ADT 2009 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

14. Financial Instruments (Continued)

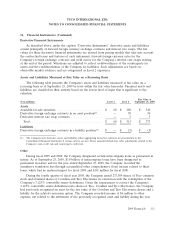

As of September 25, 2009, the total gross notional amount of the Company’s foreign exchange

contracts was approximately $525 million.

Amount of Gain

(Loss) Recognized in

Location of Gain Earnings on Derivatives

(Loss) Recognized in For the Year

Derivatives designated as hedging instruments: Earnings on Derivatives Ended September 25, 2009

Interest Rate Swap Contracts(1) ............. Interest expense $3

(1) The gain or loss on the derivative as well as the offsetting loss or gain on the hedged item attributable to the hedged risk

are recognized in current earnings. The Company includes the gain or loss on the hedged item in the same line item,

interest expense, as the offsetting loss or gain on the related interest rate swaps. For the year ended September 25, 2009,

the Company recognized a $3 million loss on the underlying debt issuances.

As of September 25, 2009, the total gross notional amount of the Company’s interest rate swap

contracts was $1.4 billion.

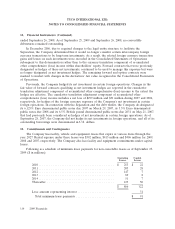

Counterparty Credit Risk

The use of derivative financial instruments exposes the Company to counterparty credit risk. If the

counterparty fails to perform, the Company is exposed to losses if the derivative is in an asset position.

When the fair value of a derivative instrument is an asset, the counterparty has to pay the Company to

settle the contract. This exposes the Company to credit risk. However, when the fair value of a

derivative instrument is a liability, the Company has to pay the counterparty to settle the contract and

therefore there is no counterparty credit risk. Tyco has established policies and procedures to limit the

potential for counterparty credit risk, including establishing limits for credit exposure and continually

assessing the creditworthiness of counterparties. As a matter of practice, the Company deals with major

banks worldwide having long-term Standard & Poor’s and Moody’s credit ratings of A-/A3 or higher. To

further reduce the risk of loss, the Company generally enters into International Swaps and Derivatives

Association master agreements with substantially all of its counterparties. Master netting agreements

provide protection in bankruptcy in certain circumstances and, in some cases, enable receivables and

payables with the same counterparty to be offset on the Consolidated Balance Sheets, providing for a

more meaningful balance sheet presentation of credit exposure. The Company’s derivative contracts do

not contain any credit risk related contingent features and do not require collateral or other security to

be furnished by the Company or the counterparties.

The Company’s exposure to credit risk associated with its derivative instruments is measured on an

individual counterparty basis, as well as by groups of counterparties that share similar attributes. As of

September 25, 2009, the Company was exposed to industry concentration with financial institutions as

well as risk of loss if an individual counterparty or issuer failed to perform its obligations under

contractual terms. The maximum amount of loss that the Company would incur, without giving

consideration to the effects of legally enforceable master netting agreements, is approximately

$32 million.

Fair Value of Financial Instruments

Effective September 27, 2008 the Company adopted the authoritative guidance for fair value

measurements for all financial assets and liabilities as well as non-financial assets and liabilities that are

recognized or disclosed at fair value in the financial statements on a recurring basis. The guidance

2009 Financials 131