ADT 2009 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

12. Debt (Continued)

Company’s debt which is actively traded was $4,338 million. When quoted market prices are not readily

available or representative of fair value, the Company utilizes market information of comparable debt

with similar terms, such as maturities, interest rates and credit risk to determine the fair value of its

debt which is traded in markets that are not active. As of September 25, 2009, the fair value of the

Company’s debt which is not actively traded was $40 million. Additionally, the Company believes the

carrying amount of its commercial paper of $200 million approximates fair value based on the short-

term nature of such debt.

Commercial Paper

In May 2008, Tyco International Finance S.A. (‘‘TIFSA’’) commenced issuing commercial paper to

U.S. institutional accredited investors and qualified institutional buyers. Borrowings under the

commercial paper program are available for general corporate purposes. As of September 25, 2009 and

September 26, 2008, TIFSA had $200 million and $116 million, respectively, of commercial paper

outstanding, which bore interest at an average rate of 0.33% and 2.95%, respectively.

As of September 25, 2009, the Company classified its outstanding commercial paper balance of

$200 million as short-term as the Company intends to repay such amount during the next twelve

months. As of September 26, 2008, the Company classified $116 million of short-term commercial

paper as long-term as settlement of the amount outstanding was not expected to require the use of

working capital in the next twelve months as the Company had both the intent and the ability to

refinance this debt on a long-term basis.

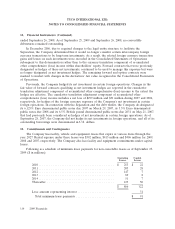

Debt Offerings

On January 9, 2009, TIFSA issued $750 million aggregate principal amount of 8.5% notes due on

January 15, 2019, which are fully and unconditionally guaranteed by the Company (the ‘‘2019 notes’’).

TIFSA received net proceeds of approximately $745 million after underwriting discounts and offering

expenses. The 2019 notes are unsecured and rank equally with TIFSA’s other unsecured and

unsubordinated debt. TIFSA may redeem any of the 2019 notes at any time by paying the greater of

the principal amount of the notes or a ‘‘make-whole’’ amount, plus accrued and unpaid interest. The

holders of the 2019 notes have the right to require TIFSA to repurchase all or a portion of the notes at

a purchase price equal to 101% of the principal amount of the notes repurchased, plus accrued and

unpaid interest upon the occurrence of a change of control triggering event, which requires both a

change of control and a rating event as defined by the Indenture governing the notes. Additionally, the

holders of the 2019 notes have the right to require the Company to repurchase all or a portion of the

2019 notes on July 15, 2014 at a purchase price equal to 100% of the principal amount of the notes

tendered, plus accrued and unpaid interest. Otherwise, the notes mature on January 15, 2019. The

Company incurred approximately $5 million of debt issuance costs in connection with the transaction,

which included underwriter discounts, as well as legal, accounting and rating agency fees. The debt

issuance costs will be amortized from the date of issuance to the earliest redemption date, which is

July 15, 2014. Interest is payable semiannually on January 15th and July 15th. The interest rate payable

on the 2019 notes is subject to escalations, as defined by the Indenture, if either Moody’s or S&P

downgrades the Company’s debt rating below investment grade. The 2019 notes will not be subject to

the preceding adjustments if at any time the Company’s debt rating increases one level above its

current rating to A3 and A- for Moody’s and S&P, respectively.

124 2009 Financials