ADT 2009 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TYCO INTERNATIONAL LTD.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

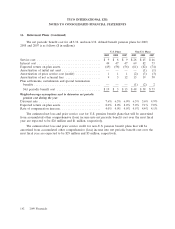

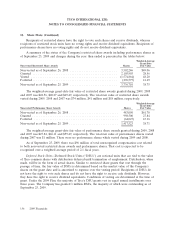

18. Share Plans (Continued)

$14 million. Of this amount, $2 million, $7 million ($1 million in discontinued operations) and

$5 million ($2 million in discontinued operations) were recorded in 2009, 2008 and 2007, respectively.

Except for the changes described, the principal terms and conditions of restricted shares, restricted

units and deferred stock units of the employees remain unchanged from the original grant.

Also in connection with the Separation, the Company amended the terms of performance based

awards granted on November 22, 2005 to provide for vesting of the remaining awards without regard to

the original performance measures. The original performance awards, which were previously adjusted to

reflect the attainment of performance metrics through fiscal year 2006, were converted to time based

restricted stock units of the employer, with the exception of corporate employees whose outstanding

awards were converted to time based restricted stock units of the three separate companies.

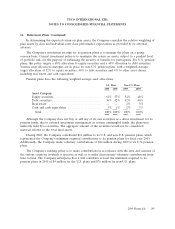

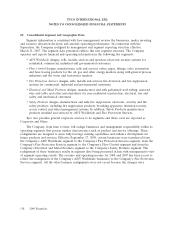

Effective October 1, 2005, the Company utilized the modified prospective transition method to

account for its shared based payment awards. Under this transition method the compensation cost

recognized beginning October 1, 2005 includes compensation cost for (i) all share-based payments

granted prior to, but not yet vested as of October 1, 2005, based on the estimated grant-date fair value

and (ii) all share-based payments granted subsequent to September 30, 2005 based on the estimated

grant-date fair value. Compensation cost is generally recognized ratably over the requisite service

period or period to retirement eligibility, if shorter.

Total share-based compensation cost recognized during 2009 was $99 million, all of which is

included in selling, general and administrative expenses. Total share-based compensation cost

recognized during 2008 was $104 million, which includes $97 million in selling, general and

administrative expenses, $3 million in separation costs and $4 million in discontinued operations. Total

share-based compensation cost recognized during 2007 was $297 million, which includes $155 million in

selling, general and administrative expenses, $13 million in restructuring and asset impairment charges,

net, $6 million in separation costs and $123 million in discontinued operations. The Company has

recognized a related tax benefit associated with its share-based compensation arrangements during

2009, 2008 and 2007 of $25 million, $28 million ($1 million in discontinued operations) and $78 million

($31 million in discontinued operations), respectively.

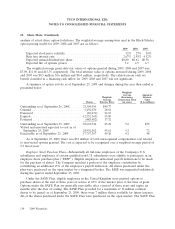

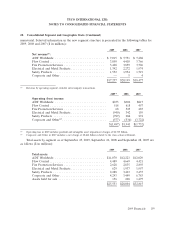

During 2004, the Tyco International Ltd. 2004 Stock and Incentive Plan (the ‘‘2004 Plan’’)

effectively replaced the Tyco International Ltd. Long Term Incentive Plan, as amended as of May 12,

1999 (the ‘‘LTIP I Plan’’) and the Tyco International Ltd. Long Term Incentive Plan II (the ‘‘LTIP II

Plan’’) for all awards effective on and after March 25, 2004. The 2004 Plan provides for the award of

stock options, stock appreciation rights, annual performance bonuses, long term performance awards,

restricted units, restricted shares, deferred stock units, promissory stock and other stock-based awards

(collectively, ‘‘Awards’’).

The 2004 Plan provides for a maximum of 40 million common shares to be issued as Awards,

subject to adjustment as provided under the terms of the 2004 Plan. In addition, any common shares

that have been approved by the Company’s shareholders for issuance under the LTIP Plans but which

have not been awarded thereunder as of January 1, 2004, reduced by the number of common shares

related to Awards made under the LTIP Plans between January 1, 2004 and March 25, 2004, the date

the 2004 Plan was approved by shareholders, (or which have been awarded but will not be issued,

owing to expiration, forfeiture, cancellation, return to the Company or settlement in cash in lieu of

common shares on or after January 1, 2004) and which are no longer available for any reason

152 2009 Financials