ADT 2009 Annual Report Download - page 241

Download and view the complete annual report

Please find page 241 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

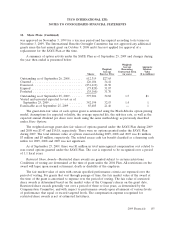

17. Shareholders’ Equity (Continued)

The Change of Domicile was approved at a special general meeting of shareholders held on March 12,

2009. The following steps occurred in connection with the Change of Domicile, which did not result in

a change to Total Shareholders’ Equity:

(1) approximately 21 million shares held directly or indirectly in treasury were cancelled;

(2) the par value of common shares was increased from $0.80 to CHF 8.53 through an

approximate 1-for-9 reverse share split, followed by the issuance of approximately eight fully

paid up shares so that the same number of shares were outstanding before and after the

Change of Domicile, which reduced share premium and increased common shares; and

(3) the remaining amount of share premium was eliminated with a corresponding increase to

contributed surplus.

Preference Shares—In connection with the Change of Domicile, all authorized preference shares

were cancelled. At September 26, 2008 Tyco had authorized 31,250,000 preference shares, par value of

$4 per share, none of which were issued and outstanding.

Common Shares—As of September 25, 2009 the Company’s share capital amounted to

CHF 3,867,911,465.07 or 479,295,101 registered common shares with a par value of CHF 8.07 per

share. Until March 12, 2011, the Board of Directors may increase the Company’s share capital by a

maximum amount of CHF 1,933,955,728.50 by issuing a maximum of 239,647,550 shares. In addition,

until March 12, 2011, (i) the share capital of the Company may be increased by an amount not

exceeding CHF 386,791,145.70 through the issue of a maximum of 47,929,510 shares through the

exercise of conversion and/or option or warrant rights granted in connection with bonds, notes or

similar instruments including convertible debt instruments and (ii) the share capital of the Company

may be increased by an amount not exceeding CHF 386,791,145.70 through the issue of a maximum of

47,929,510 shares to employees and other persons providing services to the Company. Although the

Company states its par value in Swiss francs it continues to use the U.S. dollar as its reporting currency

for preparing its Consolidated Financial Statements.

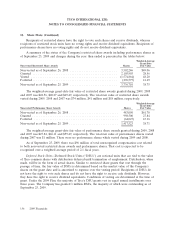

Shares Owned by Subsidiaries and Common Shares Held in Treasury—Prior to the Change of

Domicile, approximately 21 million shares held by the Company directly or indirectly in treasury were

cancelled. As of September 25, 2009 there were approximately 5 million shares held in treasury. As of

September 26, 2008 there were approximately 22 million shares held by a subsidiary and 5 million

shares held directly in treasury.

Share Premium and Contributed Surplus—As of September 26, 2008, Tyco International Ltd. was

incorporated under the laws of Bermuda. In accordance with the Bermuda Companies Act 1981, when

Tyco issued shares for cash at a premium to their par value, the resulting premium was an increase to a

share premium account, a non-distributable reserve. Contributed surplus, subject to certain conditions,

is a distributable reserve. As discussed above, effective March 17, 2009, the Company ceased to exist as

a Bermuda corporation and continued its existence as a Swiss corporation. The Company undertook a

number of steps in connection with the Change of Domicile described above, that reduced its share

premium to zero as of March 17, 2009 and increased common shares to approximately $3.5 billion. Any

share premium remaining after this recapitalization was allocated to contributed surplus, which

eliminated the remaining share premium balance.

2009 Financials 149