s contributions to the Company and

to provide appropriate rewards for continued employment. Mr. Coughlin is not expected to receive

additional awards in connection with the Company’s annual equity incentive program for fiscal 2011.

The 2010 equity grant for Mr. Coughlin was evenly split between performance share units and

stock options. The performance share units and the stock options will vest in accordance with their

normal terms (for stock options, in equal installments over four years and for performance share units,

100% at the end of the three-year performance period), provided, that if Mr. Coughlin remains

employed with the Company on October 7, 2011, both the performance share units and the stock

options will fully vest if Mr. Coughlin terminates employment before the normal vesting date. In

addition, if Mr. Coughlin remains employed with the Company on October 7, 2011, the stock options

will remain exercisable throughout the entire ten-year period commencing on their grant date, rather

than the three-year window that normally follows retirement. In connection with the grant,

Mr. Coughlin received 317,400 stock options (representing a grant date value of $3.0 million) with an

exercise price of $33.75, equal to the Company’s closing stock price on the New York Stock Exchange

on October 1, 2009. Mr. Coughlin also received a grant of 88,800 performance share units

(representing a grant date value of $3.0 million).

The Compensation Committee also modified the terms of certain prior stock options granted to

Mr. Coughlin. These prior grants, which total 435,728 stock options, were made as part of the fiscal

2010 Proxy Statement 45