ADT 2009 Annual Report Download - page 137

Download and view the complete annual report

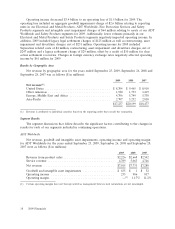

Please find page 137 of the 2009 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.savings from operational excellence initiatives. The increase in operating income during 2008 was

partially offset by $73 million of restructuring, asset impairment, and divestiture charges, net as

compared to $29 million in 2007.

Corporate and Other

Corporate expense for 2009 was $43 million higher as compared to the prior year, primarily

resulting from a charge of $125 million related to the settlement of legacy securities matters, which was

partially offset by $16 million benefit related to a settlement reached with a former executive.

Additionally, corporate expense in 2009 included $16 million of restructuring, asset impairment and

divestiture charges. Corporate expense for 2008 included net charges of $28 million composed of a

$29 million charge for a legacy legal settlement, $4 million of separation costs and $5 million for

restructuring, asset impairment and divestiture charges, net, offset by a credit of $10 million for class

action settlement recoveries. The remaining decrease in corporate expense is primarily related to cost

reduction initiatives and the restructuring program.

Corporate expense for 2008 was $3.2 billion lower as compared to the prior year, primarily

resulting from various charges in 2007, including the class action settlement charge of $2.862 billion,

separation costs of $117 million and net restructuring and asset impairment charges of $40 million

primarily related to the consolidation of certain headquarter functions. Corporate expense for 2008

included net charges of $28 million composed of a $29 million charge for a legacy legal settlement,

$4 million of separation costs and $5 million for restructuring, asset impairment and divestiture charges,

net, offset by a credit of $10 million for class action settlement recoveries. The remaining decrease in

corporate expense is primarily related to cost reduction initiatives and the restructuring program.

Legal Settlements

In the first half of fiscal 2009, the Company settled a number of legal matters stemming from

alleged violations of federal securities laws committed by former senior management, including several

lawsuits from plaintiffs that had opted out of the June 2007 class action settlement, for an aggregate

amount of approximately $90 million. Pursuant to the Separation and Distribution Agreement, the

Company’s share of this amount was approximately $24 million, with Covidien and Tyco Electronics

responsible for approximately $38 million and $28 million, respectively.

During the second quarter of 2009, the Company concluded that its best estimate of probable loss

for its unresolved legacy securities matters was $375 million. Due to the fact that any payments

ultimately made in connection with these matters would be subject to the sharing provisions of the

Separation and Distribution Agreement, the Company also recorded receivables from Covidien and

Tyco Electronics in the amounts of $158 million and $116 million, respectively. As a result, the

Company recorded a net charge of $101 million during the quarter ended March 27, 2009 in selling,

general, and administrative expenses related to these unresolved matters.

In the second half of fiscal 2009, the Company agreed to settle with all of the remaining plaintiffs

that had opted-out of the class action settlement as well as plaintiffs who had brought ERISA related

claims for a total of $271 million. Pursuant to the Separation and Distribution Agreement, the

Company’s share of the settlement amount was approximately $73 million, with Covidien and Tyco

Electronics responsible for approximately $114 million and $84 million, respectively. This settlement

activity did not result in the Company recording a charge to its Consolidated Statements of Operations

as the Company had established a reserve for its best estimate of the amount of loss during the second

quarter of 2009 as discussed above. The Company continues to believe that the accrual remaining as of

September 25, 2009 is its best estimate for the remaining unresolved claims. Although the Company

has reserved its best estimate of probable loss, related to unresolved legacy securities claims, their

2009 Financials 45