ADT 2009 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290

|

|

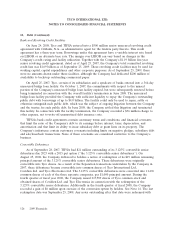

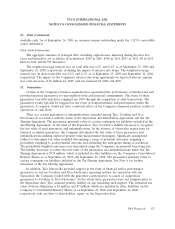

TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

10. Goodwill and Intangible Assets (Continued)

test for indefinite-lived intangible assets involves a comparison of the estimated fair value of the

intangible asset with its carrying amount. If the carrying amount of the intangible asset exceeds its fair

value, an impairment loss is recognized in an amount equal to that excess. Fair value determinations

require considerable judgment and are sensitive to change. Significant judgments inherent in this

analysis include the selection of appropriate discount rates and terminal year growth rate assumptions

and estimates of the amount and timing of future cash flows attributable to the underlying intangible

assets. Discount rate assumptions are based on an assessment of the risk inherent in the projected

future cash flows generated by the intangible asset. Also subject to judgment are assumptions about

royalty rates, which are based on the estimated rates at which similar trademarks are being licensed in

the marketplace.

Given the current economic environment and the uncertainties regarding the potential impact on

the Company’s business, there can be no assurance that the Company’s estimates and assumptions

regarding forecasted cash flow and revenue and operating income growth rates as well as the duration

of the ongoing economic downturn, or the period or strength of recovery, made for purposes of the

annual indefinite-lived intangible asset impairment test will prove to be accurate predictions of the

future. If the Company’s assumptions are not achieved, it is possible that an impairment charge may

need to be recorded. However, it is not possible at this time to determine if an impairment charge

would result or if such charge would be material.

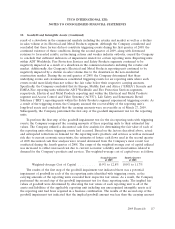

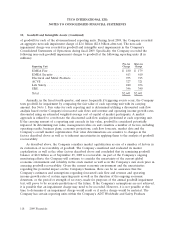

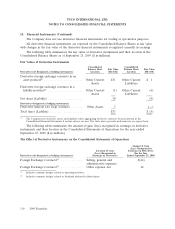

Intangible assets, net were $2,647 million and $2,681 million at September 25, 2009 and

September 26, 2008, respectively. The following table sets forth the gross carrying amount and

accumulated amortization of the Company’s intangible assets as of September 25, 2009 and

September 26, 2008 ($ in millions):

September 25, 2009 September 26, 2008

Gross Weighted-Average Gross Weighted-Average

Carrying Accumulated Amortization Carrying Accumulated Amortization

Amount Amortization Period Amount Amortization Period

Amortizable:

Contracts and related

customer

relationships ..... $6,529 $4,275 14 years $6,088 $3,922 14 years

Intellectual property . 552 462 20 years 553 405 16 years

Other ............ 17 13 10 years 17 13 15 years

Total .............. $7,098 $4,750 14 years $6,658 $4,340 15 years

Non-Amortizable:

Intellectual property . $ 212 $ 253

Other ............ 87 110

Total .............. $ 299 $ 363

Intangible asset amortization expense for 2009, 2008 and 2007 was $516 million, $528 million and

$513 million, respectively. The estimated aggregate amortization expense on intangible assets currently

owned by the Company is expected to be approximately $450 million for 2010, $350 million for 2011,

$300 million for 2012, $300 million for 2013 and $200 million for 2014.

2009 Financials 121